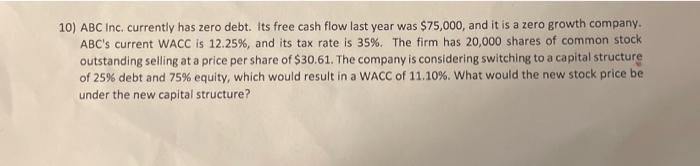

Question: Can you solve this question by showing steps? The answer to this Q is $33.78. Thank You! a 10) ABC Inc, currently has zero debt.

a 10) ABC Inc, currently has zero debt. Its free cash flow last year was $75,000, and it is a zero growth company. ABC's current WACC is 12.25%, and its tax rate is 35%. The firm has 20,000 shares of common stock outstanding selling at a price per share of $30.61. The company is considering switching to a capital structure of 25% debt and 75% equity, which would result in a WACC of 11.10%. What would the new stock price be under the new capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts