Question: can you solve this using excel, showing the formulas? I did it, but my answers aren't correct. BMC Realty is evaluating debt financing options for

can you solve this using excel, showing the formulas? I did it, but my answers aren't correct.

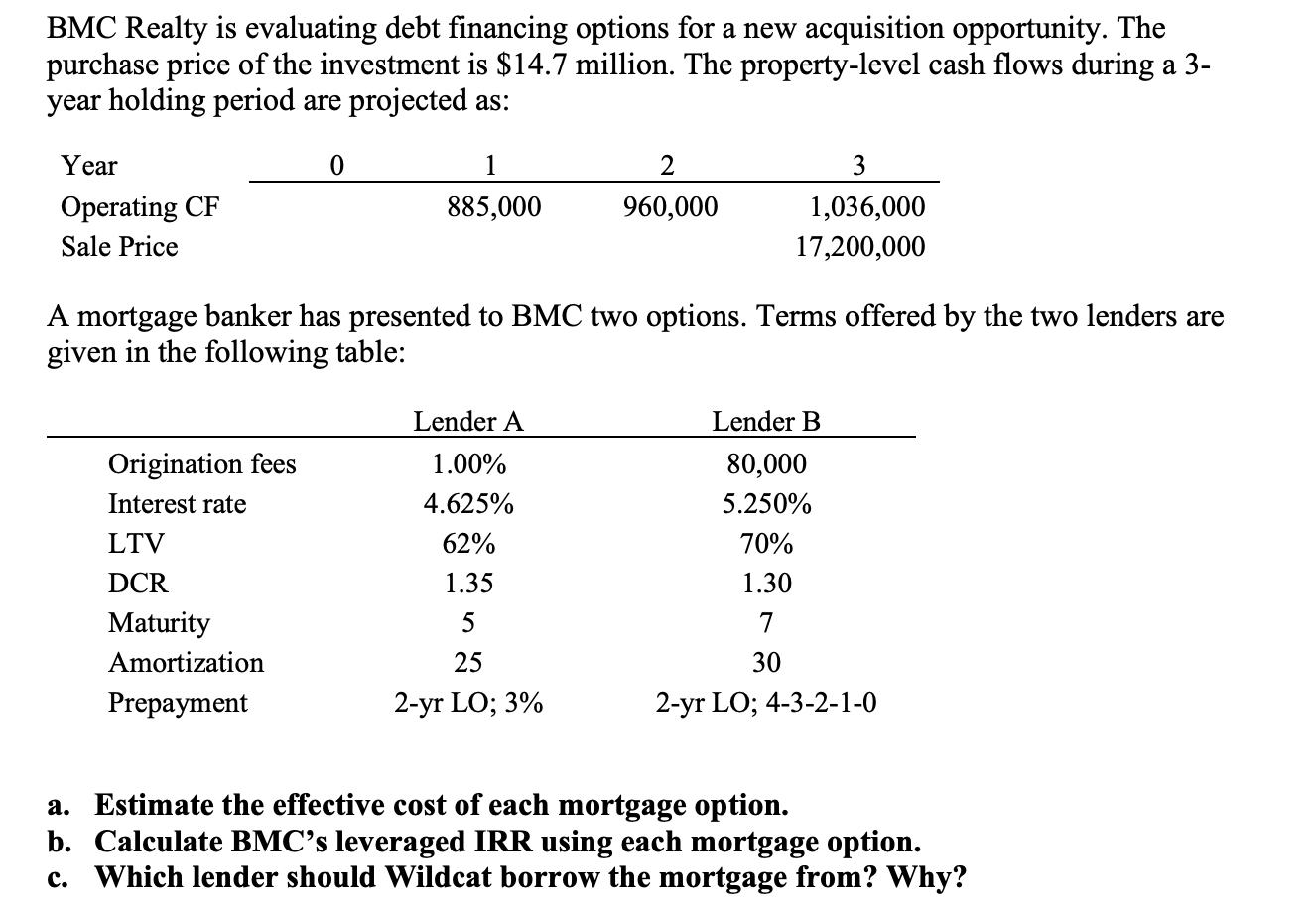

BMC Realty is evaluating debt financing options for a new acquisition opportunity. The purchase price of the investment is $14.7 million. The property-level cash flows during a 3year holding period are projected as: A mortgage banker has presented to BMC two options. Terms offered by the two lenders are given in the following table: a. Estimate the effective cost of each mortgage option. b. Calculate BMC's leveraged IRR using each mortgage option. c. Which lender should Wildcat borrow the mortgage from? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts