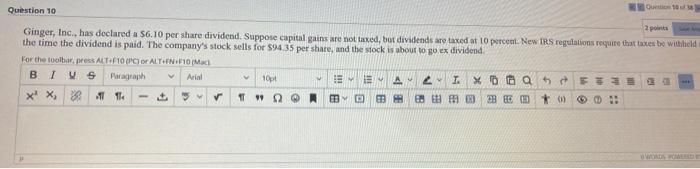

Question: can you solve with steps q10 Question 10 2 points Ginger, Inc., has declared a 56.10 per share dividend. Suppose capital gains are not taxed,

Question 10 2 points Ginger, Inc., has declared a 56.10 per share dividend. Suppose capital gains are not taxed, bot dividends are taxed at 10 percent. New RS regulations require that taxes be withheld the time the dividend is paid. The company's stock sells for $94.35 per share, and the stock is about to go ex dividend For the toolbar, press ALT=F10 PCTOR ALTINF10(M BIUs Pagraph Arial 1001 EM2 A 2 I Xota 2 x X, 82 111 192 BRE 60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts