Question: can you use excel as a method of finding a solution since I have to do it on excel I need to know what formula

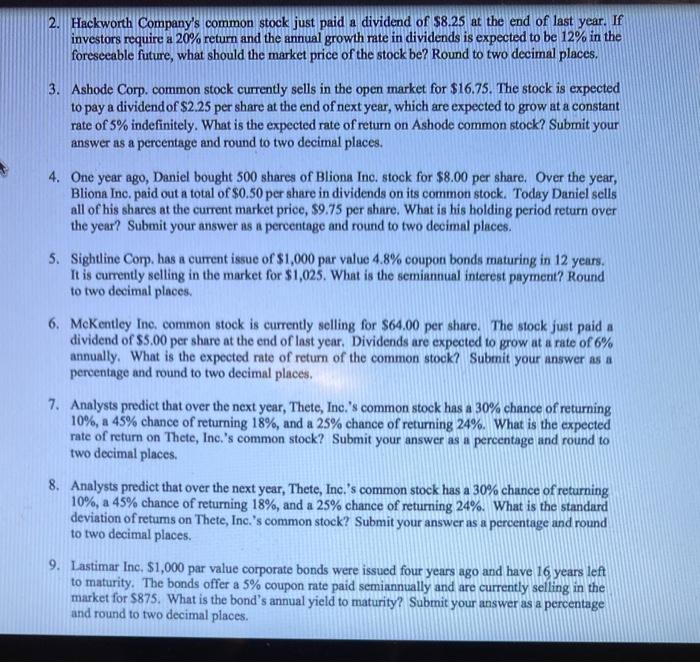

2. Hackworth Company's common stock just paid a dividend of $8.25 at the end of last year. If investors require a 20% return and the annual growth rate in dividends is expected to be 12% in the foreseeable future, what should the market price of the stock be? Round to two decimal places. 3. Ashode Corp. common stock currently sells in the open market for $16.75. The stock is expected to pay a dividend of $2.25 per share at the end of next year, which are expected to grow at a constant rate of 5% indefinitely. What is the expected rate of return on Ashode common stock? Submit your answer as a percentage and round to two decimal places. 4. One year ago, Daniel bought 500 shares of Bliona Inc. stock for $8.00 per share. Over the year, Bliona Inc. paid out a total of $0.50 per share in dividends on its common stock. Today Daniel sells all of his shares at the current market price, $9.75 per share. What is his holding period return over the year? Submit your answer as a percentage and round to two decimal places. 5. Sightline Corp, has a current issue of $1,000 par value 4.8% coupon bonds maturing in 12 years. It is currently selling in the market for $1,025. What is the semiannual interest payment? Round to two decimal places. 6. McKentley Inc, common stock is currently selling for $64.00 per share. The stock just paid a dividend of $5.00 per share at the end of last year. Dividends are expected to grow at a rate of 6% annually. What is the expected rate of return of the common stock? Submit your answer as a percentage and round to two decimal places. 7. Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of returning 10%, a 45% chance of returning 18%, and a 25% chance of returning 24%. What is the expected rate of return on Thete, Inc.'s common stock? Submit your answer as a percentage and round to two decimal places. 8. Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of returning 10%, a 45% chance of returning 18%, and a 25% chance of returning 24%. What is the standard deviation of returns on Thete, Inc.'s common stock? Submit your answer as a percentage and round to two decimal places 9. Lastimar Inc. $1,000 par value corporate bonds were issued four years ago and have 16 years left to maturity. The bonds offer a 5% coupon rate paid semiannually and are currently selling in the market for $875. What is the bond's annual yield to maturity? Submit your answer as a percentage and round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts