Question: can you use excel formulas please 3. Given the following set of cash flows: Period Cash Flow 1 $ 35,000 2 30,000 3 25,000 4

can you use excel formulas please

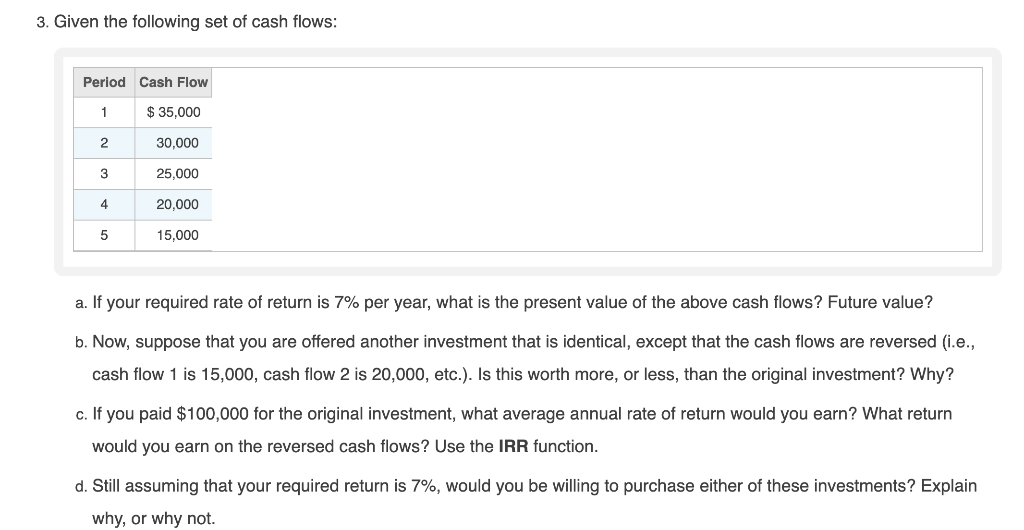

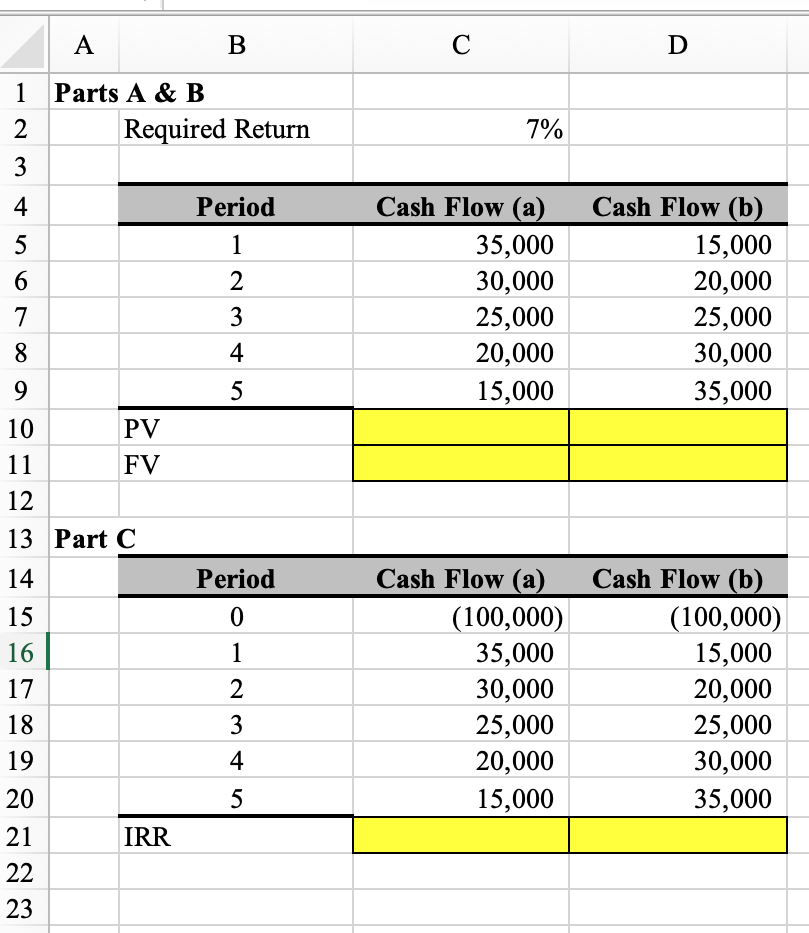

3. Given the following set of cash flows: Period Cash Flow 1 $ 35,000 2 30,000 3 25,000 4 20,000 5 15,000 a. If your required rate of return is 7% per year, what is the present value of the above cash flows? Future value? b. Now, suppose that you are offered another investment that is identical, except that the cash flows are reversed (i.e., cash flow 1 is 15,000, cash flow 2 is 20,000, etc.). Is this worth more, or less than the original investment? Why? c. If you paid $100,000 for the original investment, what average annual rate of return would you earn? What return would you earn on the reversed cash flows? Use the IRR function. d. Still assuming that your required return is 7%, would you be willing to purchase either of these investments? Explain why, or why not. A B D 1 Parts A & B 2 Required Return 3 7% 4 Period 1 2 5 6 7 8 Cash Flow (a) 35,000 30,000 25,000 20,000 15,000 Cash Flow (b) 15,000 20,000 25,000 30,000 35,000 m+ 9 5 10 PV 11 FV 12 13 Part C 14 15 Period 0 1 2 16 17 18 19 Cash Flow (a) (100,000) 35,000 30,000 25,000 20,000 15,000 Cash Flow (b) (100,000) 15,000 20,000 25,000 30,000 35,000 m+ in 4 20 IRR 21 22 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts