Question: Can you work on this question, please? What are the revenue numbers for each, Rayovac/Remington and Nu-Grow and how are they broken down by customer?

Can you work on this question, please?

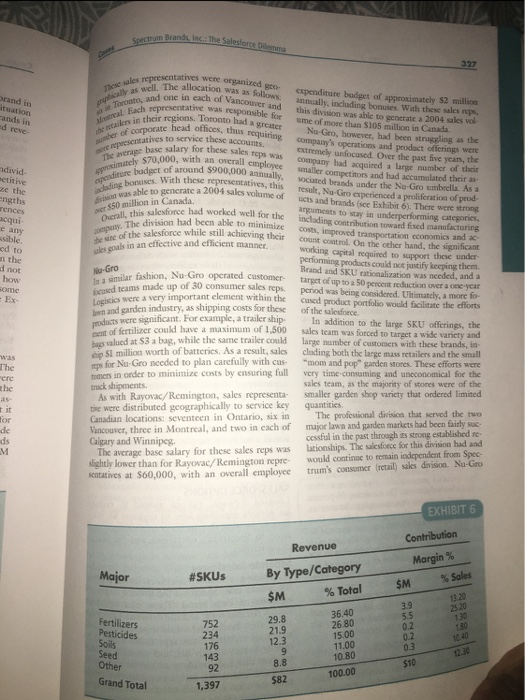

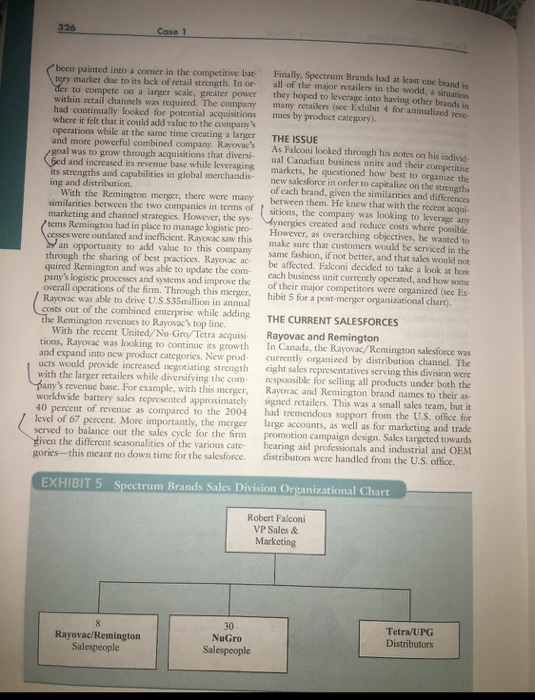

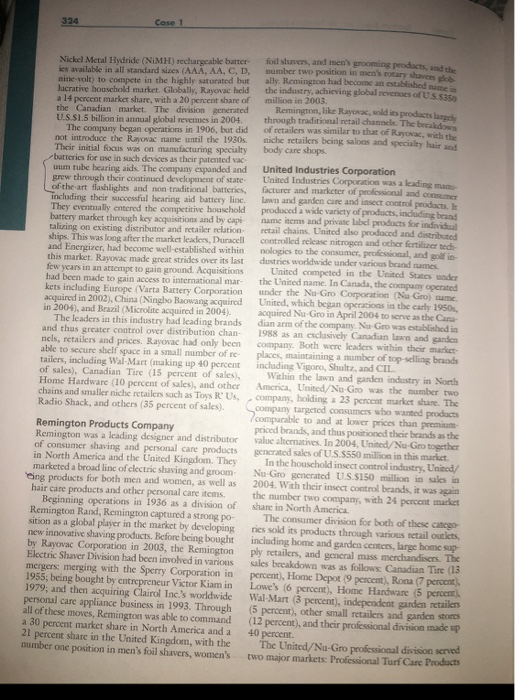

What are the revenue numbers for each, Rayovac/Remington and Nu-Grow and how are they broken down by customer? Next combine the numbers. What does that tell you? Import an excel spread sheets 1. Rayovac/Remington 2.Nu-Gro 3.Combined pg. 324 for the revenue breakdown for both, read Issue pgs. 326-328 328 maintained a separate salesforce beyood the 30 con sumer representatives exclusive to this division Ourall. Ne Giro'consumer sales operations needed adjustment. A strategy that refocused the sales team's clots on their large and more important areas, while still finding a way to reach their current Customer base, was required to turn this division around Tetra/United Pet Group The salesforce for this division in the United States was regionally based so that each sales rep could ensure an ample supply of product for their dis tributors and dealers. These sales representatives were responsible for the large accounts such as Pets Mart and Perco, mass merchandisers such as Wal-Mart, and the large number of smaller specialty retailers However, in Canada, sales for this division were handled by distributors. These distributors were re sponsible for the sales to the highly fragmented C nadian specialty pet retailer market. They offered the same services that an intemal alesforce could provide, including organizing special promotions and setting up in-store displays. Ultimately, they were able to generate sales from a large number of smaller players more economically than a small internal sales team coul. The les mans for Rayovac/Remington and Nu Gro were responsible for managing these distributors. The larger retail accounts were managed by the US les team but sesed by these distributors Sales Management Of the 38 sales reps between the Rayo /Remington and Nu-Gro divisions, four of them lled the roles of sales manager, two managers for cach division Each rep/manager was responsible for the various representatives in their specific corphic restions They spent 65 percent of their time scling to their own individual accounts. The remaining 35 percent was spent managing reps, managing distributors, forecasting strategic planning and analysing their market. For each division, one rep manager was re- sponsible for the sales reps in the large Ontario mar ket, while the other managed the sales reps in the rest of the country. Regardless of structure of the sales operation going forward. Falconi would likely organize around three regions the West, Ontario and the East--with one manager responsible for the sales reps within each region. This, of course, raised the issue of the surplus manager and would provide an opportunity to reconsider the incumbents. COMPETITOR ORGANIZATIONS Falconi wanted to look at how some of Spectrum's competitors organized their salesforces within Canada. He decided to select a few of the major plans from each industry as compris Kaikkeilis Electronics and P&G G their sales divisions by product category o ry had its own dedicated salesforce vided by specific retail channels and/or sus depending on the size of the retailer For Noncico's also was responsible exch shaving and grooming products and did not all other Philips brands such as teises in lar, Ben sales reps would sell both the Brand Gallette shaving brands, Duracell would have own les team, but neither group would cross sell scher PSG bands. In certain circumstances, purchasing manager for a retailer such as Wall mich deal with a sales rep from each product cate ory but the sales reps would deal exclusively with Wal-Mart as a customer. In other cinc e the sales reps would interface with different purchas in man in those netailers where the purchasing function was cranized by category Both Scotts and CGPC operated their sales divi as in a different manner. Their salesforces were organized by product category, but covered all retail channelThus, they had specific sales reps for a cons such as fertilizers, soils and seeds, insect control products and pet supplies CGPC only but each lop wood service clients OS multiple channel Like Philips and PSG, these companies hadde cloped a salesforce with product category pertise, yet they did not concentrate an individ walles nep on a specific retailer Due to the size and strength of each of these companies, they had been successful at developing a pult y with the consumers. Retailers were most mandated to support and sell these companies products because of the consumer demand created In addition, the lesforces had developed strong te lationships with retailers, the "push component SALESFORCE OPTIONS Looking forward. Falconi wanted to evaluate his options regarding how to organize his sales- force to see what hernatives or combinations made ense to Spectrum's operations and the market chuster Separate Salesforces Maintaining a separate salesforce for each brand e would offer Spectrum the greatest degree of expertise on each brand. These sales reps were already familiar with, and had extensive knowledge about their brands and would require little, if any, additional training. Sales reps could continue to operate as they already did, and maintain the mo- mentum they had already generated for their prod- uct lines. Ultimately, such an organization would allow for a more focused salesforce in that repre- sentatives would be in a better position to answer 327 y as well brand in ituation ands in ed reve- al Each ree se presentati mately $70,000 penditure dlading bon ndivid. ctiting ze the engths ences acqui e any was able to 550 million in Canada cd to in the al not how some presentatives were organized The allocation was as folle expenditure budget of approximately $2 million and one in each of Vancoud annually, including bonuses with the Tore presentative was responsible this division was able to ente a 2004 ales vol sales op their regions. Toronto had a gre me of more than $105 million in Canada corporate head othccs, thus requiring Nu-Go, however, had been struggling as the ctatives to service these accounts company's operations and product offerings were huse salary for these sales reps extremely focused. Over the past five years, the $20.000, with an overall emple company had acquired a large number of their dect of around $900.000 annually smaller competitors and had accumulated their as- sociated beads under the bruises. With these representatives, this Grouheella. As a able to generate a 2004 sales volume of result, Ny-Grouperienced a proliferation of prod- ucts and brands see Exhibit There were strong arguments to stay in underperforming Categories this salesforce had worked well for the inclading contribution toward fised manufacturing The division had been able to minimi costs, improved transportation Economics and ac of the salesforce while still achieving the count control. On the other hand, the significant als in an effective and efficient manner working capital required to support the under performing products could justify keeping them Brand and SKU rationalisation was needed, and a fashion. Nu-Gro operated customer taract of up to a 50 percent reaction or one year made up of 30 consumer sales reps period was being considered and more fo Tapics were a very important element within the cused product portfolio would facilitate the efforts ning costs for these and garden industry, as shipping costs for the of the l ace were significant. For example, a trailer ship- In addition to the lange SKU offerings the of fertilizer could have a maximum of 1.500 sales team was forced to target a wide variety and alued at $3 a bag, while the same trailer could large number of customers with these brands, in 1 million worth of batteries. As a result, sales cluding both the large mas retailers and the small for Nu-Groneeded to plan carefully with cus "mom and pop garden stores. These efforts were very time-consuming and unconomical for the s in order to minimize costs by ensuring full sales team, as the majority of stones were of the smaller garden shop variety that ordered limited As with Rayovac/Remington, sales representa quantities. the were distributed geographically to service key the professional division that served the two Canadian locations: seventeen in Ontario, six in major lawn and garden markets had been fairly suc Vancouver, three in Montreal, and two in cach of cessful in the past through its strong established re- Calgary and Winnipeg Nu-Gro In a similar fashion based teams made up of 30. -EX The cre zhe truck shipments for The average base salary for these sales reps was sightly lower than for Rayovac/Remington repre Scatatives at $60,000, with an overall employee lationships. The salesforce for this division had and would continue to remain independent from Spec- trum's consumer (retail) sales division. Nu-Gro EXHIBIT 6 Contribution Revenue Margin% Major #SKUS By Type/Category % Total SM % Sales $M 25:20 130 752 29.8 3.9 5.5 0.2 36.40 26.80 15.00 190 21.9 24 176 12.3 Fertilizers Pesticides Soils Seed Other Grand Total 16.40 12.30 143 11.00 10.80 100.00 92 8.8 $10 1,397 582 326 Finally, Spectrum Brands had at least one bude all of the major retailers in the world, as they hoped to leverage into having other be many retailers (see Exhibit 4 for analized nues by product category). been painted into a comer in the competitive bat tery market due to its lack of retail strength. In or der to compete on a larger scale, greater power within retail channels was required. The company had continually looked for potential acquisitions where it felt that it could add value to the company's operations while at the same time creating a larger and more powerful combined company. Rayovac's Roal was to grow through acquisitions that diversi- Bed and increased its revenue base while leveraging its strengths and capabilities in global merchandis- ing and distribution With the Remington merger, there were many similarities between the two companies in terms of marketing and channel strategies. However, the sys tems Remington had in place to manage logistic pro- cesses were outdated and incfficient. Rayovac saw this an opportunity to add value to this company through the sharing of best practices. Rayovac quired Remington and was able to update the com- pany's logistic processes and systems and improve the overall operations of the firm. Through this merger, Rayovac was able to drive U.S.535million in annual costs out of the combined enterprise while adding the Remington revenues to Rayovac's topline. With the recent United/Nu-Gro/Tetra acquisi tions, Rayovac was looking to continue its growth and expand into new product categories. New prod ucts would provide increased negotiating strength with the larger retailers while diversifying the com pany's revenue base. For example, with this merger. worldwide battery sales represented approximately 40 percent of revenue as compared to the 2004 level of 67 percent. More importantly, the merger served to balance out the sales cycle for the firm Liven the different seasonalities of the various cate gories--this meant no down time for the salesforce THE ISSUE As Falconi looked through his notes on his individ- ual Canadian business units and their competitie markets, he questioned how best to organize the new salesforce in order to capitaline on the strengths of each brand, given the similarities and differences between them. He knew that with the recent acqui sitions, the company was looking to leverage Synergies created and reduce costs where possible However, as overarching objectives, he wanted to make sure that customers would be serviced in the same fashion, if not better, and that sales would not be affected. Falconi decided to take a look at how each business unit currently operated, and how some of their major competitors were organized (see Ex- hibit 5 for a post-merter organizational chart THE CURRENT SALESFORCES Rayovac and Remington In Canada, the Rayovac/Remington salesforce was currently organized by distribution channel. The eight sales representatives serving this division were responsible for selling all products under both the Rayovac and Remington brand names to their as signed retailers. This was a small sales team, but it had tremendous support from the U.S. office for large accounts, as well as for marketing and trade promotion campaign design. Sales targeted towards hearing aid professionals and industrial and OEM distributors were handled from the U.S. office. EXHIBIT 5 Spectrum Brands Sales Division Organizational Chart Robert Falconi VP Sales & Marketing Rayovac/Remington Salespeople NuGro Salespeople Tetra/UPG Distributors Case 1 foilshers, and men's grooming products number two position in men's rotary s ally. Remington had become an established the industry, achieving global roves of million in 2003 Remington, like Rayo , sold its products through traditional retail channels. The bal of retailers was similar to that of Rarov i niche retailers being salons and specialty hair body care shops. Nickel Metal Hydride (NiMH) rechargeable batter is available in all standard sizes (AAA, AA, C, D, mine solt) to compete in the highly saturated but lucrative household market. Globally, Rayovac held a 14 percent market share, with a 20 percent share of the Canadian market. The division generated US $1.5 billion in annual global revenues in 2004 The company began operations in 1906, but did not introduce the Rayovac name until the 1930s. Their initial focus was on manufacturing specialty batteries for use in such devices as their patented vac uum tube hearing aicis. The company expanded and grew through their continued development of state of the art flashlights and non traditional batteries, including their successful hearing aid battery line They eventually entered the competitive household battery market through key acquisitions and by capi talizing on existing distributor and retailer relation ships. This was long after the market leaders, Duracell and Energizer, had become well-established within this market. Rayovac made great strides over its last few years in an attempt to gain ground. Acquisitions had been made to gain access to international mar kets including Europe Varta Battery Corporation acquired in 2002), China (Ningbo Bawang acquired in 2004), and Brazil (Microlite acquired in 2004 The leaders in this industry had leading brands and thus greater control over distribution chan nels, retailers and prices. Rayovac had only been able to secure shelf puce in a small number of re tailers, including Wal-Mart making up 40 percent of sales), Canadian Tire (15 percent of sales). Home Hardware (10 percent of sales, and other chains and smaller niche retailers such as Toys R Us Radio Shack, and others (35 percent of sales) United Industries Corporation United Industries Corporation was a leading facturer and marketer of professional and commer and garden care and insect Control process produced a wide variety of products, inducing bad name items and private Libd products for individ retail chains. United also produced and distribe controlled release nitrogen and other forti t ech nologies to the consumer, professional and dustries worldwide under various brand names United competed in the United States under the United name. In Canada, the company operated under the Nu-Gro Corporation No Gro) un United, which began operations in the early 1950 acquired Nu-Gro in April 2004 so serve as the Cang dian arm of the company NuGeo was estashed 1988 as an exclusively Canadian lawn and wanden company. Both were leaders within their market p laces anting a number of top line brands including Vigoro, Shultz, and CIL Within the law and garden industry in North America, United No-Go was the number two company, holding a 23 percent market share. The company targeted consumers who wanted products /comparable to and at lower prices than premium priced brands, and thus positioned their brands as the value alternatives. In 2004, United Nu-Gro together generated sales of US 5550 million in this market. In the household insect control industry, United Nu-Gro generated US$150 million in sales in 2004. With their insect control brands, it was again the number two company, with 24 percent market share in North America The consumer division for both of these catego res sold its products through various stail outlets including home and garden centers, large home sup ply retailers, and general mass merchandisers. The sales breakdown was as follows Canadian Tire (13 percent), Home Depot 9 percent), Rona 7 percent) Lowe's (6 percent), Home Hardware (5 percent) Wal-Mart (3 percent, independent garden retailers (5 percent), other small retailers and garden scores (12 percent), and their professional division made up 40 percent. The United/Nu-Gro professional divisions two maior markets Professional Turf Care Product Remington Products Company Remington was a leading designer and distributor of consumer shaving and personal care products in North America and the United Kingdom. They marketed a broad line of electric shaving and groom eing products for both men and women, as well as hair care products and other personal care items Beginning operations in 1936 as a division of Remington Rand, Remington captured a strong po sition as a global player in the market by developing new innovative shaving products. Before being bought by Rayovac Corporation in 2003, the Remington Electric Shaver Division had been involved in various mergers: merging with the Sperry Corporation in 1955; being bought by entrepreneur Victor Kiam in 1979; and then acquiring Clairol Inc.'s worldwide personal care appliance business in 1993. Through all of these moves, Remington was able to command a 30 percent market share in North America and a 21 percent share in the United Kingdom, with the number one position in men's foilshavers, women's What are the revenue numbers for each, Rayovac/Remington and Nu-Grow and how are they broken down by customer? Next combine the numbers. What does that tell you? Import an excel spread sheets 1. Rayovac/Remington 2.Nu-Gro 3.Combined pg. 324 for the revenue breakdown for both, read Issue pgs. 326-328 328 maintained a separate salesforce beyood the 30 con sumer representatives exclusive to this division Ourall. Ne Giro'consumer sales operations needed adjustment. A strategy that refocused the sales team's clots on their large and more important areas, while still finding a way to reach their current Customer base, was required to turn this division around Tetra/United Pet Group The salesforce for this division in the United States was regionally based so that each sales rep could ensure an ample supply of product for their dis tributors and dealers. These sales representatives were responsible for the large accounts such as Pets Mart and Perco, mass merchandisers such as Wal-Mart, and the large number of smaller specialty retailers However, in Canada, sales for this division were handled by distributors. These distributors were re sponsible for the sales to the highly fragmented C nadian specialty pet retailer market. They offered the same services that an intemal alesforce could provide, including organizing special promotions and setting up in-store displays. Ultimately, they were able to generate sales from a large number of smaller players more economically than a small internal sales team coul. The les mans for Rayovac/Remington and Nu Gro were responsible for managing these distributors. The larger retail accounts were managed by the US les team but sesed by these distributors Sales Management Of the 38 sales reps between the Rayo /Remington and Nu-Gro divisions, four of them lled the roles of sales manager, two managers for cach division Each rep/manager was responsible for the various representatives in their specific corphic restions They spent 65 percent of their time scling to their own individual accounts. The remaining 35 percent was spent managing reps, managing distributors, forecasting strategic planning and analysing their market. For each division, one rep manager was re- sponsible for the sales reps in the large Ontario mar ket, while the other managed the sales reps in the rest of the country. Regardless of structure of the sales operation going forward. Falconi would likely organize around three regions the West, Ontario and the East--with one manager responsible for the sales reps within each region. This, of course, raised the issue of the surplus manager and would provide an opportunity to reconsider the incumbents. COMPETITOR ORGANIZATIONS Falconi wanted to look at how some of Spectrum's competitors organized their salesforces within Canada. He decided to select a few of the major plans from each industry as compris Kaikkeilis Electronics and P&G G their sales divisions by product category o ry had its own dedicated salesforce vided by specific retail channels and/or sus depending on the size of the retailer For Noncico's also was responsible exch shaving and grooming products and did not all other Philips brands such as teises in lar, Ben sales reps would sell both the Brand Gallette shaving brands, Duracell would have own les team, but neither group would cross sell scher PSG bands. In certain circumstances, purchasing manager for a retailer such as Wall mich deal with a sales rep from each product cate ory but the sales reps would deal exclusively with Wal-Mart as a customer. In other cinc e the sales reps would interface with different purchas in man in those netailers where the purchasing function was cranized by category Both Scotts and CGPC operated their sales divi as in a different manner. Their salesforces were organized by product category, but covered all retail channelThus, they had specific sales reps for a cons such as fertilizers, soils and seeds, insect control products and pet supplies CGPC only but each lop wood service clients OS multiple channel Like Philips and PSG, these companies hadde cloped a salesforce with product category pertise, yet they did not concentrate an individ walles nep on a specific retailer Due to the size and strength of each of these companies, they had been successful at developing a pult y with the consumers. Retailers were most mandated to support and sell these companies products because of the consumer demand created In addition, the lesforces had developed strong te lationships with retailers, the "push component SALESFORCE OPTIONS Looking forward. Falconi wanted to evaluate his options regarding how to organize his sales- force to see what hernatives or combinations made ense to Spectrum's operations and the market chuster Separate Salesforces Maintaining a separate salesforce for each brand e would offer Spectrum the greatest degree of expertise on each brand. These sales reps were already familiar with, and had extensive knowledge about their brands and would require little, if any, additional training. Sales reps could continue to operate as they already did, and maintain the mo- mentum they had already generated for their prod- uct lines. Ultimately, such an organization would allow for a more focused salesforce in that repre- sentatives would be in a better position to answer 327 y as well brand in ituation ands in ed reve- al Each ree se presentati mately $70,000 penditure dlading bon ndivid. ctiting ze the engths ences acqui e any was able to 550 million in Canada cd to in the al not how some presentatives were organized The allocation was as folle expenditure budget of approximately $2 million and one in each of Vancoud annually, including bonuses with the Tore presentative was responsible this division was able to ente a 2004 ales vol sales op their regions. Toronto had a gre me of more than $105 million in Canada corporate head othccs, thus requiring Nu-Go, however, had been struggling as the ctatives to service these accounts company's operations and product offerings were huse salary for these sales reps extremely focused. Over the past five years, the $20.000, with an overall emple company had acquired a large number of their dect of around $900.000 annually smaller competitors and had accumulated their as- sociated beads under the bruises. With these representatives, this Grouheella. As a able to generate a 2004 sales volume of result, Ny-Grouperienced a proliferation of prod- ucts and brands see Exhibit There were strong arguments to stay in underperforming Categories this salesforce had worked well for the inclading contribution toward fised manufacturing The division had been able to minimi costs, improved transportation Economics and ac of the salesforce while still achieving the count control. On the other hand, the significant als in an effective and efficient manner working capital required to support the under performing products could justify keeping them Brand and SKU rationalisation was needed, and a fashion. Nu-Gro operated customer taract of up to a 50 percent reaction or one year made up of 30 consumer sales reps period was being considered and more fo Tapics were a very important element within the cused product portfolio would facilitate the efforts ning costs for these and garden industry, as shipping costs for the of the l ace were significant. For example, a trailer ship- In addition to the lange SKU offerings the of fertilizer could have a maximum of 1.500 sales team was forced to target a wide variety and alued at $3 a bag, while the same trailer could large number of customers with these brands, in 1 million worth of batteries. As a result, sales cluding both the large mas retailers and the small for Nu-Groneeded to plan carefully with cus "mom and pop garden stores. These efforts were very time-consuming and unconomical for the s in order to minimize costs by ensuring full sales team, as the majority of stones were of the smaller garden shop variety that ordered limited As with Rayovac/Remington, sales representa quantities. the were distributed geographically to service key the professional division that served the two Canadian locations: seventeen in Ontario, six in major lawn and garden markets had been fairly suc Vancouver, three in Montreal, and two in cach of cessful in the past through its strong established re- Calgary and Winnipeg Nu-Gro In a similar fashion based teams made up of 30. -EX The cre zhe truck shipments for The average base salary for these sales reps was sightly lower than for Rayovac/Remington repre Scatatives at $60,000, with an overall employee lationships. The salesforce for this division had and would continue to remain independent from Spec- trum's consumer (retail) sales division. Nu-Gro EXHIBIT 6 Contribution Revenue Margin% Major #SKUS By Type/Category % Total SM % Sales $M 25:20 130 752 29.8 3.9 5.5 0.2 36.40 26.80 15.00 190 21.9 24 176 12.3 Fertilizers Pesticides Soils Seed Other Grand Total 16.40 12.30 143 11.00 10.80 100.00 92 8.8 $10 1,397 582 326 Finally, Spectrum Brands had at least one bude all of the major retailers in the world, as they hoped to leverage into having other be many retailers (see Exhibit 4 for analized nues by product category). been painted into a comer in the competitive bat tery market due to its lack of retail strength. In or der to compete on a larger scale, greater power within retail channels was required. The company had continually looked for potential acquisitions where it felt that it could add value to the company's operations while at the same time creating a larger and more powerful combined company. Rayovac's Roal was to grow through acquisitions that diversi- Bed and increased its revenue base while leveraging its strengths and capabilities in global merchandis- ing and distribution With the Remington merger, there were many similarities between the two companies in terms of marketing and channel strategies. However, the sys tems Remington had in place to manage logistic pro- cesses were outdated and incfficient. Rayovac saw this an opportunity to add value to this company through the sharing of best practices. Rayovac quired Remington and was able to update the com- pany's logistic processes and systems and improve the overall operations of the firm. Through this merger, Rayovac was able to drive U.S.535million in annual costs out of the combined enterprise while adding the Remington revenues to Rayovac's topline. With the recent United/Nu-Gro/Tetra acquisi tions, Rayovac was looking to continue its growth and expand into new product categories. New prod ucts would provide increased negotiating strength with the larger retailers while diversifying the com pany's revenue base. For example, with this merger. worldwide battery sales represented approximately 40 percent of revenue as compared to the 2004 level of 67 percent. More importantly, the merger served to balance out the sales cycle for the firm Liven the different seasonalities of the various cate gories--this meant no down time for the salesforce THE ISSUE As Falconi looked through his notes on his individ- ual Canadian business units and their competitie markets, he questioned how best to organize the new salesforce in order to capitaline on the strengths of each brand, given the similarities and differences between them. He knew that with the recent acqui sitions, the company was looking to leverage Synergies created and reduce costs where possible However, as overarching objectives, he wanted to make sure that customers would be serviced in the same fashion, if not better, and that sales would not be affected. Falconi decided to take a look at how each business unit currently operated, and how some of their major competitors were organized (see Ex- hibit 5 for a post-merter organizational chart THE CURRENT SALESFORCES Rayovac and Remington In Canada, the Rayovac/Remington salesforce was currently organized by distribution channel. The eight sales representatives serving this division were responsible for selling all products under both the Rayovac and Remington brand names to their as signed retailers. This was a small sales team, but it had tremendous support from the U.S. office for large accounts, as well as for marketing and trade promotion campaign design. Sales targeted towards hearing aid professionals and industrial and OEM distributors were handled from the U.S. office. EXHIBIT 5 Spectrum Brands Sales Division Organizational Chart Robert Falconi VP Sales & Marketing Rayovac/Remington Salespeople NuGro Salespeople Tetra/UPG Distributors Case 1 foilshers, and men's grooming products number two position in men's rotary s ally. Remington had become an established the industry, achieving global roves of million in 2003 Remington, like Rayo , sold its products through traditional retail channels. The bal of retailers was similar to that of Rarov i niche retailers being salons and specialty hair body care shops. Nickel Metal Hydride (NiMH) rechargeable batter is available in all standard sizes (AAA, AA, C, D, mine solt) to compete in the highly saturated but lucrative household market. Globally, Rayovac held a 14 percent market share, with a 20 percent share of the Canadian market. The division generated US $1.5 billion in annual global revenues in 2004 The company began operations in 1906, but did not introduce the Rayovac name until the 1930s. Their initial focus was on manufacturing specialty batteries for use in such devices as their patented vac uum tube hearing aicis. The company expanded and grew through their continued development of state of the art flashlights and non traditional batteries, including their successful hearing aid battery line They eventually entered the competitive household battery market through key acquisitions and by capi talizing on existing distributor and retailer relation ships. This was long after the market leaders, Duracell and Energizer, had become well-established within this market. Rayovac made great strides over its last few years in an attempt to gain ground. Acquisitions had been made to gain access to international mar kets including Europe Varta Battery Corporation acquired in 2002), China (Ningbo Bawang acquired in 2004), and Brazil (Microlite acquired in 2004 The leaders in this industry had leading brands and thus greater control over distribution chan nels, retailers and prices. Rayovac had only been able to secure shelf puce in a small number of re tailers, including Wal-Mart making up 40 percent of sales), Canadian Tire (15 percent of sales). Home Hardware (10 percent of sales, and other chains and smaller niche retailers such as Toys R Us Radio Shack, and others (35 percent of sales) United Industries Corporation United Industries Corporation was a leading facturer and marketer of professional and commer and garden care and insect Control process produced a wide variety of products, inducing bad name items and private Libd products for individ retail chains. United also produced and distribe controlled release nitrogen and other forti t ech nologies to the consumer, professional and dustries worldwide under various brand names United competed in the United States under the United name. In Canada, the company operated under the Nu-Gro Corporation No Gro) un United, which began operations in the early 1950 acquired Nu-Gro in April 2004 so serve as the Cang dian arm of the company NuGeo was estashed 1988 as an exclusively Canadian lawn and wanden company. Both were leaders within their market p laces anting a number of top line brands including Vigoro, Shultz, and CIL Within the law and garden industry in North America, United No-Go was the number two company, holding a 23 percent market share. The company targeted consumers who wanted products /comparable to and at lower prices than premium priced brands, and thus positioned their brands as the value alternatives. In 2004, United Nu-Gro together generated sales of US 5550 million in this market. In the household insect control industry, United Nu-Gro generated US$150 million in sales in 2004. With their insect control brands, it was again the number two company, with 24 percent market share in North America The consumer division for both of these catego res sold its products through various stail outlets including home and garden centers, large home sup ply retailers, and general mass merchandisers. The sales breakdown was as follows Canadian Tire (13 percent), Home Depot 9 percent), Rona 7 percent) Lowe's (6 percent), Home Hardware (5 percent) Wal-Mart (3 percent, independent garden retailers (5 percent), other small retailers and garden scores (12 percent), and their professional division made up 40 percent. The United/Nu-Gro professional divisions two maior markets Professional Turf Care Product Remington Products Company Remington was a leading designer and distributor of consumer shaving and personal care products in North America and the United Kingdom. They marketed a broad line of electric shaving and groom eing products for both men and women, as well as hair care products and other personal care items Beginning operations in 1936 as a division of Remington Rand, Remington captured a strong po sition as a global player in the market by developing new innovative shaving products. Before being bought by Rayovac Corporation in 2003, the Remington Electric Shaver Division had been involved in various mergers: merging with the Sperry Corporation in 1955; being bought by entrepreneur Victor Kiam in 1979; and then acquiring Clairol Inc.'s worldwide personal care appliance business in 1993. Through all of these moves, Remington was able to command a 30 percent market share in North America and a 21 percent share in the United Kingdom, with the number one position in men's foilshavers, women's