Question: Can you write a brief write-up for what is happening here? (200-500 words) C D E F G H J M OPTION TRADING STRATEGIES Two

Can you write a brief write-up for what is happening here? (200-500 words)

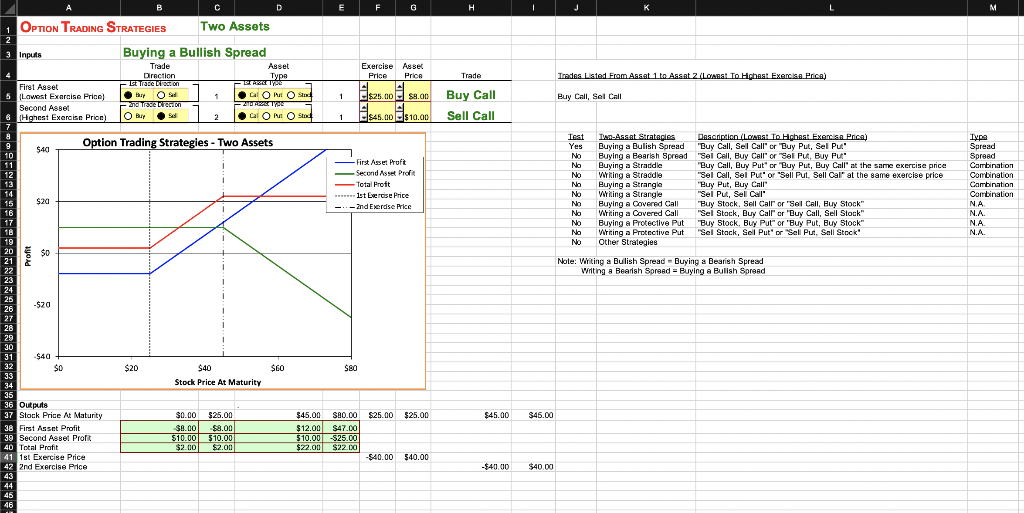

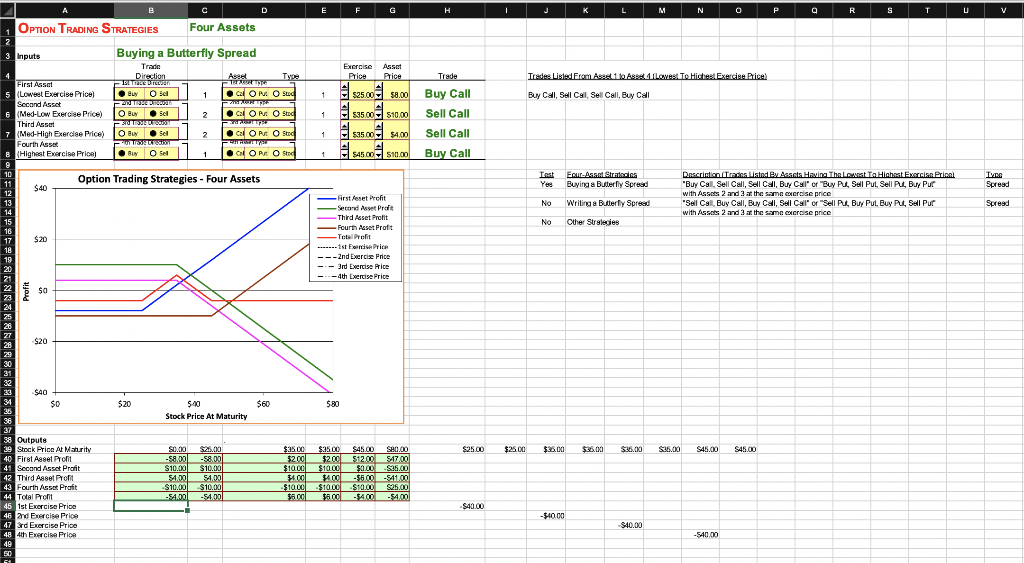

C D E F G H J M OPTION TRADING STRATEGIES Two Assets Inputs Buying a Bullish Spread Trade Asset Direction Type First Asset - Ist Trace roton DIABET (Lowest Exercise Price) thy O Od L ON OS Second Asset - 2nd Trace recon 20 Type 6 (Highest Exercise Prion) Lo Buy . Sd 2 Gal ON 50 Exercise Asset Price Price Trade Trades Listed From Assat 1 to Assat 2 (Last To Highest Exercise Prica) O Stel 1 Buy Call, Sel Call $25.00 54.00 $ - $45.00 - $10.00 Buy Call Sell Call 1 Option Trading Strategies - Two Assets $40 9 10 11 12 13 14 15 16 17 18 - First Asset Profit Second Asset Profit Total Prott 1st Exercise Price .- 2nd Exerdse Price Test Yes NO No No Na NO No No No No No Two-Ass at Strategies Description (LCARSE To Hghest Exercise Prica) Buying a Bulish Spread "Buy Call, Sell Call" or "Buy Put, Sel Put" Buying a Bearish Spread "Sel Call, Buy Call or "Sel Put, Buy Put' Buying a Straddle "Buy Call, Buy Put' or 'Buy Put, Buy Call at the same exercise price Writing a Straddle "Sel Call, Sel Put' or 'Sell Put. Sell Call at the same exercise price Burying a Strangle "Buy Put, Buy Call Writing a Strangle "Sel Put, Sel Call" Buying a Covered Call "Buy Stock, Sell Call or 'Sel Call, Buy Stock Writing a Covered Call "Sel Stack, Buy Callor "Buy Call, Sell Stock Buying a Protective Put "Buy Stock, Buy Put" or "Buy Put, Buy Stock" Writing a Protective Put "Sel Stack, Sell Put' or Sell Pui, Sell Stock Other Strategies Lupe Spread Spread Combination Combination Combination Combination NA N.A. N.A N.A. $20 - Note: Writing a Bulish Spread - Buying a Bearish Spread Writing a Beanish Spread = Buying a Buliah Spread $20 $60 $90 20 $0 21 22 23 24 26 -$20 26 27 28 29 30 31 $40 32 $0 33 34 35 36 Outputs 37 Stock Price At Maturity 38 First Asset Profit 39 Second Asset Profit 40 Total Profit 41 1st Exercise Price 42 2nd Exercise Price 43 44 46 46 $40 Stock Price At Maturity $ $25.00 $25.00 $45.00 $45.00 $0.00 $25.00 $0.00 $0.00 $10.00 $10.00 $ $2.00 $2.00 $45.00 S80.00 $12.00 $47.00 $ 510.00 $25.00 $22.00 $22.00 - -$40.00 $40.00 $ -$40.00 $40.00 D E F G I J K L M N O P Q R S T U V Exercise Price Asset Price Tradea LiseFrom A1 Alaves To Hiche Exercise Brice 1 1 $25.00 $8.00 $ Buy Call, Sel Cail, Sell Call, Buy Call Trade Buy Call Sell Call Sell Call 1 1 OPTION TRADING STRATEGIES Four Assets 2 3 Inputs Buying a Butterfly Spread Trade Direction First Asset FILTRE 5 (Lowest Exercise Price Buy Oso 1 1 O Put Sed Second Asset 20 TREAT - OP 6 (Med-Low Exercise Price) O se Buy 2 Cal Put Stod Third Asset - 3/0 TISUE OY IT: 7 (Med-High Exercise Price) OB O Buy Sell | 2 OP Stod Fourth Asset PUTO THESITY 8 (Highest Exercise Price . Sel Buy O 1 O Sud COPA OS 9 10 Option Trading Strategies - Four Assets 11 $40 12 13 14 15 18 17 $20 18 19 $35.00 - $10.00 $35.00 $4,00 . $45.00 - $10.00 1 Buy Call - Test Yes Four-AG Statens Buying a Butterfly Spread IVRE Spread Descrinien der Press Hawin The Last To Hinhas Evan Prin "Buy Call Sell Call, Sell Call, Buy Call or Buy Pul, Sell Pul, Sell Put, Buy Pur with Assos 2 and 3 of the same exercise price Sell Call, Buy Call, Buy Call, Sell Call" or "Sell P, Buy Put, Buy PL Sell Pur with Assets 2 and 3 at the same excroise price No Writing a Butterfly Spread Spread No Cther Surgledes First feset Profit Serand Aset Pro Third Reset Profit Fourth Asset Proft -Total Profit - 1st Ferie Price ---2nd Exercise Price --3rd Exercise Price -4th Exercise Price $a a $20 $40 $0 $20 $60 $80 $90 Stock Price At Maturity $25.00 $25.00 $36.00 $35.00 $35.00 $36.00 S45.00 S45.00 38 Outputs 39 Stock Prion At Marity 40 First Assel Front 41 Second Asset Profit 42 Third Asset Profit 43 Fourth Asset Profit 44 Total Pront 45 1st Exercise Price 46 and Exercise Price 47 3rd Exercise Price 48 4th Exercise Price 49 50 $0.00 $25.00 -58,00 58.00 -$ $ $10.00 $10.00 54.00 4.00 $10.00 $10.00 -54.00 5400 $35.00 $35.00 $45.00 S80.00 $200 $200 $1200 17.00 $ $10.00 $10.00 $0.00 $. 35.00 34000-$5.0 -811.00 $ $10.00 $10.00 $10.00 $25.00 100 $800 54.00 54.00 -$ $40.00 -$40.00 $10.00 -540.00 C D E F G H J M OPTION TRADING STRATEGIES Two Assets Inputs Buying a Bullish Spread Trade Asset Direction Type First Asset - Ist Trace roton DIABET (Lowest Exercise Price) thy O Od L ON OS Second Asset - 2nd Trace recon 20 Type 6 (Highest Exercise Prion) Lo Buy . Sd 2 Gal ON 50 Exercise Asset Price Price Trade Trades Listed From Assat 1 to Assat 2 (Last To Highest Exercise Prica) O Stel 1 Buy Call, Sel Call $25.00 54.00 $ - $45.00 - $10.00 Buy Call Sell Call 1 Option Trading Strategies - Two Assets $40 9 10 11 12 13 14 15 16 17 18 - First Asset Profit Second Asset Profit Total Prott 1st Exercise Price .- 2nd Exerdse Price Test Yes NO No No Na NO No No No No No Two-Ass at Strategies Description (LCARSE To Hghest Exercise Prica) Buying a Bulish Spread "Buy Call, Sell Call" or "Buy Put, Sel Put" Buying a Bearish Spread "Sel Call, Buy Call or "Sel Put, Buy Put' Buying a Straddle "Buy Call, Buy Put' or 'Buy Put, Buy Call at the same exercise price Writing a Straddle "Sel Call, Sel Put' or 'Sell Put. Sell Call at the same exercise price Burying a Strangle "Buy Put, Buy Call Writing a Strangle "Sel Put, Sel Call" Buying a Covered Call "Buy Stock, Sell Call or 'Sel Call, Buy Stock Writing a Covered Call "Sel Stack, Buy Callor "Buy Call, Sell Stock Buying a Protective Put "Buy Stock, Buy Put" or "Buy Put, Buy Stock" Writing a Protective Put "Sel Stack, Sell Put' or Sell Pui, Sell Stock Other Strategies Lupe Spread Spread Combination Combination Combination Combination NA N.A. N.A N.A. $20 - Note: Writing a Bulish Spread - Buying a Bearish Spread Writing a Beanish Spread = Buying a Buliah Spread $20 $60 $90 20 $0 21 22 23 24 26 -$20 26 27 28 29 30 31 $40 32 $0 33 34 35 36 Outputs 37 Stock Price At Maturity 38 First Asset Profit 39 Second Asset Profit 40 Total Profit 41 1st Exercise Price 42 2nd Exercise Price 43 44 46 46 $40 Stock Price At Maturity $ $25.00 $25.00 $45.00 $45.00 $0.00 $25.00 $0.00 $0.00 $10.00 $10.00 $ $2.00 $2.00 $45.00 S80.00 $12.00 $47.00 $ 510.00 $25.00 $22.00 $22.00 - -$40.00 $40.00 $ -$40.00 $40.00 D E F G I J K L M N O P Q R S T U V Exercise Price Asset Price Tradea LiseFrom A1 Alaves To Hiche Exercise Brice 1 1 $25.00 $8.00 $ Buy Call, Sel Cail, Sell Call, Buy Call Trade Buy Call Sell Call Sell Call 1 1 OPTION TRADING STRATEGIES Four Assets 2 3 Inputs Buying a Butterfly Spread Trade Direction First Asset FILTRE 5 (Lowest Exercise Price Buy Oso 1 1 O Put Sed Second Asset 20 TREAT - OP 6 (Med-Low Exercise Price) O se Buy 2 Cal Put Stod Third Asset - 3/0 TISUE OY IT: 7 (Med-High Exercise Price) OB O Buy Sell | 2 OP Stod Fourth Asset PUTO THESITY 8 (Highest Exercise Price . Sel Buy O 1 O Sud COPA OS 9 10 Option Trading Strategies - Four Assets 11 $40 12 13 14 15 18 17 $20 18 19 $35.00 - $10.00 $35.00 $4,00 . $45.00 - $10.00 1 Buy Call - Test Yes Four-AG Statens Buying a Butterfly Spread IVRE Spread Descrinien der Press Hawin The Last To Hinhas Evan Prin "Buy Call Sell Call, Sell Call, Buy Call or Buy Pul, Sell Pul, Sell Put, Buy Pur with Assos 2 and 3 of the same exercise price Sell Call, Buy Call, Buy Call, Sell Call" or "Sell P, Buy Put, Buy PL Sell Pur with Assets 2 and 3 at the same excroise price No Writing a Butterfly Spread Spread No Cther Surgledes First feset Profit Serand Aset Pro Third Reset Profit Fourth Asset Proft -Total Profit - 1st Ferie Price ---2nd Exercise Price --3rd Exercise Price -4th Exercise Price $a a $20 $40 $0 $20 $60 $80 $90 Stock Price At Maturity $25.00 $25.00 $36.00 $35.00 $35.00 $36.00 S45.00 S45.00 38 Outputs 39 Stock Prion At Marity 40 First Assel Front 41 Second Asset Profit 42 Third Asset Profit 43 Fourth Asset Profit 44 Total Pront 45 1st Exercise Price 46 and Exercise Price 47 3rd Exercise Price 48 4th Exercise Price 49 50 $0.00 $25.00 -58,00 58.00 -$ $ $10.00 $10.00 54.00 4.00 $10.00 $10.00 -54.00 5400 $35.00 $35.00 $45.00 S80.00 $200 $200 $1200 17.00 $ $10.00 $10.00 $0.00 $. 35.00 34000-$5.0 -811.00 $ $10.00 $10.00 $10.00 $25.00 100 $800 54.00 54.00 -$ $40.00 -$40.00 $10.00 -540.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts