Question: Canada Canning Company owns processing equipment that had an initial cost of $120,000, expected useful life of eight years, and expected residual value of $14,800.

Canada Canning Company owns processing equipment that had an initial cost of $120,000, expected useful life of eight years, and expected residual value of $14,800. Depreciation calculations are done to the nearest month using the straight-line method, and depreciation is recorded each December 31. During the equipment's fifth year of service, the following expenditures were made:

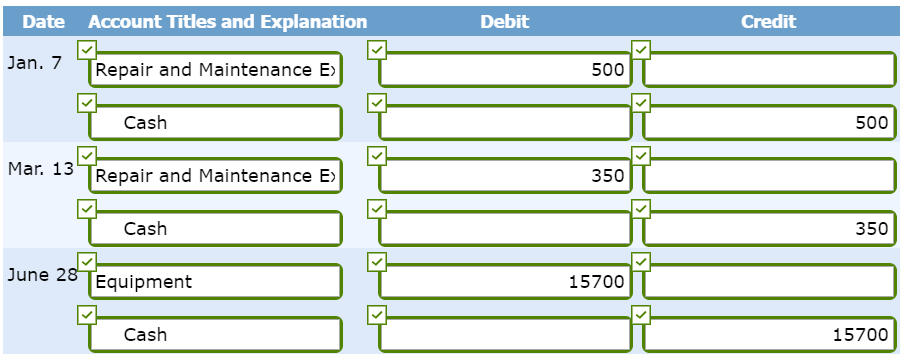

Prepare journal entries to record each of the above transactions.

Prepare journal entries to record each of the above transactions.

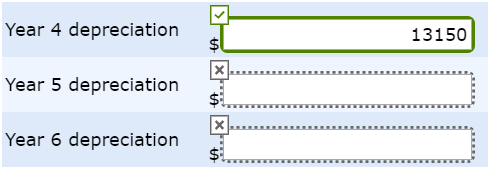

Calculate the depreciation expense that should be recorded for this equipment in the fourth year of its life, in the fifth year of its life (the year in which the above transactions took place), and in the sixth year of its life. (Round answers to the nearest whole dollar)

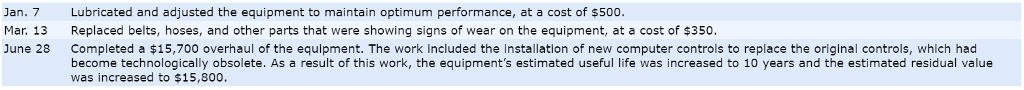

Jan. 7 Mar. 13 June 28 Lubricated and adjusted the equipment to maintain optimum performance, at a cost of $500 Replaced belts, hoses, and other parts that were showing signs of wear on the equipment, at a cost of $350 Completed a $15,700 overhaul of the equipment. The work Included the Installation of new computer controls to replace the original controls, which had become technologically obsolete. As a result of this work, the equipment's estimated useful life was increased to 10 years and the estimated residual value was increased to $15,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts