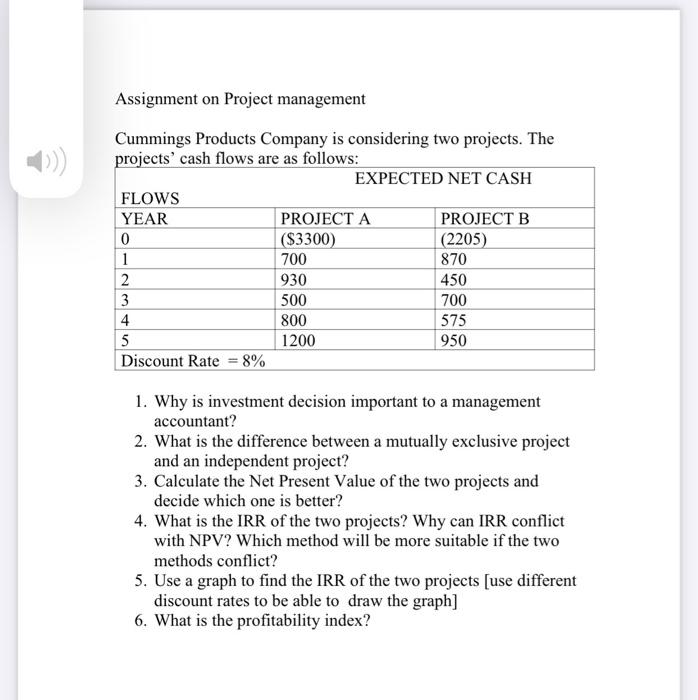

Question: canadian account Assignment on Project management Cummings Products Company is considering two projects. The roects' cash flows are as follows: EXPECTED NET CASH FLOWS YEAR

Assignment on Project management Cummings Products Company is considering two projects. The roects' cash flows are as follows: EXPECTED NET CASH FLOWS YEAR 0 2 3 4 5 Discount Rate 8% PROJECT A S3300 700 930 500 800 1200 PROJECT B 2205 870 450 700 575 950 I. Why is investment decision important to a management accountant? 2. What is the difference between a mutually exclusive project and an independent project? 3. Calculate the Net Present Value of the two projects and decide which one is better? 4. What is the IRR of the two projects? Why can IRR conflict with NPV? Which method will be more suitable if the two methods conflict? 5. Use a graph to find the IRR Of the two projects [use different discount rates to be able to draw the graph] 6. What is the profitability index?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts