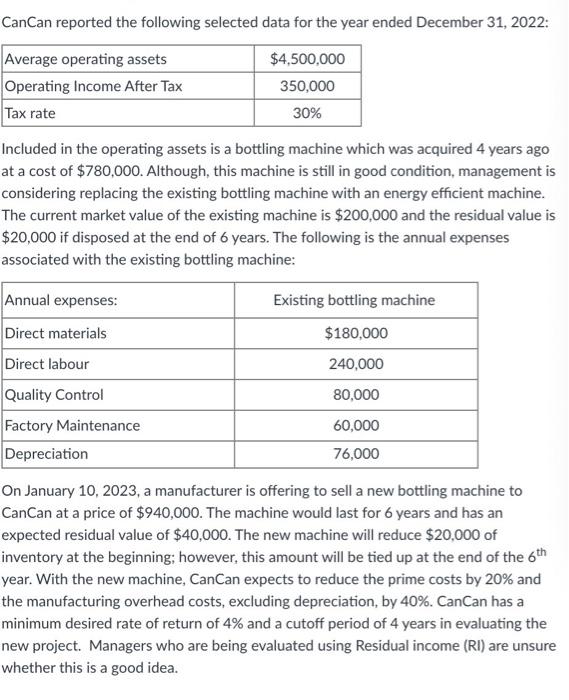

Question: CanCan reported the following selected data for the year ended December 31, 2022: Average operating assets $4,500,000 Operating Income After Tax 350,000 Tax rate 30%

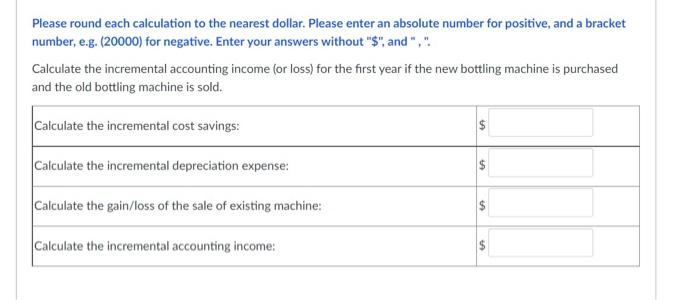

CanCan reported the following selected data for the year ended December 31, 2022: Average operating assets $4,500,000 Operating Income After Tax 350,000 Tax rate 30% Included in the operating assets is a bottling machine which was acquired 4 years ago at a cost of $780,000. Although, this machine is still in good condition, management is considering replacing the existing bottling machine with an energy efficient machine. The current market value of the existing machine is $200,000 and the residual value is $20,000 if disposed at the end of 6 years. The following is the annual expenses associated with the existing bottling machine: Annual expenses: Direct materials Direct labour Quality Control Factory Maintenance Depreciation Existing bottling machine $180,000 240,000 80,000 60,000 76,000 On January 10, 2023, a manufacturer is offering to sell a new bottling machine to CanCan at a price of $940,000. The machine would last for 6 years and has an expected residual value of $40,000. The new machine will reduce $20,000 of inventory at the beginning; however, this amount will be tied up at the end of the 6th year. With the new machine, CanCan expects to reduce the prime costs by 20% and the manufacturing overhead costs, excluding depreciation, by 40%. CanCan has a minimum desired rate of return of 4% and a cutoff period of 4 years in evaluating the new project. Managers who are being evaluated using Residual income (RI) are unsure whether this is a good idea. Please round each calculation to the nearest dollar. Please enter an absolute number for positive, and a bracket number, e.g. (20000) for negative. Enter your answers without "$", and ".. Calculate the incremental accounting income (or loss) for the first year if the new bottling machine is purchased and the old bottling machine is sold. Calculate the incremental cost savings: $ Calculate the incremental depreciation expense: $ Calculate the gain/loss of the sale of existing machine: $ Calculate the incremental accounting income: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts