Question: cancel request. thank you MINDTAP Q Search work The basic concepts of financial management are the same for all businesses, regardless of how they are

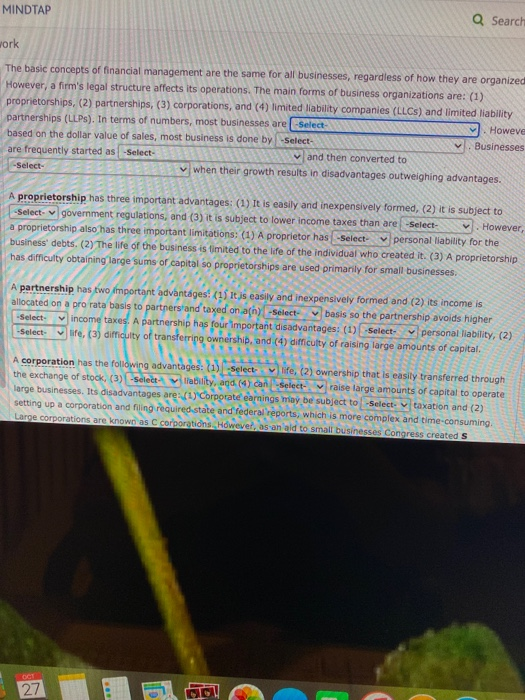

MINDTAP Q Search work The basic concepts of financial management are the same for all businesses, regardless of how they are organized However, a firm's legal structure affects its operations. The main forms of business organizations are: (1) proprietorships, (2) partnerships, (3) corporations, and (4) limited liability companies (LLCs) and limited liability partnerships (LLPs). In terms of numbers, most businesses are -Select- Howeve based on the dollar value of sales, most business is done by -Select- Businesses are frequently started as -Select- and then converted to -Select- when their growth results in disadvantages outweighing advantages A proprietorship has three important advantages: (1) It is easily and inexpensively formed, (2) it is subject to -Select- government regulations, and (3) it is subject to lower income taxes than are -Select v. However, a proprietorship also has three important limitations: (1) A proprietor has -Select personal liability for the business' debts. (2) The life of the business is limited to the life of the individual who created it. (3) A proprietorship has difficulty obtaining large sums of capital so proprietorships are used primarily for small businesses. A partnership has two important advantages (1) it is easily and inexpensively formed and (2) its income is allocated on a pro rata basis to partners and taxed on an) -Select basis so the partnership avoids higher -Select income taxes. A partnership has four important disadvantages: (1) -Select personal liability, (2) -Select life. (3) difficulty of transferring ownership, and (4) difficulty of raising large amounts of capital. A corporation has the following advantages: (i) -Select life, (2) ownership that is easily transferred through the exchange of stock. (3) -Select- ability, and (4) can select- vraise large amounts of capital to operate large businesses. Its disadvantages are: (1) Corporate earnings may be subject to -Select- v taxation and (2) setting up a corporation and filing required state and federal reports, which is more complex and time-consuming. Large corporations are known as C corporations. However, as an aid to small businesses Congress created S 27 ca MINDTAP Q Search work The basic concepts of financial management are the same for all businesses, regardless of how they are organized However, a firm's legal structure affects its operations. The main forms of business organizations are: (1) proprietorships, (2) partnerships, (3) corporations, and (4) limited liability companies (LLCs) and limited liability partnerships (LLPs). In terms of numbers, most businesses are -Select- Howeve based on the dollar value of sales, most business is done by -Select- Businesses are frequently started as -Select- and then converted to -Select- when their growth results in disadvantages outweighing advantages A proprietorship has three important advantages: (1) It is easily and inexpensively formed, (2) it is subject to -Select- government regulations, and (3) it is subject to lower income taxes than are -Select v. However, a proprietorship also has three important limitations: (1) A proprietor has -Select personal liability for the business' debts. (2) The life of the business is limited to the life of the individual who created it. (3) A proprietorship has difficulty obtaining large sums of capital so proprietorships are used primarily for small businesses. A partnership has two important advantages (1) it is easily and inexpensively formed and (2) its income is allocated on a pro rata basis to partners and taxed on an) -Select basis so the partnership avoids higher -Select income taxes. A partnership has four important disadvantages: (1) -Select personal liability, (2) -Select life. (3) difficulty of transferring ownership, and (4) difficulty of raising large amounts of capital. A corporation has the following advantages: (i) -Select life, (2) ownership that is easily transferred through the exchange of stock. (3) -Select- ability, and (4) can select- vraise large amounts of capital to operate large businesses. Its disadvantages are: (1) Corporate earnings may be subject to -Select- v taxation and (2) setting up a corporation and filing required state and federal reports, which is more complex and time-consuming. Large corporations are known as C corporations. However, as an aid to small businesses Congress created S 27 ca

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts