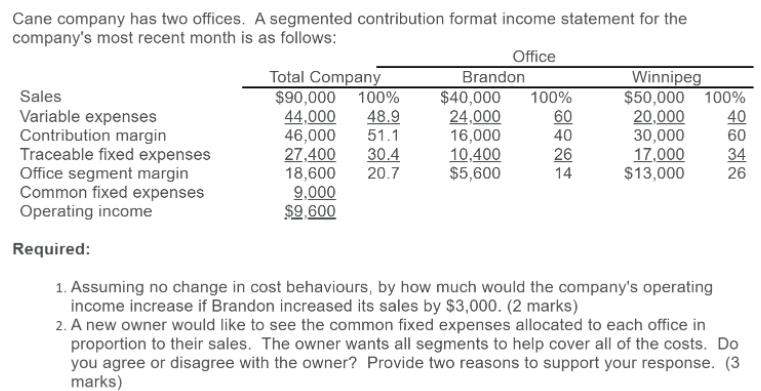

Question: Cane company has two offices. A segmented contribution format income statement for the company's most recent month is as follows: Office Total Company $90,000

Cane company has two offices. A segmented contribution format income statement for the company's most recent month is as follows: Office Total Company $90,000 100% 44,000 Brandon $40,000 24,000 16,000 10.400 $5,600 Winnipeg $50,000 100% 20,000 100% 60 40 Sales 40 Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses Operating income 48.9 51.1 30,000 46,000 27.400 18,600 60 30.4 20.7 26 14 17,000 $13,000 34 26 9.000 $9.600 Required: 1. Assuming no change in cost behaviours, by how much would the company's operating income increase if Brandon increased its sales by $3,000. (2 marks) 2. A new owner would like to see the common fixed expenses allocated to each office in proportion to their sales. The owner wants all segments to help cover all of the costs. Do you agree or disagree with the owner? Provide two reasons to support your response. (3 marks)

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

ANSWER 1 If sales increased by 3000 below mentioned income changes will take place New Income 10800 ... View full answer

Get step-by-step solutions from verified subject matter experts