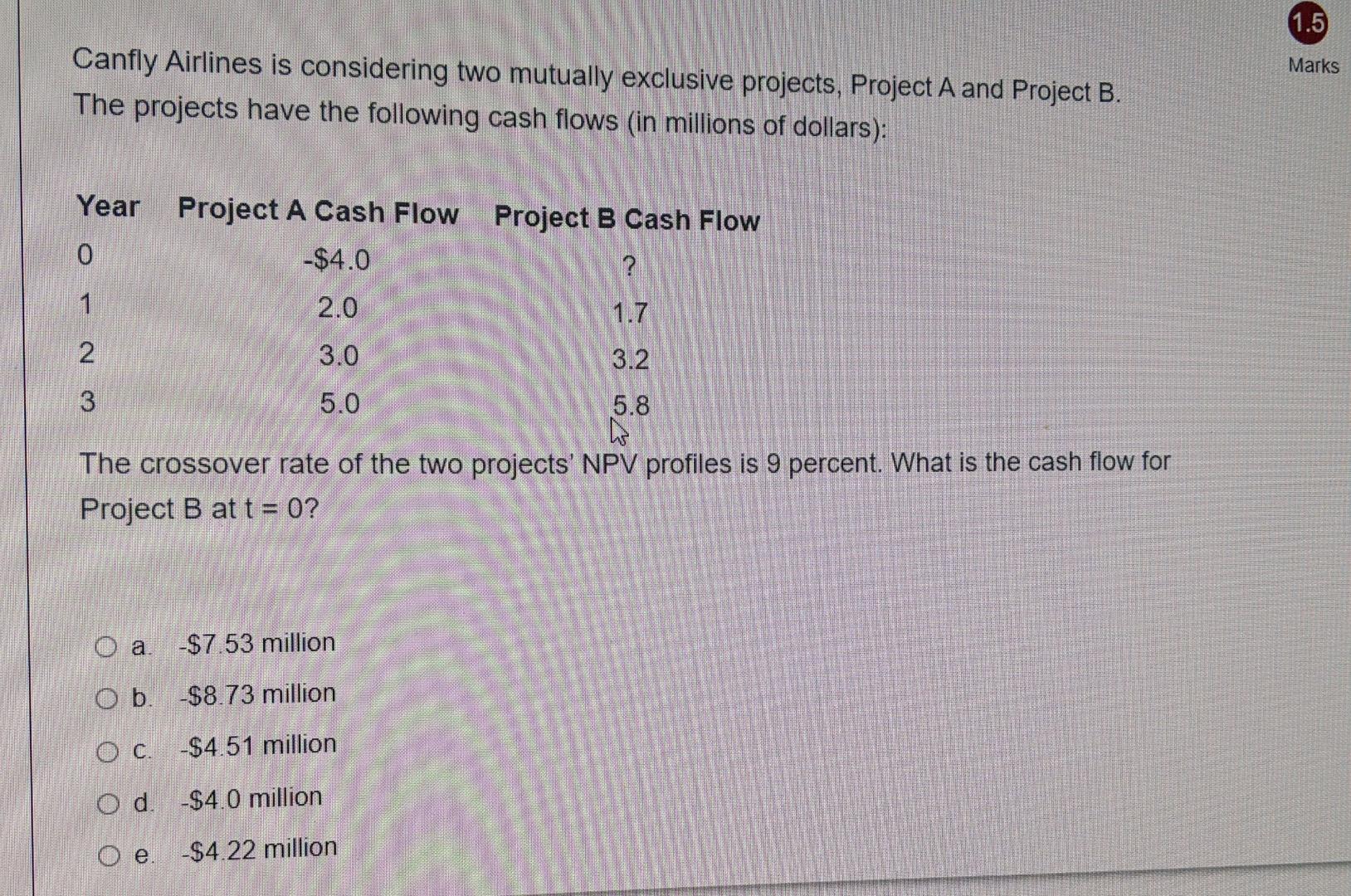

Question: Canfly Airlines is considering two mutually exclusive projects, Project A and Project B. The projects have the following cash flows (in millions of dollars): Year

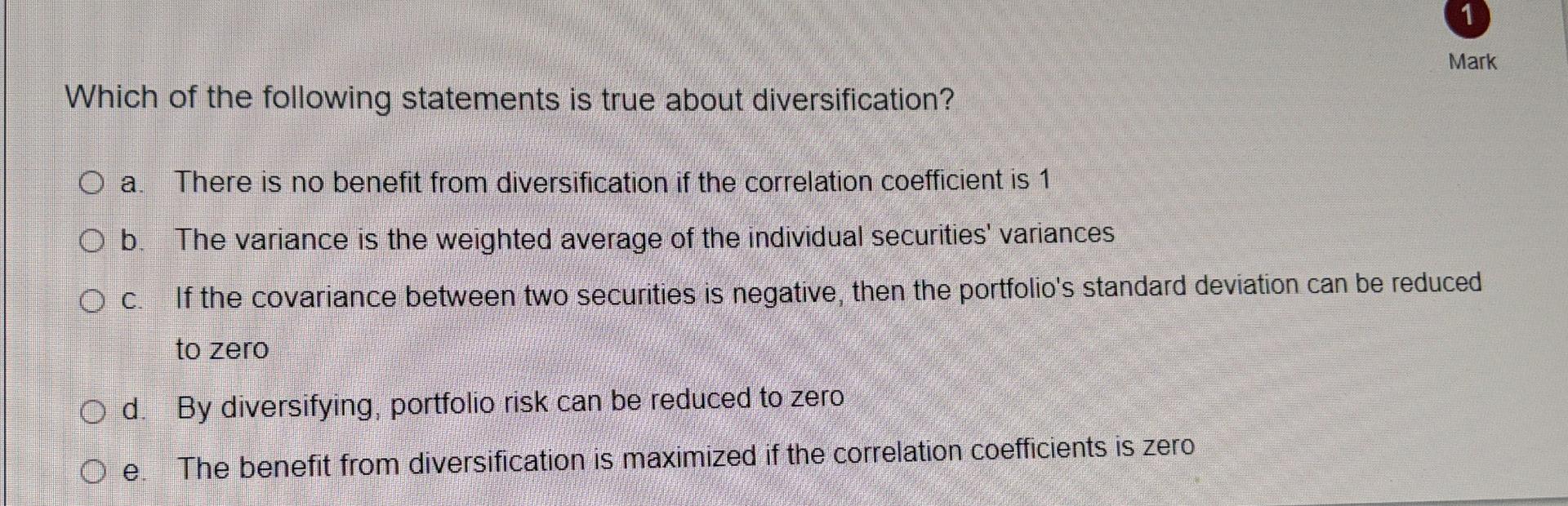

Canfly Airlines is considering two mutually exclusive projects, Project A and Project B. The projects have the following cash flows (in millions of dollars): Year Project A Cash Flow Project B Cash Flow 0 -$4.0 ? 1 2.0 1.7 3.0 3.2 3 5.0 5.8 D The crossover rate of the two projects' NPV profiles is 9 percent. What is the cash flow for Project B at t = 0? 0 a. -$7.53 million O b. -$8.73 million O c. -$4.51 million O d. -$4.0 million Oe. -$4.22 million 1.5 Marks 1 Mark Which of the following statements is true about diversification? O a. There is no benefit from diversification if the correlation coefficient is 1 O b. The variance is the weighted average of the individual securities' variances 0 . If the covariance between two securities is negative, then the portfolio's standard deviation can be reduced to zero O d. By diversifying, portfolio risk can be reduced to zero e. The benefit from diversification is maximized if the correlation coefficients is zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts