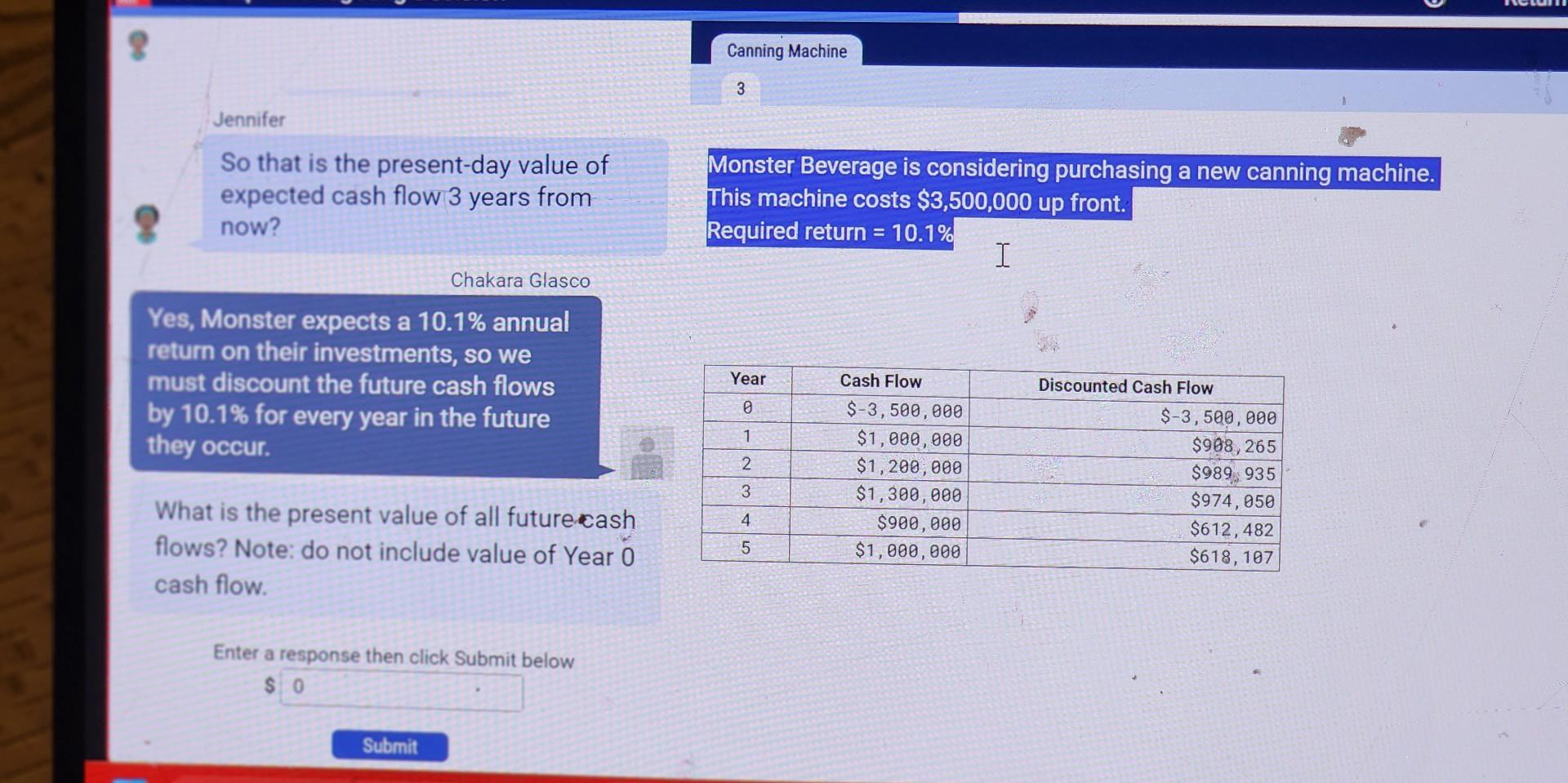

Question: Canning Machine 3 Jennifer So that is the present-day value of expected cash flow 3 years from now? Monster Beverage is considering purchasing a new

Canning Machine 3 Jennifer So that is the present-day value of expected cash flow 3 years from now? Monster Beverage is considering purchasing a new canning machine. This machine costs \\( \\$ 3,500,000 \\) up front. Required return \=10.1 Chakara Glasco Yes, Monster expects a \10.1 annual return on their investments, so we must discount the future cash flows by \10.1 for every year in the future they occur. What is the present value of all future cash flows? Note: do not include value of Year 0 cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts