Question: Cannot figure out how to get the net cash provided by operating activities. Can someone explain how to get it? Net Cash Flow from Operating

Cannot figure out how to get the net cash provided by operating activities. Can someone explain how to get it?

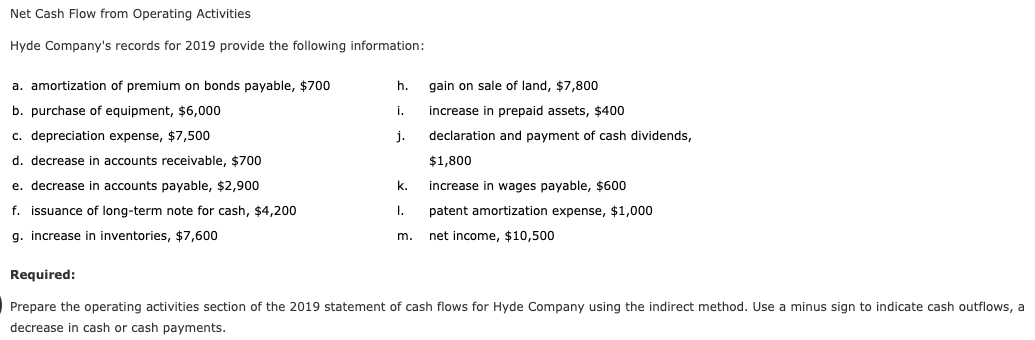

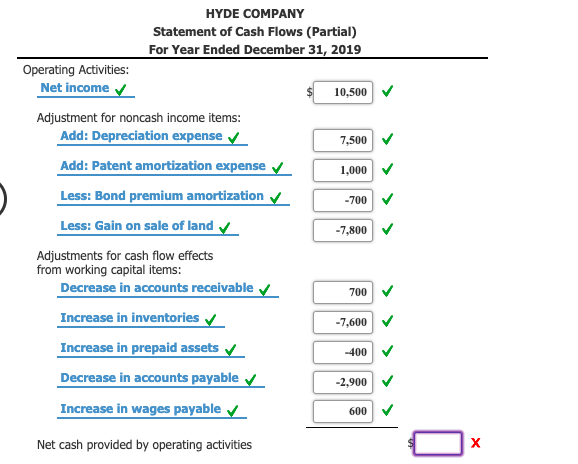

Net Cash Flow from Operating Activities Hyde Company's records for 2019 provide the following information: a. amortization of premium on bonds payable, $700 b. purchase of equipment, $6,000 C. depreciation expense, $7,500 d. decrease in accounts receivable, $700 e. decrease in accounts payable, $2,900 f. issuance of long-term note for cash, $4,200 g. increase in inventories, $7,600 h. gain on sale of land, $7,800 i. increase in prepaid assets, $400 j. declaration and payment of cash dividends, $1,800 k. increase in wages payable, $600 1. patent amortization expense, $1,000 m. net income, $10,500 Required: Prepare the operating activities section of the 2019 statement of cash flows for Hyde Company using the indirect method. Use a minus sign to indicate cash outflows, a decrease in cash or cash payments. HYDE COMPANY Statement of Cash Flows (Partial) For Year Ended December 31, 2019 Operating Activities: Net Income 10,500 Adjustment for noncash income items: Add: Depreciation expense 7,500 Add: Patent amortization expense V 1,000 Less: Bond premium amortization 700 Less: Gain on sale of land -7,800 Adjustments for cash flow effects from working capital items: Decrease in accounts receivable 700 Increase in inventories -7,600 Increase in prepaid assets -400 Decrease in accounts payable -2,900 Increase in wages payable 600 Net cash provided by operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts