Question: cannot figure out how to properly do this. thank you. here are better quality pictures. my apologies. 6. Marfeet value ratios Futins are mestly calculated

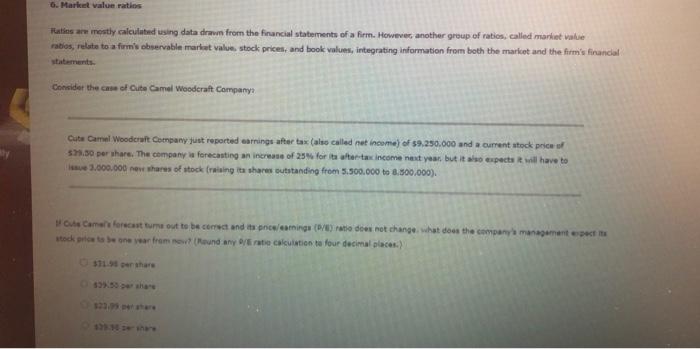

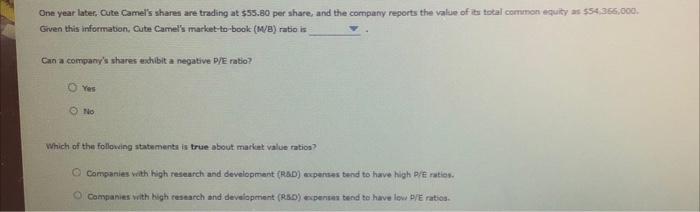

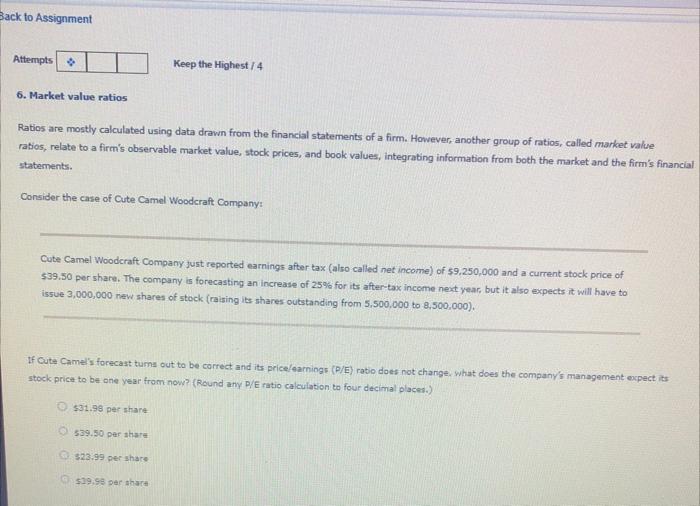

6. Marfeet value ratios Futins are mestly calculated using data drawm from the financial statements of a firm. Howevec another group of ratios; called markiet value rabies, relate to a firmis cobervable market value, stock prices, and book values, integrating information from both the market and the firmis financial. statements. Consider the cass of Cite Camel Wooderaft Company? Cuta Camel Woodcrat Cempany just reported earnings after tax (also called net income) of 39,250.000 and a current atock price sif 57.3. per thare, The cempany it forecasting an increase of 25% for ita alter-tax income naic year, but it also eupects if will have to isuee 2.000.000 nevt thaces of stock (raising ita shares outstanding frem 5.500.000 to 8.500.000 ). One year later, Cute Camel's shares are trading at $55.60 per share, and the compary reports the value of tw total common equiky as $54.355,000. Grven this informabion, Cute Camel's market-to book (M/B) ratio is Cain a company's shares exhibit a negative P/E natio? Which of the following statementi is true sbout markat value matios? Companies wath high research and developmant (RAD) axperaes tend to have high p/ f ration. Companies with kigh tesearch and deveiopmont (R.SD) enpentas tend te have lew P/E ratios. 6. Market value ratios Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value ratios, relate to a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financia statements. Consider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company just reported earnings after tax (also called net income) of 59,250,000 and a current stock price of \$39.50 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 3,000,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,500,000), If Cute Camel's forecast tuma out to be correct and its price/earnings (P/E) ratio does not change. what does the company's management expect iss stock prica to be one year from now? (Round any P/E ratio calculation to four decimal places.) $31.98 per share 539.50 per atare 323.99 per share 519,9s per share Can a compury s shares eutsit a noputive Pr ratie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts