Question: cannot figure out this problem Ariana Grande, a single taxpayer (age 47), has an AGI of $300,000. This year, she paid qualifying medical expenses of

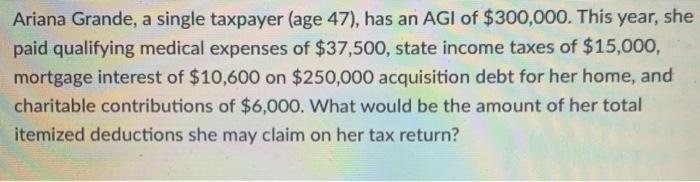

Ariana Grande, a single taxpayer (age 47), has an AGI of $300,000. This year, she paid qualifying medical expenses of $37,500, state income taxes of $15,000, mortgage interest of $10,600 on $250,000 acquisition debt for her home, and charitable contributions of $6,000. What would be the amount of her total itemized deductions she may claim on her tax return? Ariana Grande, a single taxpayer (age 47), has an AGI of $300,000. This year, she paid qualifying medical expenses of $37,500, state income taxes of $15,000, mortgage interest of $10,600 on $250,000 acquisition debt for her home, and charitable contributions of $6,000. What would be the amount of her total itemized deductions she may claim on her tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts