Question: Cannot figure this one out please help. Required information [The following information applies to the questions displayed below.] Rebecca is a calendar-year taxpayer who operates

Cannot figure this one out please help.

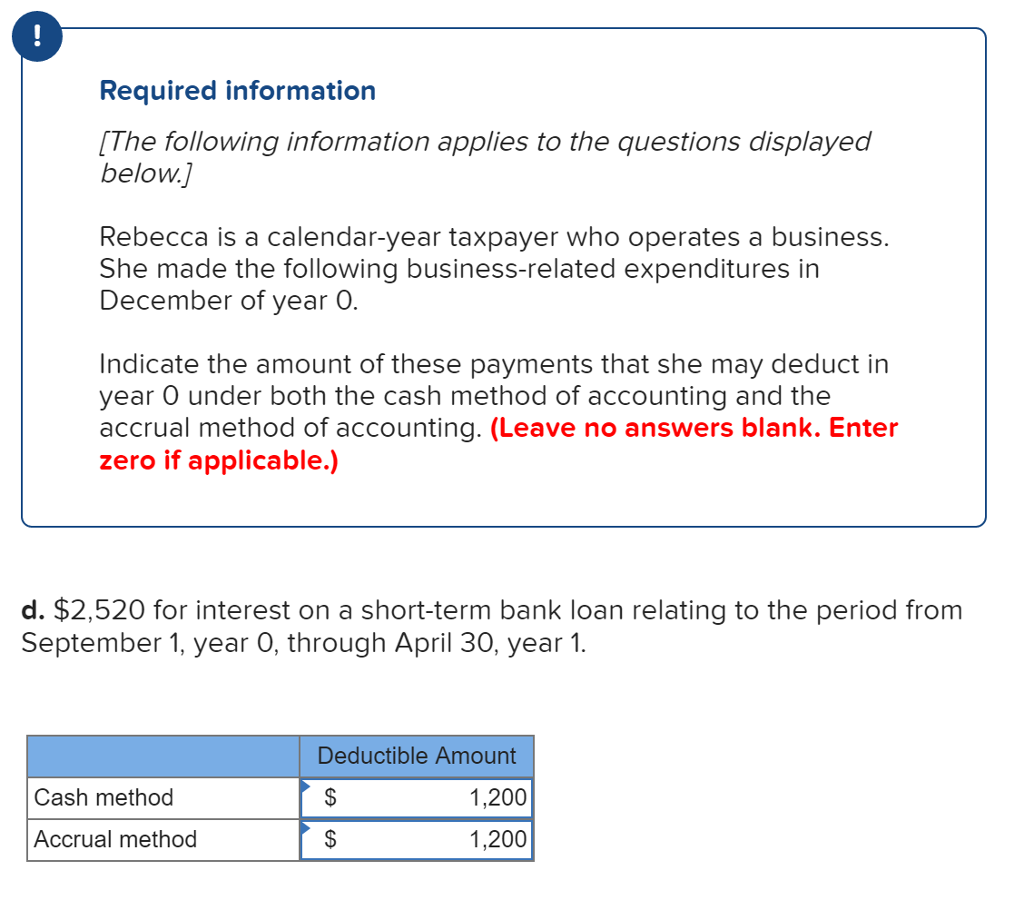

Required information [The following information applies to the questions displayed below.] Rebecca is a calendar-year taxpayer who operates a business. She made the following business-related expenditures in December of year O. Indicate the amount of these payments that she may deduct in year 0 under both the cash method of accounting and the accrual method of accounting. (Leave no answers blank. Enter zero if applicable.) d. $2,520 for interest on a short-term bank loan relating to the period fronm September 1, year O, through April 30, year1 Deductible Amount 1,200 1,200 Cash method Accrual method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts