Question: Cannot find the other answer thats makes NPV=0 Homework: Ch 5B HW, NPV and Other Investment Criteria, 325, Score: 0 of 1 pt P7-19 (similar

Cannot find the other answer thats makes NPV=0

Cannot find the other answer thats makes NPV=0

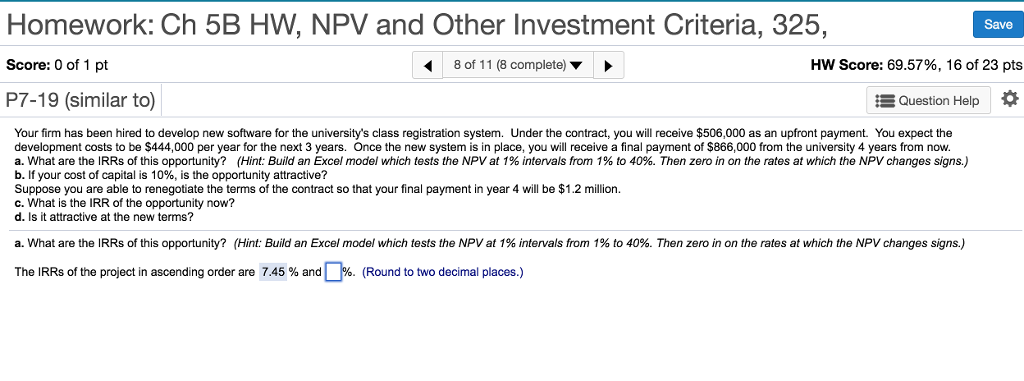

Homework: Ch 5B HW, NPV and Other Investment Criteria, 325, Score: 0 of 1 pt P7-19 (similar to) Save 8 of 11 (8 complete) HW Score: 69.57%, 16 of 23 pts Question Help * Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $506,000 as an upfront payment. You expect the development costs to be $444,000 per year for the next 3 years. Once the new system is in place, you will receive a final payment of $866,000 from the university 4 years from now. a. What are the IRRs of this opportunity? Hint: Build an Excel model which tests the NPV at 1% intervals from 1% to 40%. Then zero in on the rates at which the NPV changes signs. b. If your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million c. What is the IRR of the opportunity now? d. Is it attractive at the new terms? a. What are the IRRs of this opportunity? Hint: Build an Excel model which tests the PV at 1% ntervals from 1% to 409 Then zero in o the rates at which the IP changes s s. The IRRs of the project in ascending order are 7.45 % and . (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts