Question: cannot open new tabs , windows, or applications during the exam. 1 Fill in the Blank 3 5 points Assume that two firms compete in

cannot open new tabs windows, or applications during the exam.

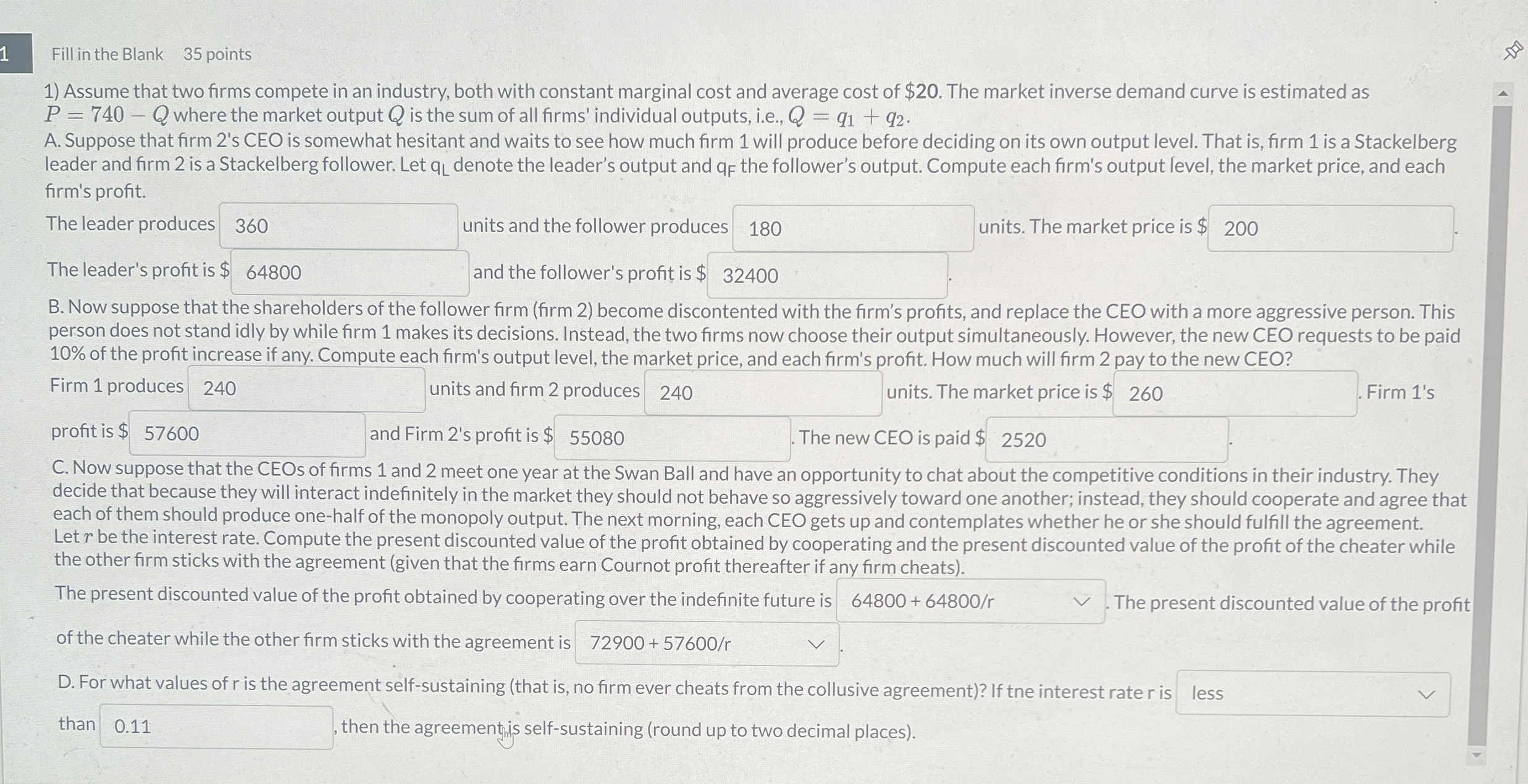

Fill in the Blank points

Assume that two firms compete in an industry, both with constant marginal cost and average cost of $ The market inverse demand curve is estimated as where the market output is the sum of all firms' individual outputs, ie

A Suppose that firm s CEO is somewhat hesitant and waits to see how much firm will produce before deciding on its own output level. That is firm is a Stackelberg leader and firm is a Stackelberg follower. Let denote the leader's output and the follower's output. Compute each firm's output level, the market price, and each firm's profit.

The leader produces units and the follower produce units. The market price is $

The leader's profit is : and the follower's profit is

B Now suppose that the shareholders of the follower firm firm become discontented with the firm's profits, and replace the CEO with a more aggressive person. This person does not stand idly by while firm makes its decisions. Instead, the two firms now choose their output simultaneously. However, the new CEO requests to be paid of the profit increase if any. Compute each firm's output level, the market price, and each firm's profit. How much will firm nav to the new CEO?

Firm produce units and firm produces units. The market price is $ Firm s profit is and Firm s profit is $ The new CEO is paid

C Now suppose that the CEOs of firms and meet one year at the Swan Ball and have an opportunity to chat about the competitive conditions in their industry. They decide that because they will interact indefinitely in the market they should not behave so aggressively toward one another; instead, they should cooperate and agree that each of them should produce onehalf of the monopoly output. The next morning, each CEO gets up and contemplates whether he or she should fulfill the agreement. Let be the interest rate. Compute the present discounted value of the profit obtained by cooperating and the present discounted value of the profit of the cheater while the other firm sticks with the agreement given that the firms earn Cournot profit thereafter if any firm cheats

The present discounted value of the profit obtained by cooperating over the indefinite future is

of the cheater while the other firm sticks with the agreement is

The present discounted value of the profit

D For what values of is the agreement selfsustaininghnthat is no firm ever cheats from the collusive agreement If the interest rate is than then the agreement is selfsustaining round up to two decimal places

Fill in the Blank points

Assume that two firms compete in an industry, both with constant marginal cost and average cost of $ The market inverse demand curve is estimated as where the market output is the sum of all firms' individual outputs, ie

A Suppose that firm s CEO is somewhat hesitant and waits to see how much firm will produce before deciding on its own output level. That is firm is a Stackelberg leader and firm is a Stackelberg follower. Let denote the leader's output and the follower's output. Compute each firm's output level, the market price, and each firm's profit.

The leader produces units and the follower produce: units. The market price is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock