Question: Cannot remember how my teacher got $21,400. This is for individual income tax. Fire and theft insurance 1 4,100 1,900 The Byrds had the following

Cannot remember how my teacher got $21,400. This is for individual income tax.

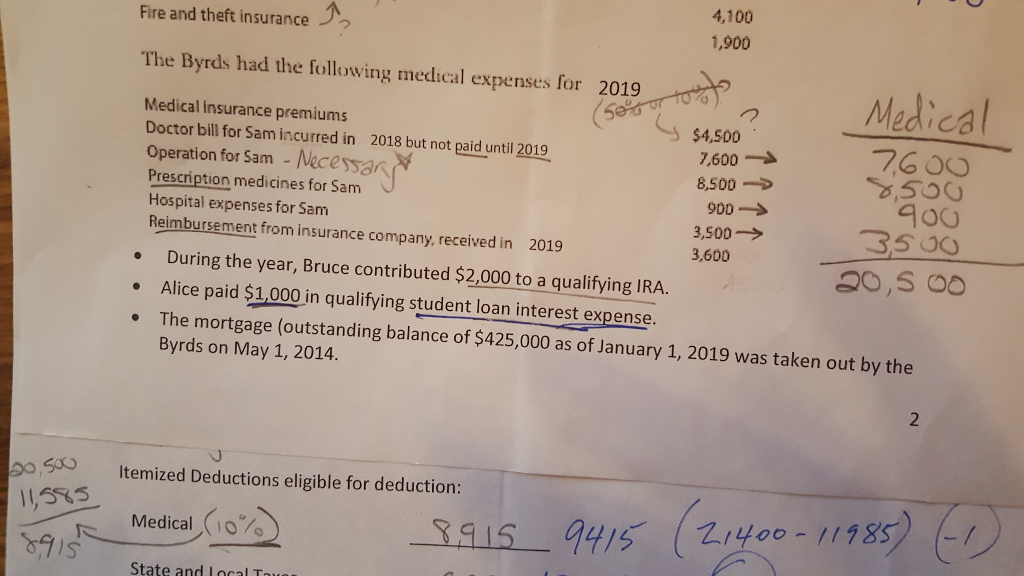

Fire and theft insurance 1 4,100 1,900 The Byrds had the following medical expenses for 2019 (586 Medical Medical insurance premiums y $4,500 Doctor bill for Sam incurred in 2018 but not paid until 2019 7,600 7,600 Operation for Sam - Necessar 8,500 Prescription medicines for Sam J 900 Hospital expenses for Sam 3,500 - Reimbursement from insurance company received in 3500 2019 3,600 During the year, Bruce contributed $2,000 to a qualifying IRA. 20,5 00 Alice paid $1,000 in qualifying student loan interest expense. The mortgage (outstanding balance of $425,000 as of January 1, 2019 was taken out by the Byrds on May 1, 2014. 8,500 - 900- 20,500 Itemized Deductions eligible for deduction: 11,585 Medical (10%) 8.915_9415 (21400 - 11985) (0 State and Local The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts