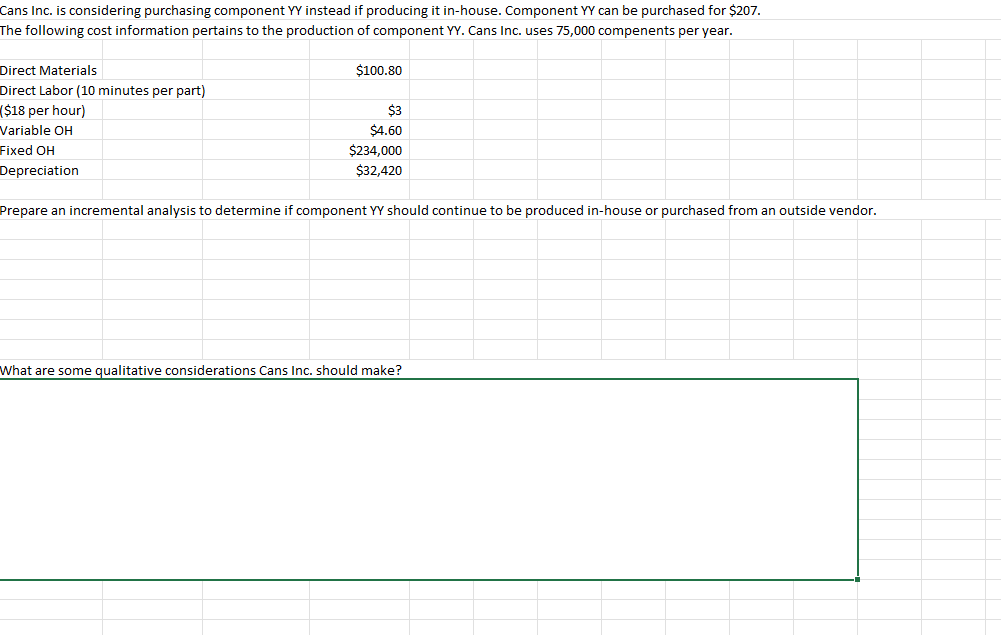

Question: Cans Inc. is considering purchasing component YY instead if producing it in-house. Component YY can be purchased for $207. The following cost information pertains to

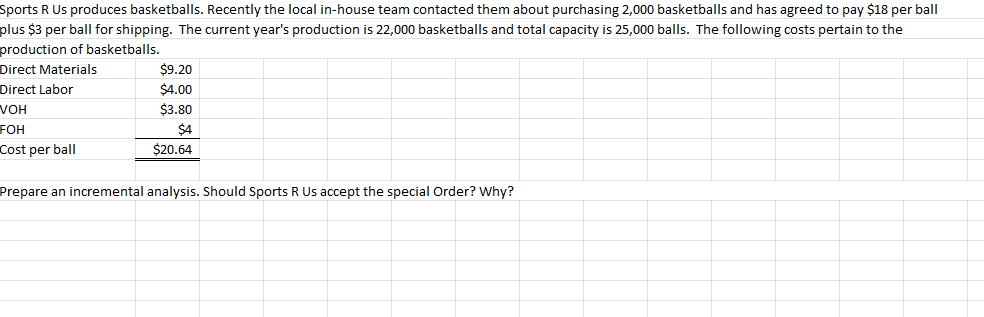

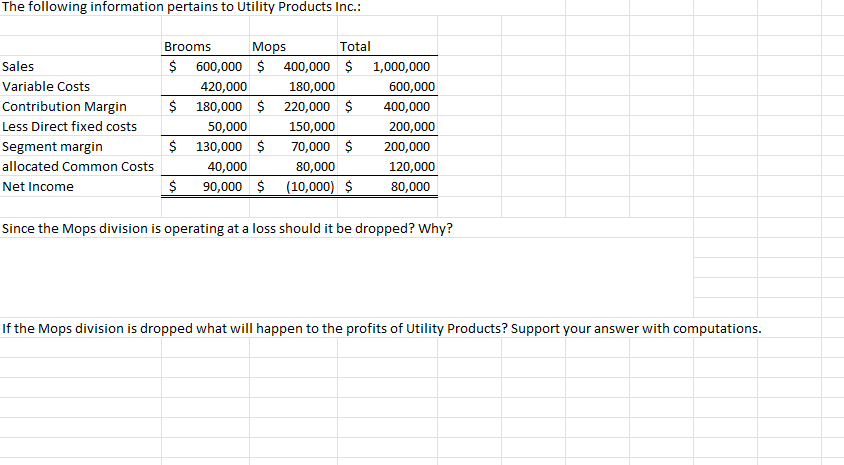

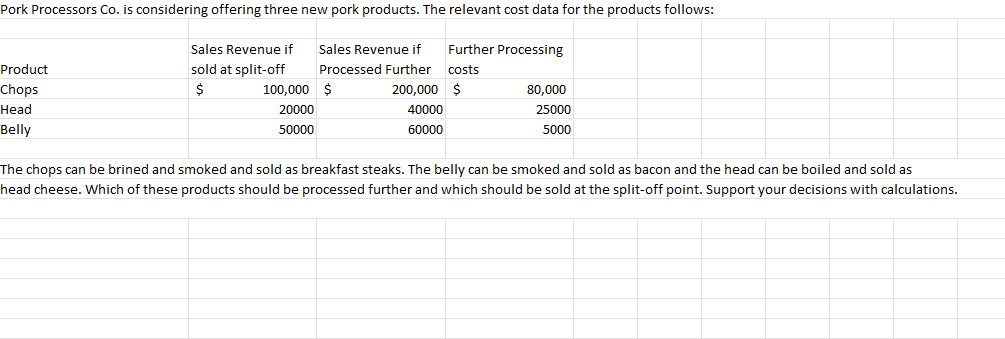

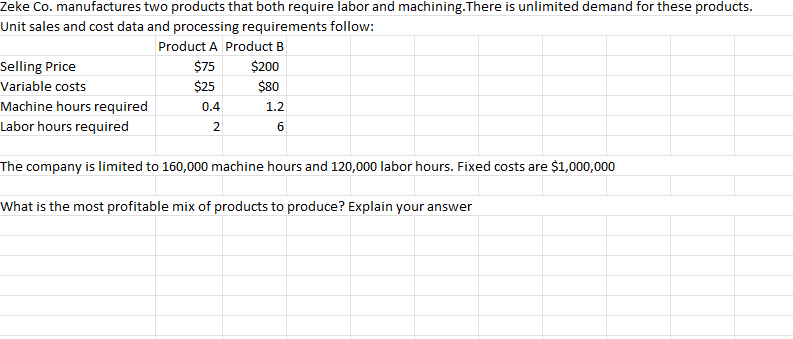

Cans Inc. is considering purchasing component YY instead if producing it in-house. Component YY can be purchased for $207. The following cost information pertains to the production of component YY. Cans Inc. uses 75,000 compenents per year. Direct Materials 5100.80 Direct Labor (10 minutes per part) (518 per hour) 83 Variable OH S4.60 Fixed OH 234,000 Depreciation 532,420 Prepare an incremental analysis to determine if component YY should continue to be produced in-house or purchased from an outside vendor. What are some qualitative considerations Cans Inc. should make? Sports R Us produces basketballs. Recently the local in-house team contacted them about purchasing 2,000 basketballs and has agreed to pay $18 per ball plus $3 per ball for shipping. The current year's production is 22,000 basketballs and total capacity is 25,000 balls. The following costs pertain to the production of basketballs. Direct Materials $9.20 Direct Labar $4.00 VOH $3.80 FOH 44 Cost per ball 520.64 Prepare an incremental analysis. Should Sports R Us accept the special Order? Why? The following information pertains to Utility Products Inc.: Brooms nMops Total Sales 4 B00O000 S 400,000 S 1,000,000 Variable Costs 420,000 180,000 600,000 Contribution Margin 180,000 S 220,000 5 400,000 Less Direct fixed costs 50,000 150,000 200,000 Segment margin S 130,000 S 70,000 S 200,000 allocated Common Costs 40,000 80,000 120,000 Met Income 5 90,000 $ (10,000) S 80,000 Since the Mops division is operating at a loss should it be dropped? Why? If the Mops division is dropped what will happen to the profits of Utility Products? Support your answer with computations. Pork Processors Co. is considering offering three new pork products. The relevant cost data for the products follows: Sales Revenue if Sales Revenue if Further Processing Product sold at split-off Processed Further costs Chops g 100,000 S 200,000 S 80,000 Head 20000 40000 25000 Belly 50000 60000 5000 The chops can be brined and smoked and sold as breakfast steaks. The belly can be smoked and sold as bacon and the head can be boiled and sold as head cheese. Which of these products should be processed further and which should be sold at the split-off point. Support your decisions with calculations. Zeke Co. manufactures two products that both require labor and machining.There is unlimited demand for these products. Unit sales and cost data and processing requirements follow: Product A ProductB selling Price 575 5200 Variable costs 525 S80 Machine hours required 0.4 1.2 Labor hours required 2 6 The company is limited to 160,000 machine hours and 120,000 labor hours. Fixed costs are 51,000,000 What is the most profitable mix of products to produce? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts