Question: Can't figure out what I'm missing or doing wrong. Ricky's Piano Rebuilding Company has been operating for one year. On January 1, at the start

Can't figure out what I'm missing or doing wrong.

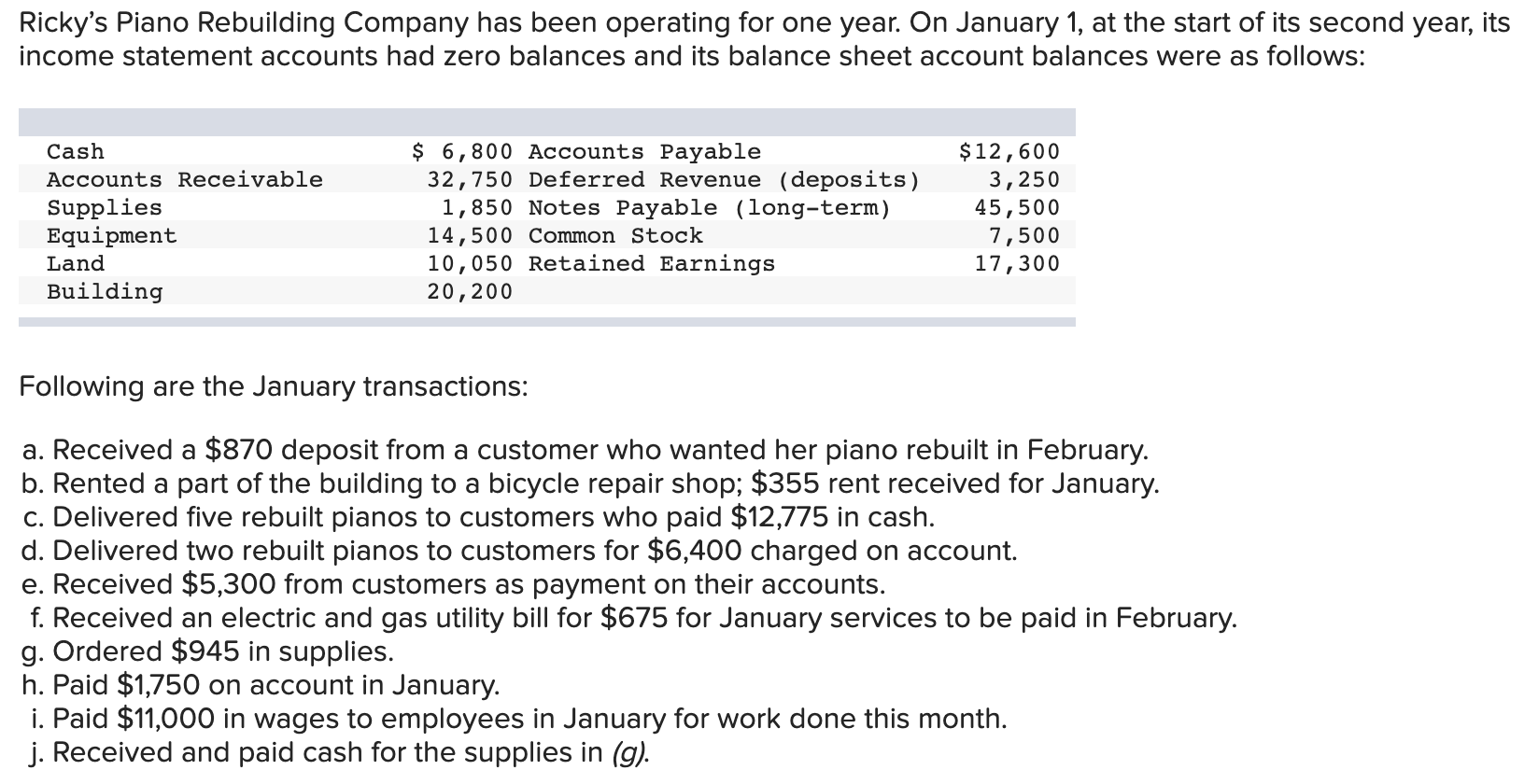

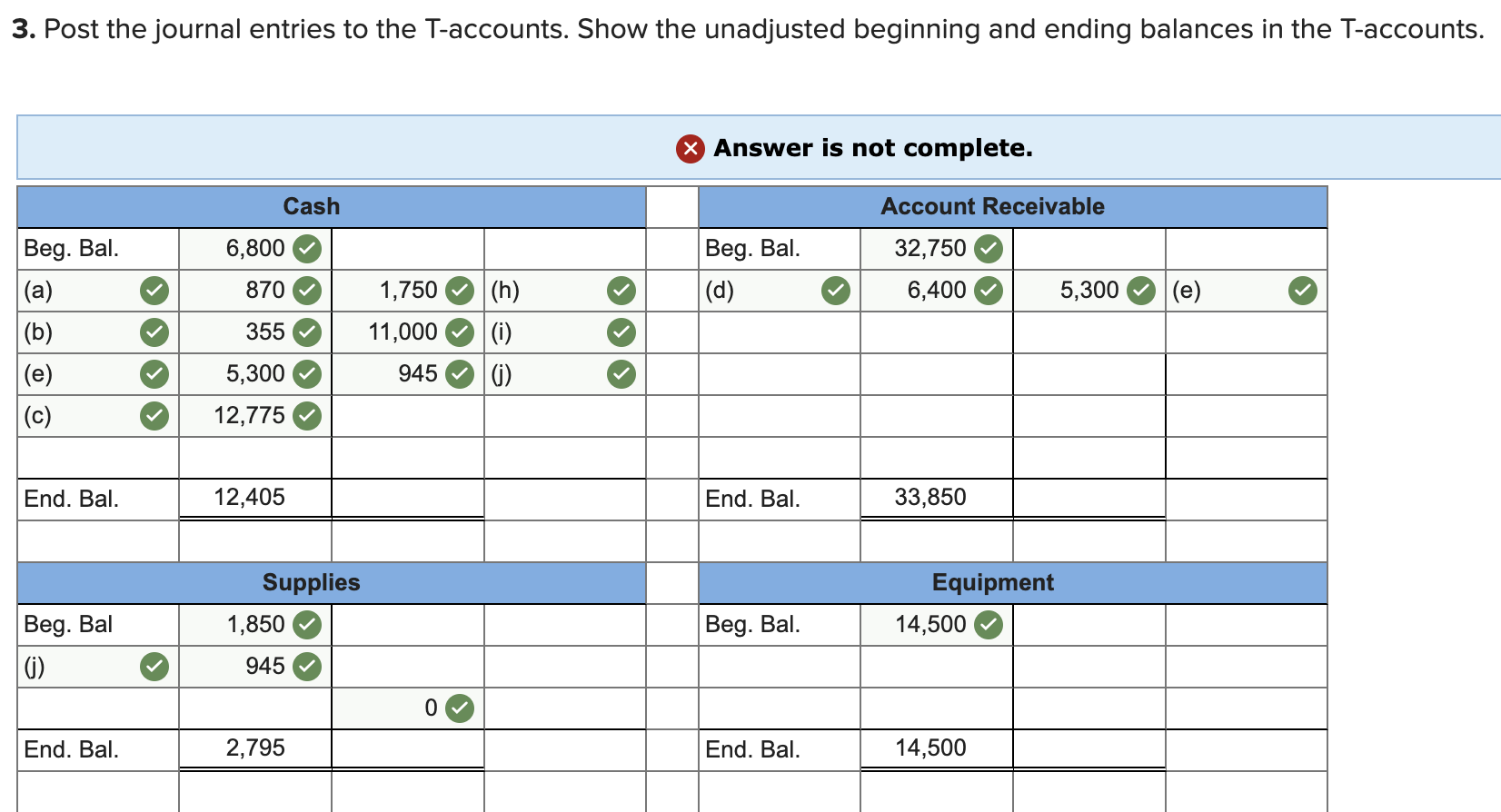

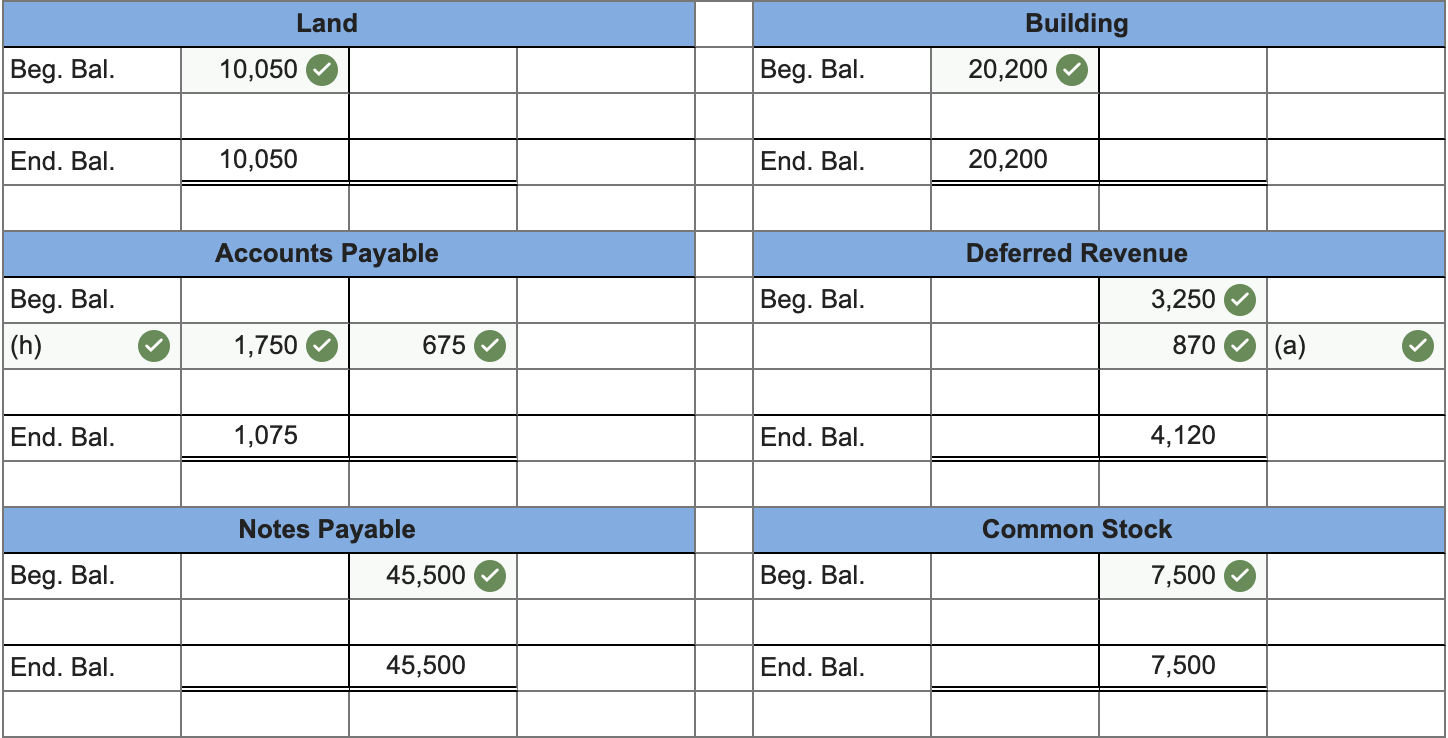

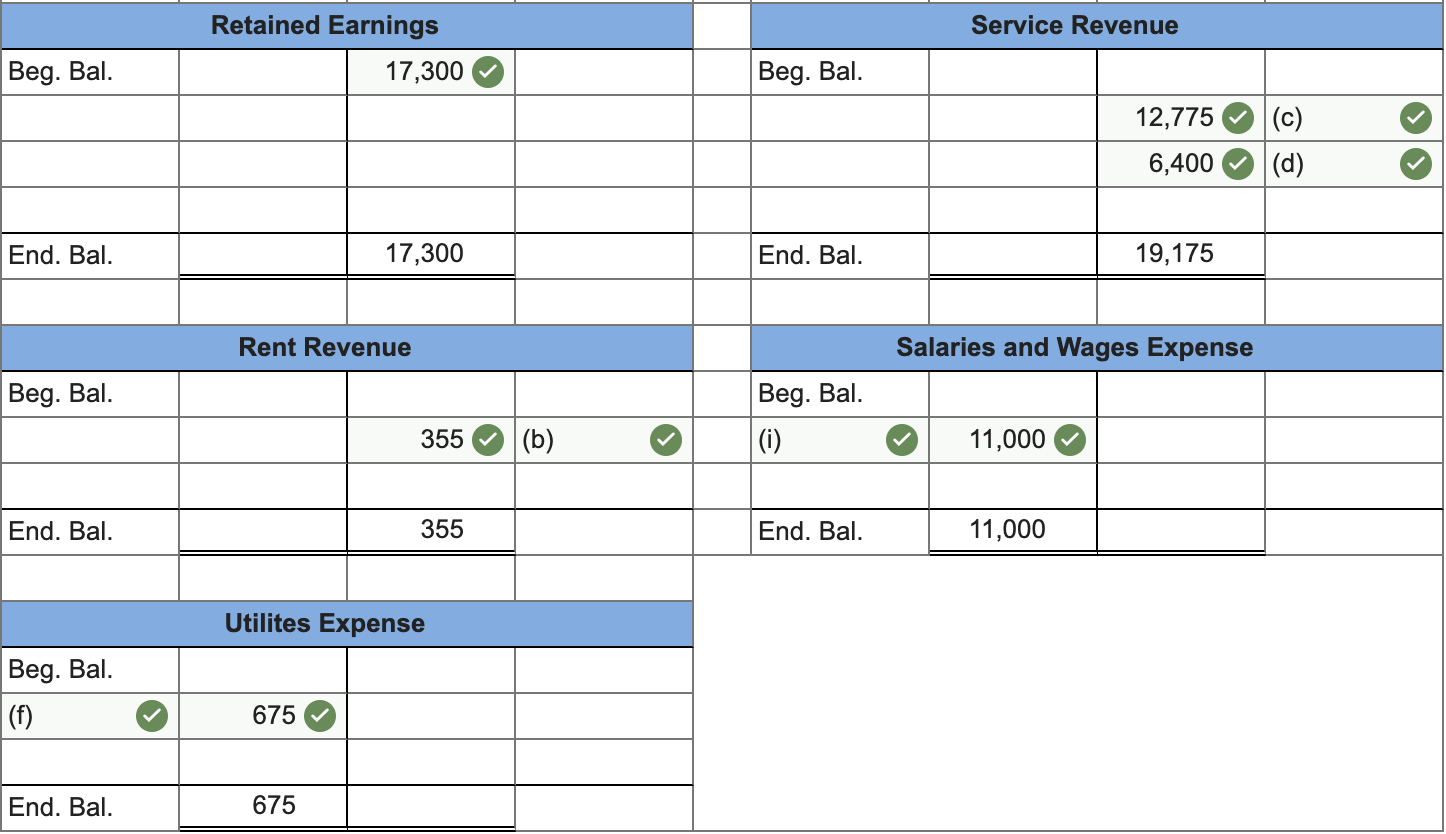

Ricky's Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Land Building $ 6,800 Accounts Payable 32,750 Deferred Revenue (deposits) 1,850 Notes Payable (long-term) 14,500 Common Stock 10,050 Retained Earnings 20,200 $12,600 3,250 45,500 7,500 17,300 Following are the January transactions: a. Received a $870 deposit from a customer who wanted her piano rebuilt in February. b. Rented a part of the building to a bicycle repair shop; $355 rent received for January. c. Delivered five rebuilt pianos to customers who paid $12,775 in cash. d. Delivered two rebuilt pianos to customers for $6,400 charged on account. e. Received $5,300 from customers as payment on their accounts. f. Received an electric and gas utility bill for $675 for January services to be paid in February. g. Ordered $945 in supplies. h. Paid $1,750 on account in January. i. Paid $11,000 in wages to employees in January for work done this month. j. Received and paid cash for the supplies in (g). 3. Post the journal entries to the T-accounts. Show the unadjusted beginning and ending balances in the T-accounts. Answer is not complete. Cash Account Receivable 6,800 Beg. Bal. (d) 32,750 6,400 870 5,300 (e) Beg. Bal. (a) (b) (e) (c) 1,750 11,000 355 (h) (i) (i) 5,300 945 12,775 End. Bal. 12,405 End. Bal. 33,850 Supplies 1,850 Equipment 14,500 Beg. Bal. Beg. Bal () 945 0 End. Bal. 2,795 End. Bal. 14,500 Land Building 20,200 Beg. Bal. 10,050 Beg. Bal. End. Bal. 10,050 End. Bal. 20,200 Accounts Payable Deferred Revenue Beg. Bal. 3,250 Beg. Bal. (h) 1,750 675 870 (a) End. Bal. 1,075 End. Bal. 4,120 Common Stock Notes Payable 45,500 Beg. Bal. Beg. Bal. 7,500 End. Bal. 45,500 End. Bal. 7,500 Service Revenue Retained Earnings 17,300 Beg. Bal. Beg. Bal. 12,775 6,400 (c) (d) End. Bal. 17,300 End. Bal. 19,175 Rent Revenue Salaries and Wages Expense Beg. Bal. Beg. Bal. (i) 355 (b) 11,000 End. Bal. 355 End. Bal. 11,000 Utilites Expense Beg. Bal. (f) 675 End. Bal. 675

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts