Question: CAny help is appreciated with this problem 1 1 Pre Following is the dusted trial balance of Ben's Jewelers on December 31, 20x1. EN'S JOWERS

CAny help is appreciated with this problem

CAny help is appreciated with this problem

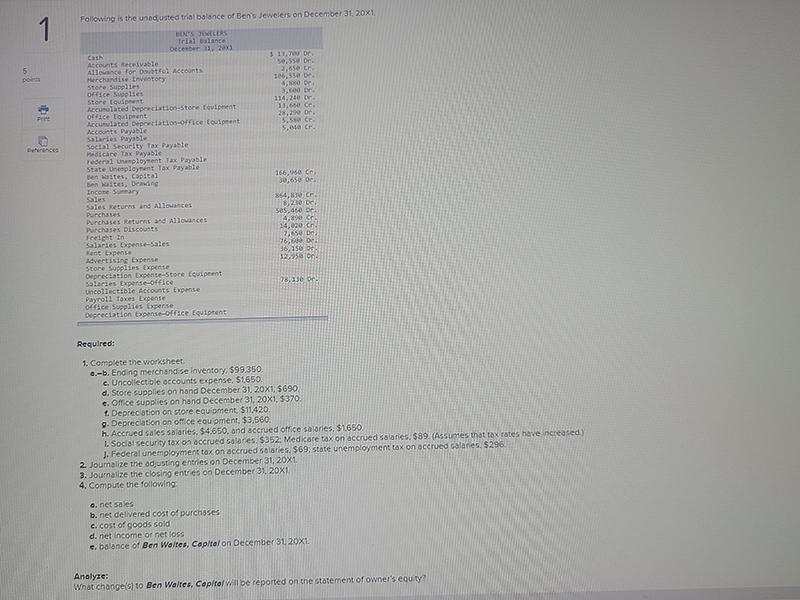

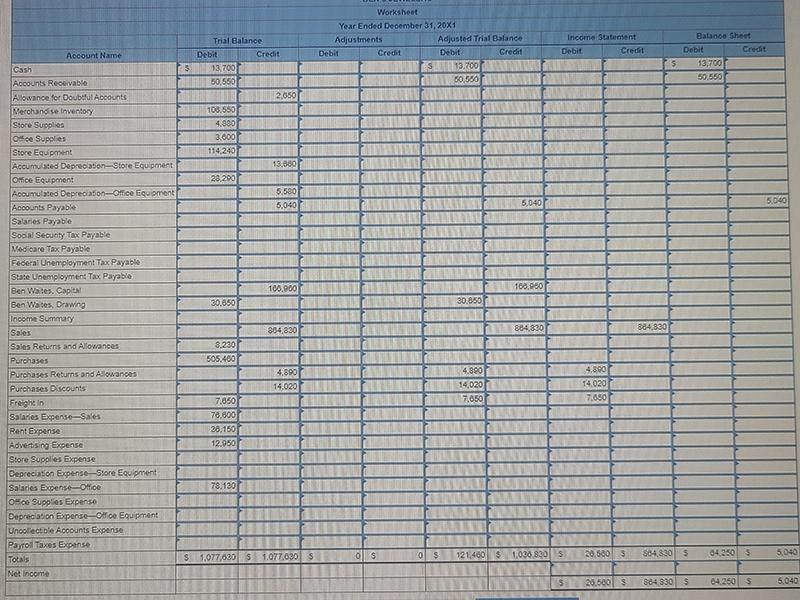

1 1 Pre Following is the dusted trial balance of Ben's Jewelers on December 31, 20x1. EN'S JOWERS Trial balance December 2008 Cat 11, Accounts Receivable 50.55 Allowance for of Accounts 2,650 C Merchandise Erventory 106,30 Store Supplies 40 De office Supplies 3. Dr Store Equipent 114.20 Kulated Deperditionstece coupe 11.60 de office Equipment 2290 Acculated depreciation office count 5,5 cm Accounts Payable 9,010 cm Salarie Payable Social Security Tax Payable Medicare Tax Payable Yederal Unployment Tax Payable State Unployment Tax Payable Ben Bites, capital 166, Benite, Dane 30,650 Incone Sonary Sales 354,830 CE Sales Returns Albanci 02.0: Purchase ses, 460 De Purchase turn Allowances 4,90 Purchases Discounts 14.020xen Freight in 2,650 D Salaries Expense-sales 96,68 Want Expense 36,15 e Advertising Open 12.95 On Store Supplies Expecte Depreciation Expense-Store Coupent Salaries Expense office uncollectible Accounts Expense Payroll foxes Lxpense or Supplies Expense Depreciation Expense of ce Equipment Required: 1. Complete the worksheet 6.-5. Ending merchand se inventory $99.350. c. Uncollectible accounts expense, $1650. d. Store supplies on hand December 31, 20X1. $690 c. Office Supplies on hand December 31, 20x1, $370 Depreciation on store equipment, $11.420 9. Depreciation on office equipment, $3.560 h. Accrued sales salaries, $4,650. and accrued office salaries, $1650 L Social Security tax on accrued salanes. $352, Medicare tax on accrued Salaries. $89. (Assumes that tax rates have ncreased) J. Federal unemployment tax on accrued Solares. $69.state unemployment tax on accrued salanes. $296 2. Journalize the adjusting entries on December 31, 20X1 3. Journalize the closing entries on December 31, 20X1 4. Compute the following a. net sales b. net delivered cost of purchases c. cost of goods sold d. net income or net loss c. balance of Ben Woltes, Capital on December 31 20X1. Analyze: What changes to Ben Waltes, Capitol will be reported on the statement of owner's equity? Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit 13.700 60.550 Income Statement Debit Credit Batoce Sheet Debit Credit 13,700 50.550 5 3 Trial Balance Debit Credit 13.700 30.550 2,650 106,550 4.890 3.000 114 240 13.880 28.200 5.500 5,040 5,040 5.040 100.000 100.000 Account Name Cash Accounts Receivable Allowance for Doubtful Abcounts Verchandise Inventory Store Supplies orce Supplies Store Equipment Accumulated Depreciation Store Equipment Omice Equipment Accumulated Deprecaon-Office Equipment Accounts Payable Salaries Payable Social Security Tax Payable Neocare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Ben Wates. Capital Ben Wates, Drawing Income Summary Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight in Salaries Expense Sales Rent Expense Advertising Expense Store Supplies Expense Depreciation Expense-Store Equipment Salaries Expense-Office Osce Supplies Expenso Depreciation Expense-Ole Equipment Uncorect ble Accounts Expense Payroll Taxes Expanse Totals 30.650 30.850 884,830 884830 884,8301 8.230 505.4807 4.890 14,020 4.300 14,020 7.050 4.800 14.020 7.000 7.850 70.000 20,150 12.950 78.130 $ 0$ 20.500 5 121.460 $ 1,038.830 S $64.8305 $ 1,077.630 1.077.030S 042503 5.040 Net Income 5 28.500 5 5643303 64.260 S 5,040 1 1 Pre Following is the dusted trial balance of Ben's Jewelers on December 31, 20x1. EN'S JOWERS Trial balance December 2008 Cat 11, Accounts Receivable 50.55 Allowance for of Accounts 2,650 C Merchandise Erventory 106,30 Store Supplies 40 De office Supplies 3. Dr Store Equipent 114.20 Kulated Deperditionstece coupe 11.60 de office Equipment 2290 Acculated depreciation office count 5,5 cm Accounts Payable 9,010 cm Salarie Payable Social Security Tax Payable Medicare Tax Payable Yederal Unployment Tax Payable State Unployment Tax Payable Ben Bites, capital 166, Benite, Dane 30,650 Incone Sonary Sales 354,830 CE Sales Returns Albanci 02.0: Purchase ses, 460 De Purchase turn Allowances 4,90 Purchases Discounts 14.020xen Freight in 2,650 D Salaries Expense-sales 96,68 Want Expense 36,15 e Advertising Open 12.95 On Store Supplies Expecte Depreciation Expense-Store Coupent Salaries Expense office uncollectible Accounts Expense Payroll foxes Lxpense or Supplies Expense Depreciation Expense of ce Equipment Required: 1. Complete the worksheet 6.-5. Ending merchand se inventory $99.350. c. Uncollectible accounts expense, $1650. d. Store supplies on hand December 31, 20X1. $690 c. Office Supplies on hand December 31, 20x1, $370 Depreciation on store equipment, $11.420 9. Depreciation on office equipment, $3.560 h. Accrued sales salaries, $4,650. and accrued office salaries, $1650 L Social Security tax on accrued salanes. $352, Medicare tax on accrued Salaries. $89. (Assumes that tax rates have ncreased) J. Federal unemployment tax on accrued Solares. $69.state unemployment tax on accrued salanes. $296 2. Journalize the adjusting entries on December 31, 20X1 3. Journalize the closing entries on December 31, 20X1 4. Compute the following a. net sales b. net delivered cost of purchases c. cost of goods sold d. net income or net loss c. balance of Ben Woltes, Capital on December 31 20X1. Analyze: What changes to Ben Waltes, Capitol will be reported on the statement of owner's equity? Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit 13.700 60.550 Income Statement Debit Credit Batoce Sheet Debit Credit 13,700 50.550 5 3 Trial Balance Debit Credit 13.700 30.550 2,650 106,550 4.890 3.000 114 240 13.880 28.200 5.500 5,040 5,040 5.040 100.000 100.000 Account Name Cash Accounts Receivable Allowance for Doubtful Abcounts Verchandise Inventory Store Supplies orce Supplies Store Equipment Accumulated Depreciation Store Equipment Omice Equipment Accumulated Deprecaon-Office Equipment Accounts Payable Salaries Payable Social Security Tax Payable Neocare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Ben Wates. Capital Ben Wates, Drawing Income Summary Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight in Salaries Expense Sales Rent Expense Advertising Expense Store Supplies Expense Depreciation Expense-Store Equipment Salaries Expense-Office Osce Supplies Expenso Depreciation Expense-Ole Equipment Uncorect ble Accounts Expense Payroll Taxes Expanse Totals 30.650 30.850 884,830 884830 884,8301 8.230 505.4807 4.890 14,020 4.300 14,020 7.050 4.800 14.020 7.000 7.850 70.000 20,150 12.950 78.130 $ 0$ 20.500 5 121.460 $ 1,038.830 S $64.8305 $ 1,077.630 1.077.030S 042503 5.040 Net Income 5 28.500 5 5643303 64.260 S 5,040

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts