Question: cap rate spread 2) In the Cornerstone report Lecture 3, Nov 9 -Cap-rates-and-RE-Cycles.pdf you can find some interesting formulas. One formula is the cap rate

cap rate spread

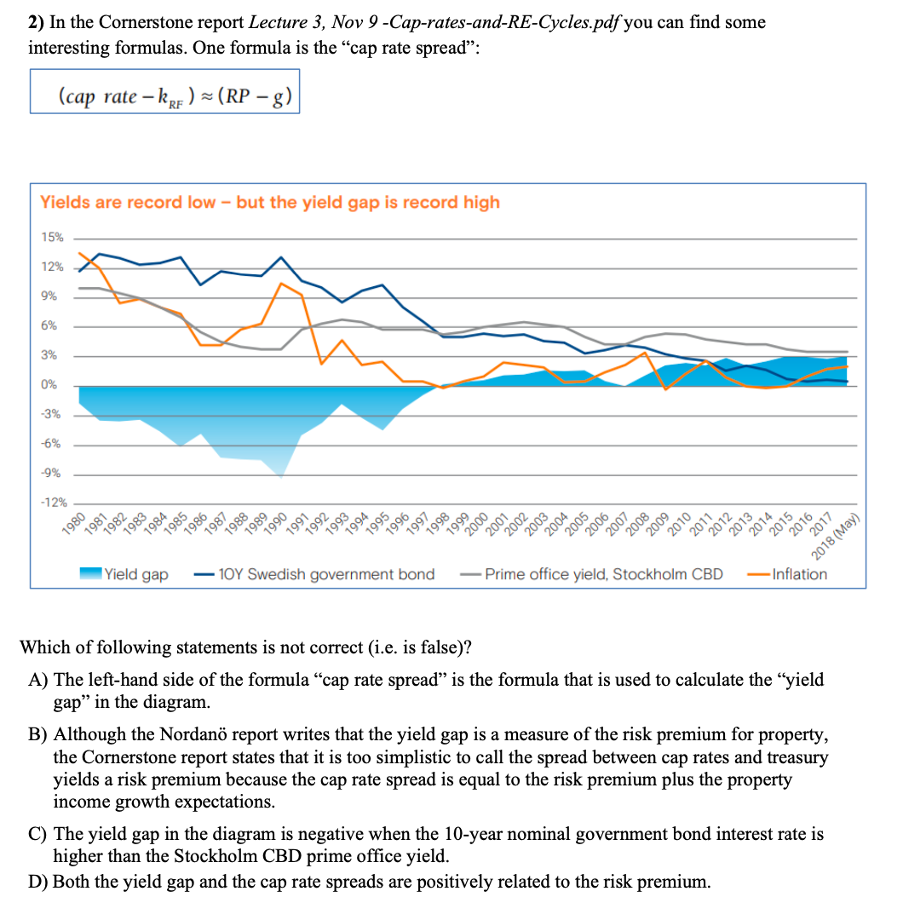

2) In the Cornerstone report Lecture 3, Nov 9 -Cap-rates-and-RE-Cycles.pdf you can find some interesting formulas. One formula is the cap rate spread": (cap rate KRF) - (RP g) Yields are record low - but the yield gap is record high 15% 12% 9% 6% 3% 0% -3% -6% -9% -12% 1988 1990 1996 1995 1999 2000 2003 2010 2008 2009 2007 2006 2014 2013 1989 1997 1998 1991 1992 1993 1994 2011 2012 1980 1981 1982 1983 1984 1985 1986 1987 2001 2002 2004 2005 2015 2016 2017 2018 (May) Yield gap 108 Swedish government bond Prime office yield, Stockholm CBD Inflation Which of following statements is not correct (i.e. is false)? A) The left-hand side of the formula cap rate spread is the formula that is used to calculate the yield gap" in the diagram. B) Although the Nordan report writes that the yield gap is a measure of the risk premium for property, the Cornerstone report states that it is too simplistic to call the spread between cap rates and treasury yields a risk premium because the cap rate spread is equal to the risk premium plus the property income growth expectations. C) The yield gap in the diagram is negative when the 10-year nominal government bond interest rate is higher than the Stockholm CBD prime office yield. D) Both the yield gap and the cap rate spreads are positively related to the risk premium. 2) In the Cornerstone report Lecture 3, Nov 9 -Cap-rates-and-RE-Cycles.pdf you can find some interesting formulas. One formula is the cap rate spread": (cap rate KRF) - (RP g) Yields are record low - but the yield gap is record high 15% 12% 9% 6% 3% 0% -3% -6% -9% -12% 1988 1990 1996 1995 1999 2000 2003 2010 2008 2009 2007 2006 2014 2013 1989 1997 1998 1991 1992 1993 1994 2011 2012 1980 1981 1982 1983 1984 1985 1986 1987 2001 2002 2004 2005 2015 2016 2017 2018 (May) Yield gap 108 Swedish government bond Prime office yield, Stockholm CBD Inflation Which of following statements is not correct (i.e. is false)? A) The left-hand side of the formula cap rate spread is the formula that is used to calculate the yield gap" in the diagram. B) Although the Nordan report writes that the yield gap is a measure of the risk premium for property, the Cornerstone report states that it is too simplistic to call the spread between cap rates and treasury yields a risk premium because the cap rate spread is equal to the risk premium plus the property income growth expectations. C) The yield gap in the diagram is negative when the 10-year nominal government bond interest rate is higher than the Stockholm CBD prime office yield. D) Both the yield gap and the cap rate spreads are positively related to the risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts