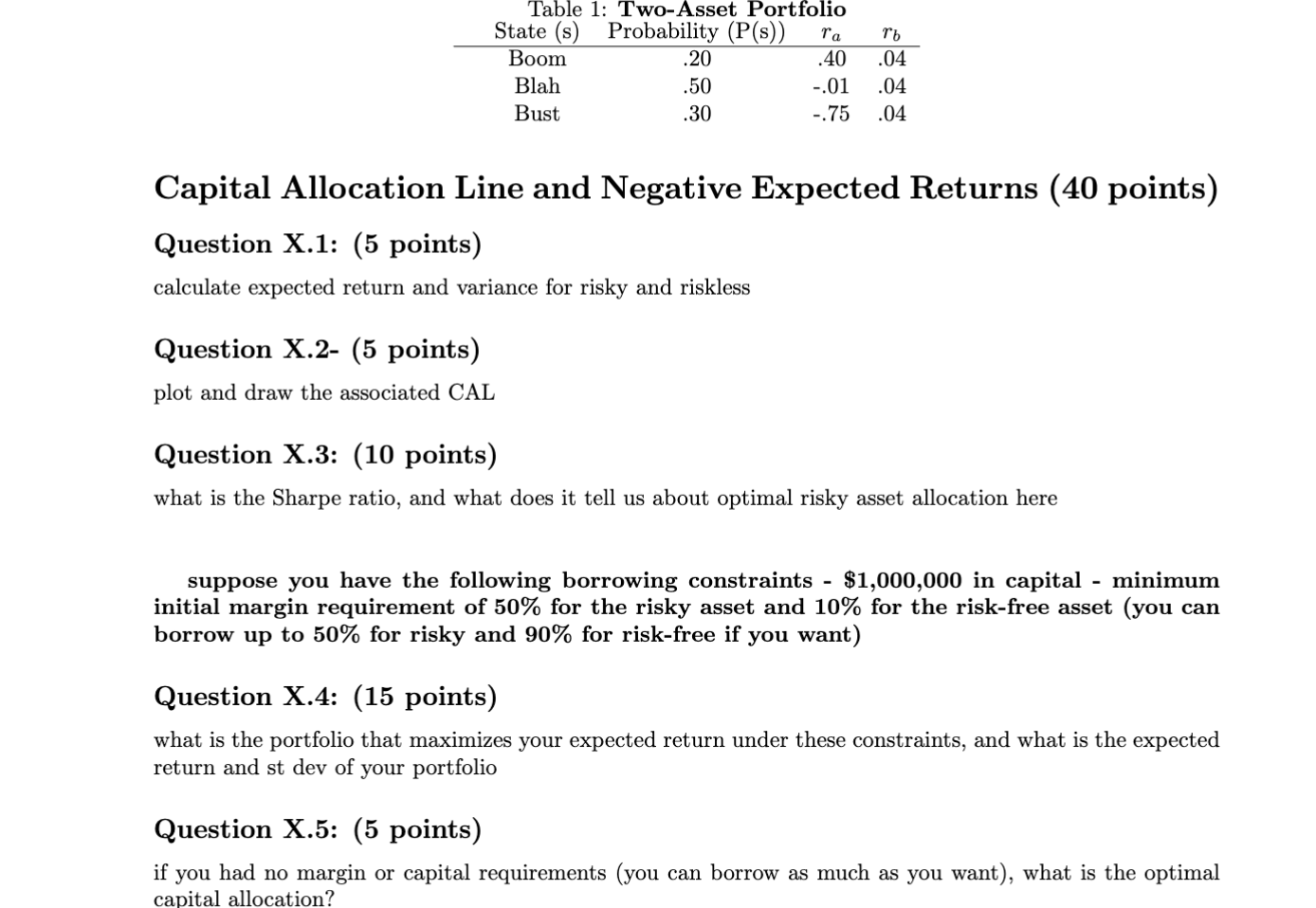

Question: Capital Allocation Line and Negative Expected Returns ( 4 0 points ) Question X . 1 : ( 5 points ) calculate expected return and

Capital Allocation Line and Negative Expected Returns points Question X: points calculate expected return and variance for risky and riskless Question X points plot and draw the associated CAL Question X: points what is the Sharpe ratio, and what does it tell us about optimal risky asset allocation here suppose you have the following borrowing constraints $ in capital minimum initial margin requirement of for the risky asset and for the riskfree asset you can borrow up to for risky and for riskfree if you want Question X: points what is the portfolio that maximizes your expected return under these constraints, and what is the expected return and st dev of your portfolio Question X: points if you had no margin or capital requirements you can borrow as much as you want what is the optimal capital allocation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock