Question: Capital Asset Pricing Model (50 points, 10 points each) Assume Treasury bills (T-bills) are currently yielding 1%. Over long horizons and many markets, the stock

- Capital Asset Pricing Model (50 points, 10 points each)

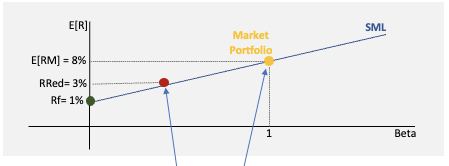

Assume Treasury bills (T-bills) are currently yielding 1%. Over long horizons and many markets, the stock market has averaged about a 7% premium over T-bills. The annual standard deviation of the market portfolio has averaged 20% when estimated over long horizons. Use these historic means and standard deviations as the basis of your expected return and standard deviation estimates. When answering the following questions, you may assume that you can borrow and lend at T-bill rates.

- Using the estimates from above, draw the security market line (SML). Carefully label the axes of your graph, the intercept of the line, and the slope of the line. In your graph, label the points corresponding to T-bills and the market.

What does the RRed mean??

E[R] SML Market Portfolio E[RM] = 8% RRed 3% Rf= 1% 1 Beta E[R] SML Market Portfolio E[RM] = 8% RRed 3% Rf= 1% 1 Beta

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock