Question: = Capital Asset Pricing Model and Arbitrage Pricing Theory. (a) Suppose that an investor with preferences G(up, 05) aos: a > 0 optimally chooses a

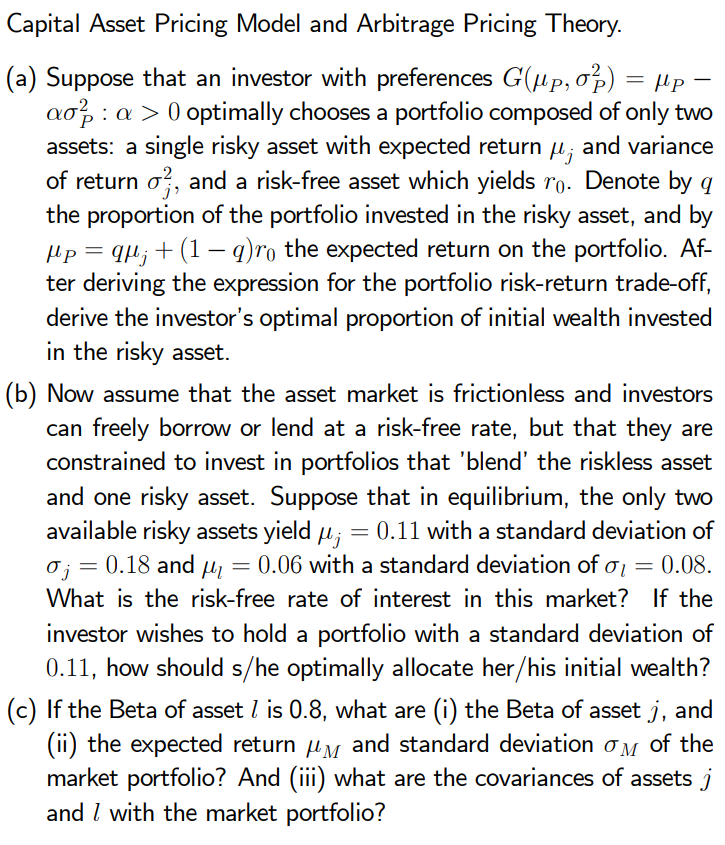

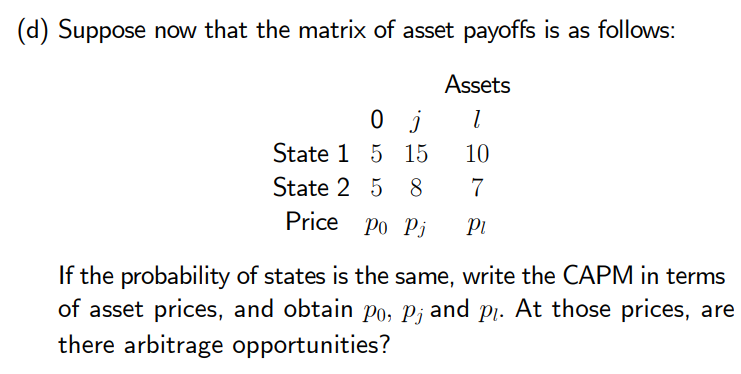

= Capital Asset Pricing Model and Arbitrage Pricing Theory. (a) Suppose that an investor with preferences G(up, 05) aos: a > 0 optimally chooses a portfolio composed of only two assets: a single risky asset with expected return H; and variance of return o;, and a risk-free asset which yields ro. Denote by q the proportion of the portfolio invested in the risky asset, and by Mp = qu; +(1 9)r, the expected return on the portfolio. Af- ter deriving the expression for the portfolio risk-return trade-off, derive the investor's optimal proportion of initial wealth invested in the risky asset. (b) Now assume that the asset market is frictionless and investors can freely borrow or lend at a risk-free rate, but that they are constrained to invest in portfolios that 'blend' the riskless asse and one risky asset. Suppose that in equilibrium, the only two available risky assets yield ; = 0.11 with a standard deviation of 0; = 0.18 and My 0.06 with a standard deviation of 01 = 0.08. What is the risk-free rate of interest in this market? If the investor wishes to hold a portfolio with a standard deviation of 0.11, how should s/he optimally allocate her/his initial wealth? (c) If the Beta of asset 1 is 0.8, what are (i) the Beta of asset j, and (ii) the expected return pl.m and standard deviation om of the market portfolio? And (iii) what are the covariances of assets ; and l with the market portfolio? = Capital Asset Pricing Model and Arbitrage Pricing Theory. (a) Suppose that an investor with preferences G(up, 05) aos: a > 0 optimally chooses a portfolio composed of only two assets: a single risky asset with expected return H; and variance of return o;, and a risk-free asset which yields ro. Denote by q the proportion of the portfolio invested in the risky asset, and by Mp = qu; +(1 9)r, the expected return on the portfolio. Af- ter deriving the expression for the portfolio risk-return trade-off, derive the investor's optimal proportion of initial wealth invested in the risky asset. (b) Now assume that the asset market is frictionless and investors can freely borrow or lend at a risk-free rate, but that they are constrained to invest in portfolios that 'blend' the riskless asse and one risky asset. Suppose that in equilibrium, the only two available risky assets yield ; = 0.11 with a standard deviation of 0; = 0.18 and My 0.06 with a standard deviation of 01 = 0.08. What is the risk-free rate of interest in this market? If the investor wishes to hold a portfolio with a standard deviation of 0.11, how should s/he optimally allocate her/his initial wealth? (c) If the Beta of asset 1 is 0.8, what are (i) the Beta of asset j, and (ii) the expected return pl.m and standard deviation om of the market portfolio? And (iii) what are the covariances of assets ; and l with the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts