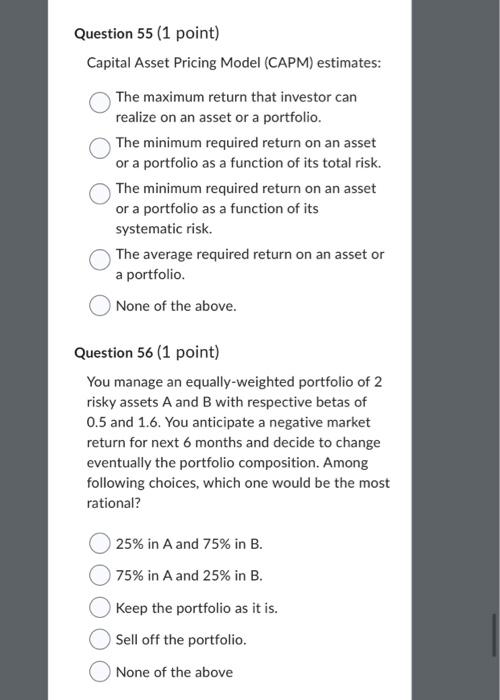

Question: Capital Asset Pricing Model (CAPM) estimates: The maximum return that investor can realize on an asset or a portfolio. The minimum required return on an

Capital Asset Pricing Model (CAPM) estimates: The maximum return that investor can realize on an asset or a portfolio. The minimum required return on an asset or a portfolio as a function of its total risk. The minimum required return on an asset or a portfolio as a function of its systematic risk. The average required return on an asset or a portfolio. None of the above. Question 56 (1 point) You manage an equally-weighted portfolio of 2 risky assets A and B with respective betas of 0.5 and 1.6. You anticipate a negative market return for next 6 months and decide to change eventually the portfolio composition. Among following choices, which one would be the most rational? 25% in A and 75% in B. 75% in A and 25% in B. Keep the portfolio as it is. Sell off the portfolio. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts