Question: (Capital Asset Pricing Model) The expected return for the general market is 11.5 percent, and the risk premium in the markat is 7.3 percent. Tasaco,

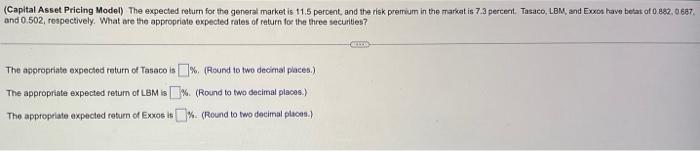

(Capital Asset Pricing Model) The expected return for the general market is 11.5 percent, and the risk premium in the markat is 7.3 percent. Tasaco, LBM, and Exoxos lave betat of 0.882,0 6.7, and 0.502 , respectively. What are the appropriate expected rates of return for the three securities? The appropriate expected raturn of Tasaco is %. (Round to two decimal places.) The appropriate expected return of LBM is 6. (Round to fwo decimal places.) The appropeiate expected raturn of Exooe is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts