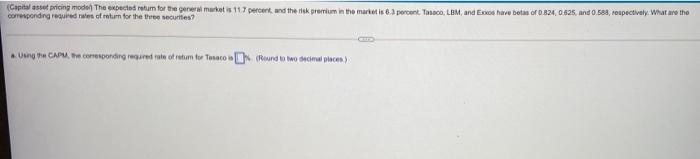

Question: (Capital asset pricing model) The expected return for the general market is 11.7 percent, and the risk premium in the market is 6.3 percent. Tasaco,

Capital pricing model The expected retum for the general market is 11.7 percent, and the itak premium in the market is 6.3 percent Taco, LBM, and to have bota of 0.824, 0.625, and 0.58%, respectively. What are the corresponding reure les of return for the three securities? * CAP. corresponding messed the ot ruhom toe TacoRound to wo decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts