Question: (Capital asset pricing model) Using the CAPM, estimate the appropriate required rate of return for the three stocks listed in the popup window, , given

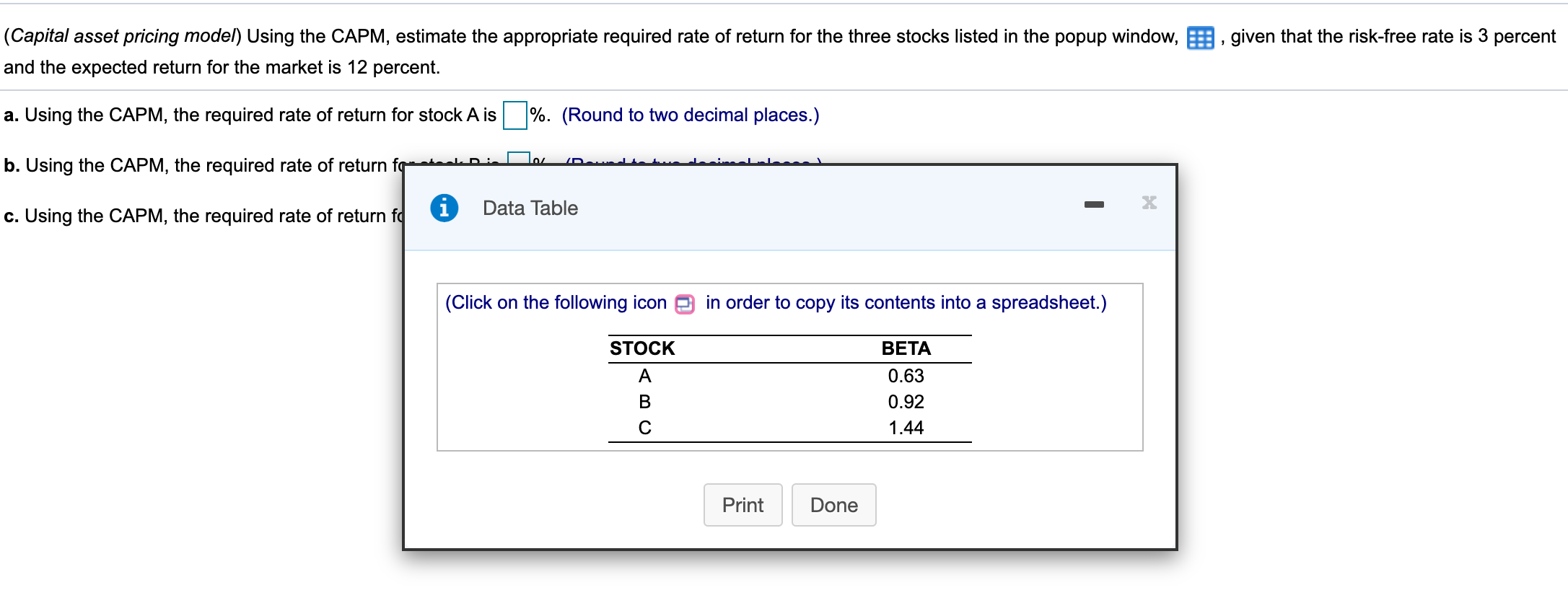

(Capital asset pricing model) Using the CAPM, estimate the appropriate required rate of return for the three stocks listed in the popup window, , given that the risk-free rate is 3 percent and the expected return for the market is 12 percent. a. Using the CAPM, the required rate of return for stock A is %. (Round to two decimal places.) b. Using the CAPM, the required rate of return for stock B is %. (Round to two decimal places.) c. Using the CAPM, the required rate of return for stock C is %. (Round to two decimal places.) given that the risk-free rate is 3 percent (Capital asset pricing model) Using the CAPM, estimate the appropriate required rate of return for the three stocks listed in the popup window, and the expected return for the market is 12 percent. a. Using the CAPM, the required rate of return for stock A is %. (Round to two decimal places.) Lor D. b. Using the CAPM, the required rate of return fq i c. Using the CAPM, the required rate of return fa X Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) STOCK BETA > 0.63 0.92 1.44 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts