Question: Capital Budgeting Analysis ( Total: 1 0 Marks ) A company is considering an investment project with the following details: Initial Investment: $ 1

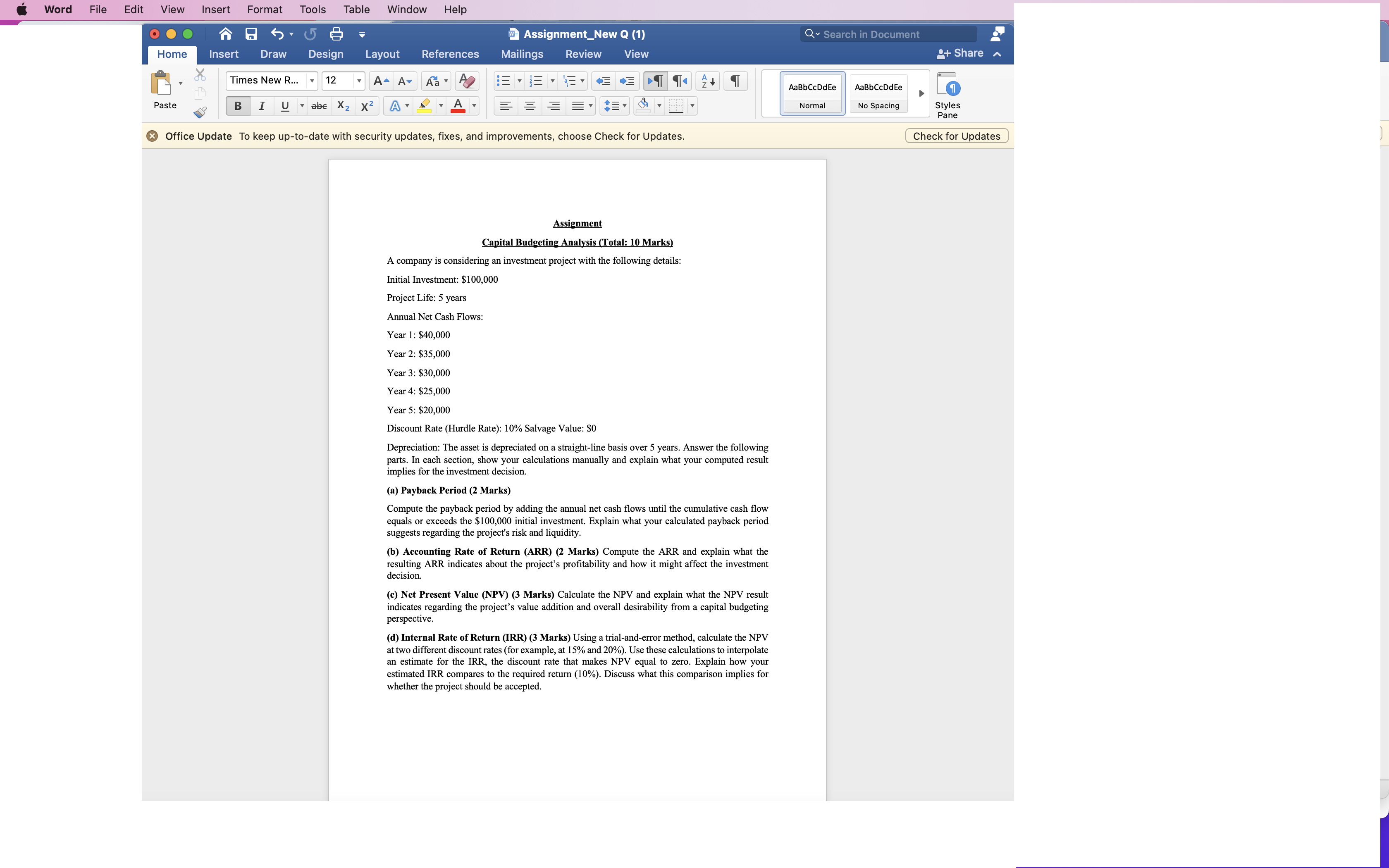

Capital Budgeting Analysis Total: Marks A company is considering an investment project with the following details: Initial Investment: $ Project Life: years Annual Net Cash Flows: Year : $ Year : $ Year : $ Year : $ Year : $ Discount Rate Hurdle Rate: Salvage Value: $ Depreciation: The asset is depreciated on a straightline basis over years. Answer the following parts. In each section, show your calculations manually and explain what your computed result implies for the investment decision. a Payback Period Marks Compute the payback period by adding the annual net cash flows until the cumulative cash flow equals or exceeds the $ initial investment. Explain what your calculated payback period suggests regarding the project's risk and liquidity. b Accounting Rate of Return ARR Marks Compute the ARR and explain what the resulting ARR indicates about the project's profitability and how it might affect the investment decision. c Net Present Value NPV Marks Calculate the NPV and explain what the NPV result indicates regarding the project's value addition and overall desirability from a capital budgeting perspective. d Internal Rate of Return IRR Marks Using a trialanderror method, calculate the NPV at two different discount rates for example, at and Use these calculations to interpolate an estimate for the IRR, the discount rate that makes NPV equal to zero. Explain how your estimated IRR compares to the required return Discuss what this comparison implies for whether the project should be accepted.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock