Question: CAPITAL BUDGETING CASE STUDY ANALYSIS Project A: This project requires an initial investment of $ 2 , 0 0 0 , 0 0 0 in

CAPITAL BUDGETING CASE STUDY ANALYSIS

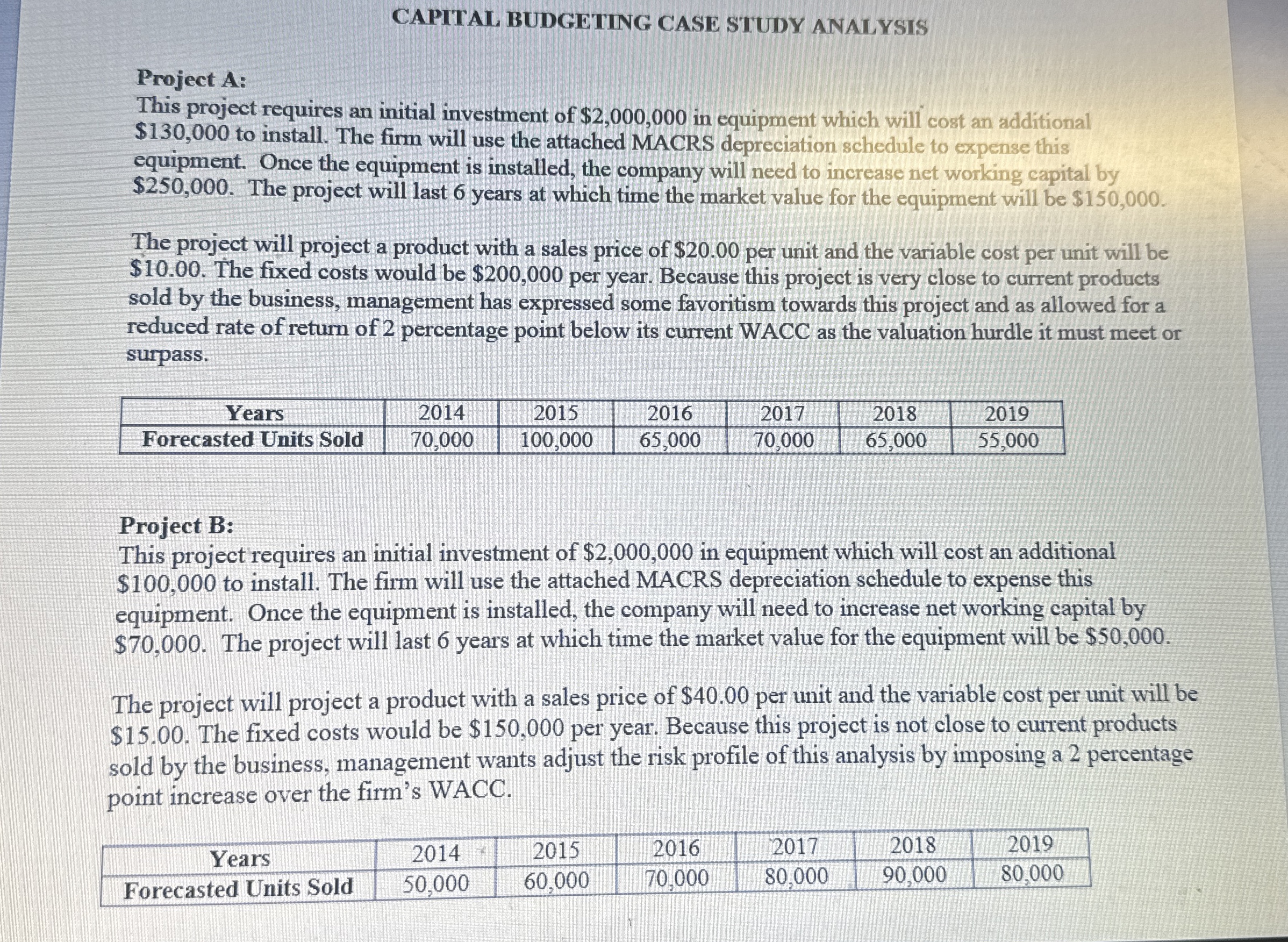

Project A:

This project requires an initial investment of $ in equipment which will cost an additional $ to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $ The project will last years at which time the market value for the equipment will be $

The project will project a product with a sales price of $ per unit and the variable cost per unit will be $ The fixed costs would be $ per year. Because this project is very close to current products sold by the business, management has expressed some favoritism towards this project and as allowed for a reduced rate of return of percentage point below its current WACC as the valuation hurdle it must meet or surpass.

tableYearsForecasted Units Sold,

Project B:

This project requires an initial investment of $ in equipment which will cost an additional $ to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $ The project will last years at which time the market value for the equipment will be $

The project will project a product with a sales price of $ per unit and the variable cost per unit will be $ The fixed costs would be $ per year. Because this project is not close to current products sold by the business, management wants adjust the risk profile of this analysis by imposing a percentage point increase over the firm's WACC.

tableYearsForecasted Units Sold,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock