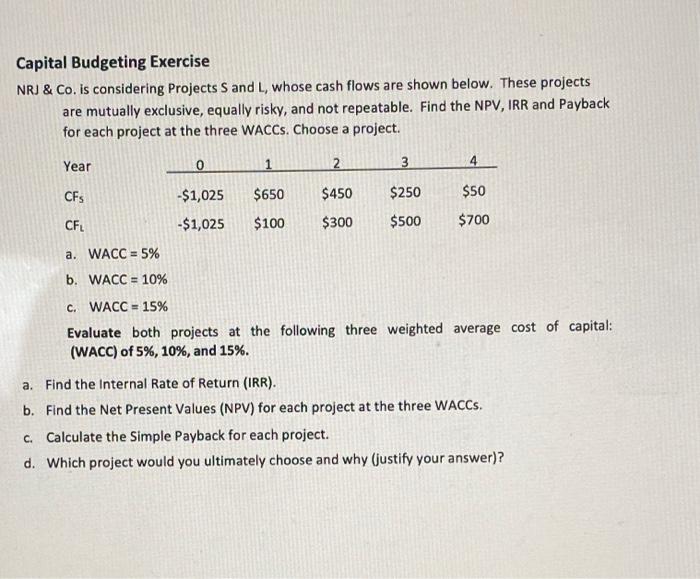

Question: Capital Budgeting Exercise NRJ & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky,

Capital Budgeting Exercise NRJ \& Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. Find the NPV, IRR and Payback for each project at the three WACCs. Choose a project. a. XACC=5% b. WACC=10% c. WACC=15% Evaluate both projects at the following three weighted average cost of capital: (WACC) of 5%,10%, and 15%. a. Find the Internal Rate of Return (IRR). b. Find the Net Present Values (NPV) for each project at the three WACCs. c. Calculate the Simple Payback for each project. d. Which project would you ultimately choose and why (justify your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts