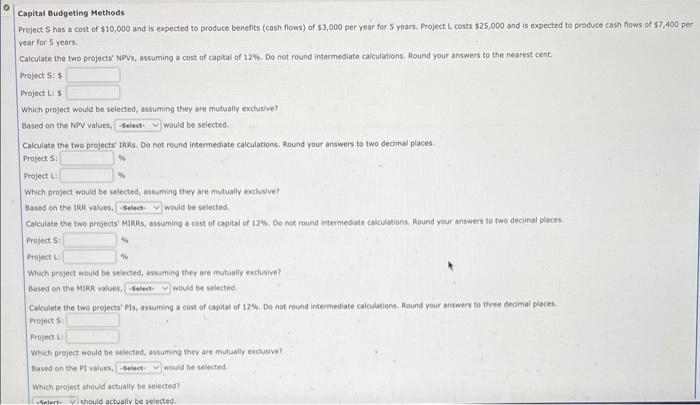

Question: Capital Budgeting Methods year for 5 years. Calculate the two projects' NDVs, assuming a cost of capial of 12%. Do not round intermedlate calculations. Round

Capital Budgeting Methods year for 5 years. Calculate the two projects' NDVs, assuming a cost of capial of 12\%. Do not round intermedlate calculations. Round your answers to the nearest cent: Project 5: 5 Project Lis Which project would be selected, sssuming they are mutually excluever. Based on the Nipv values, would be selected. Calculate the two projects' thrs. Do not round intermediate calculations. Round your answers to two decimal places. Project 5: Project L: \% Which project wauld be selected, assuming they are mutually exclustive? Based on the IRR valses, would be selected. Calculate the twe projects' MIRRs, assuming a cost of apital of 12%. Do mot round intermediage calculations Round your anwwers to two decimal places. Project S: Mroject L Which peoject would be selected, assuming ther are mutually eadusive? Bated on the MrkR values, would be selected. Calculate the two projects' Ps, aswming a cost of capital of 12M, Do not round intermediate calculations. Found your answers to three decimal plsces. Project S: Prosect L. Which project nould be selected, assuming they are nitually exclusive? Based on then Pt values, would be selected. Which project should actually be seiected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts