Question: CAPITAL BUDGETING PROBLEM Alliance Lights Replacement Project Alliance Lights, a manufacturer of halogen bulbs, is considering replacing its machinery. The old equipment was purchased for

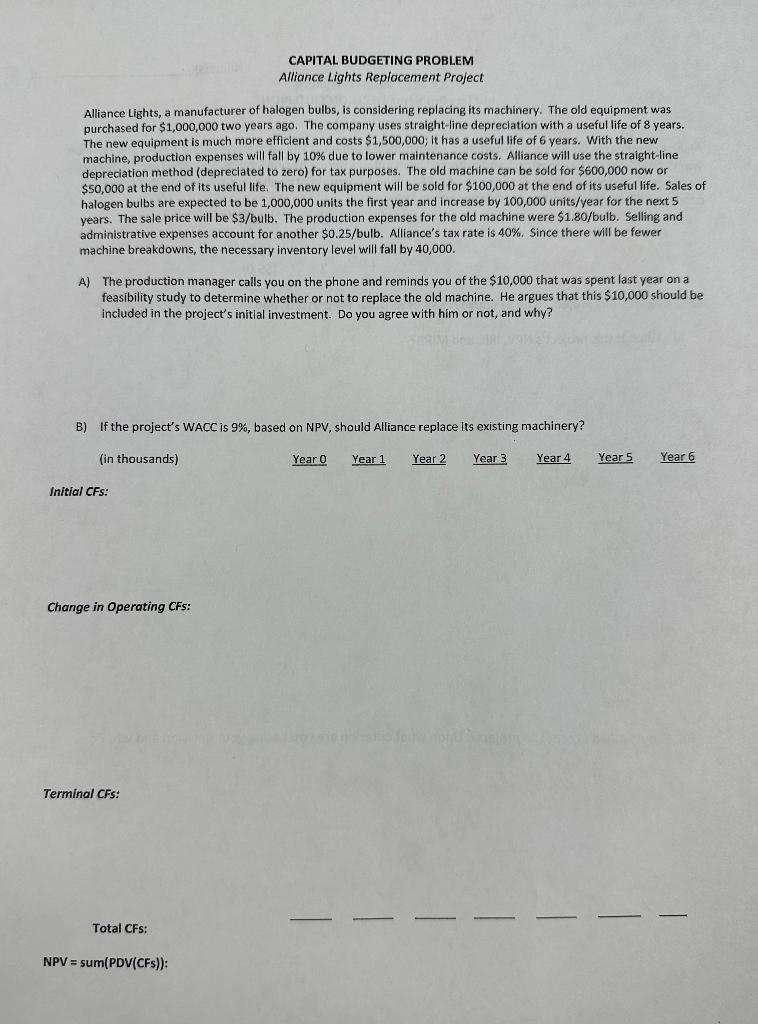

CAPITAL BUDGETING PROBLEM Alliance Lights Replacement Project Alliance Lights, a manufacturer of halogen bulbs, is considering replacing its machinery. The old equipment was purchased for $1,000,000 two years ago. The company uses straight-line depreciation with a useful life of 8 years. The new equipment is much more efficient and costs $1,500,000; it has a useful life of 6 years. With the new machine, production expenses will fall by 10% due to lower maintenance costs. Alliance will use the straight-line depreciation method (depreclated to zero) for tax purposes. The old machine can be sold for $600,000 now or $50,000 at the end of its useful life. The new equipment will be sold for $100,000 at the end of its useful life. Sales of halogen bulbs are expected to be 1,000,000 units the first year and increase by 100,000 units/year for the next 5 years. The sale price will be $3/bulb. The production expenses for the old machine were $1.80/bulb. Selling and administrative expenses account for another $0.25/bulb. Alliance's tax rate is 40%. Since there will be fewer machine breakdowns, the necessary inventory level will fall by 40,000. A) The production manager calls you on the phone and reminds you of the $10,000 that was spent last year on a feasibility study to determine whether or not to replace the old machine. He argues that this $10,000 should be included in the project's initial investment. Do you agree with him or not, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts