Question: Capital Budgeting Problems 1) Teck Engineering normally expects a minimum nate of retum of 12 on investments. Two projects are avallable but only one can

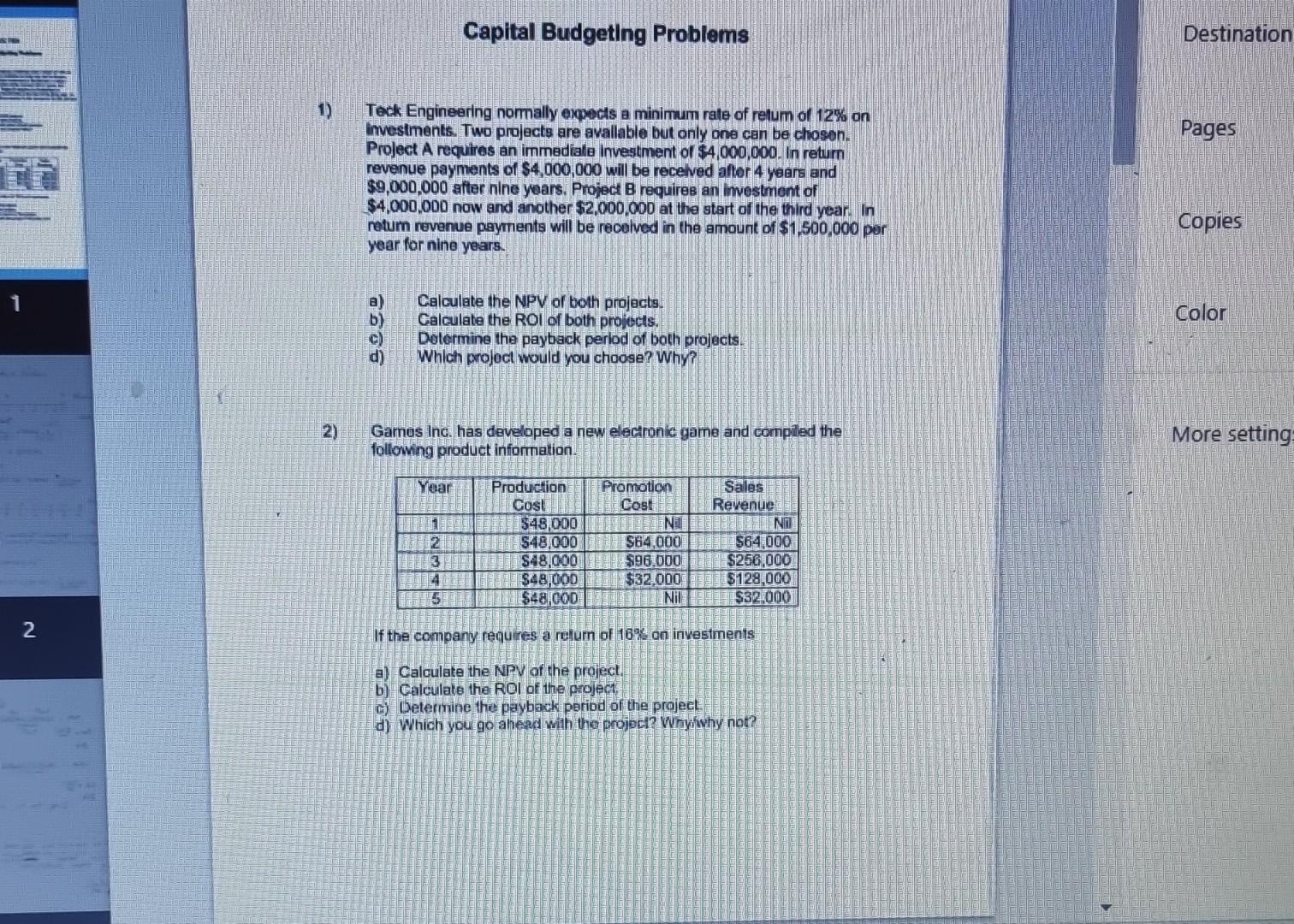

Capital Budgeting Problems 1) Teck Engineering normally expects a minimum nate of retum of \12 on investments. Two projects are avallable but only one can be chosen. Project \\( A \\) requitres an immediale investment of \\( \\$ 4,000,000 \\). In return revenue payments of \\( \\$ 4,000,000 \\) will be recelved aftor 4 years and \\( \\$ 9,000,000 \\) after nine years. Project \\( B \\) requires an imestment of \\( \\$ 4,000,000 \\) now and another \\( \\$ 2,000,000 \\) at the start of the third year. In retum revenue payments will be recelved in the amount of \\( \\$ 1,500,000 \\) por year for nine years. a) Calculate the NPV of both projacts. b) Galculate the ROI of both projects. c) Determine the payback perlod of both projects. d) Which projoct would you choose? Why? 2) Garnes inc. has developed a new electronic game and compiled the following product information. Color Pages Copies Destination Copies Color

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts