Question: Capital Budgeting Problems - Applied TVM (FIN 3300) Instructions: Space is left at the end of each question to show the keystrokes you used to

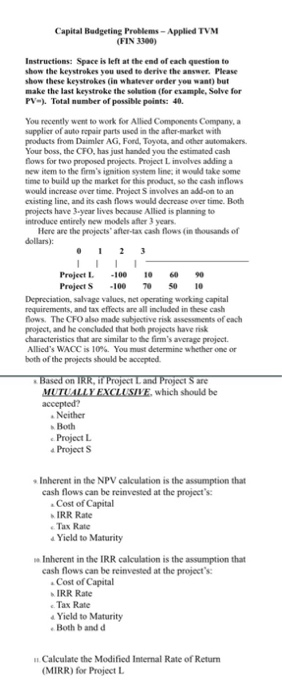

Capital Budgeting Problems - Applied TVM (FIN 3300) Instructions: Space is left at the end of each question to show the keystrokes you used to derive the answer. Please show these keystrokes (in whatever order you want) but make the last keystroke the solution (for example, Selve for PV). Total number of possible points: 40. You recently went to work for Allied Components Company, a supplier of auto repair parts used in the aftermarket with products from Daimler AG, Ford, Toyota, and other automakers. Your boss, the CFO, has just handed you the estimated cash flows for two proposed projects Project Linvolves adding a new item to the firm's ignition system line it would take some time to build up the market for this product, so the cash inflows would increase over time. Projects involves an add-on to an existing line, and its cash flows would decrease over time. Both projects have 3-year lives because Allied is planning to introduce entirely new models after 3 years. Here are the projects' after-tax cash flows (in thousands of dollars): 11 Project L. 90 Projects 70 Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. The CFO also made subjective risk assessments of each project, and he concluded that both projects have risk characteristics that are similar to the firm's average project. Allied's WACC is 10%. You must determine whether one or both of the projects should be accepted. Based on IRR, it Project Land Project S are MUTUALLY EXCLUSIVE, which should be accepted? Neither Both Project L Projects Inherent in the NPV calculation is the assumption that cash flows can be reinvested at the project's Cost of Capital IRR Rate Tax Rate Yield to Maturity Inherent in the IRR calculation is the assumption that cash flows can be reinvested at the project's Cost of Capital IRR Rate Tax Rate Yield to Maturity Both band d 1. Calculate the Modified Internal Rate of Return (MIRR) for Project L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts