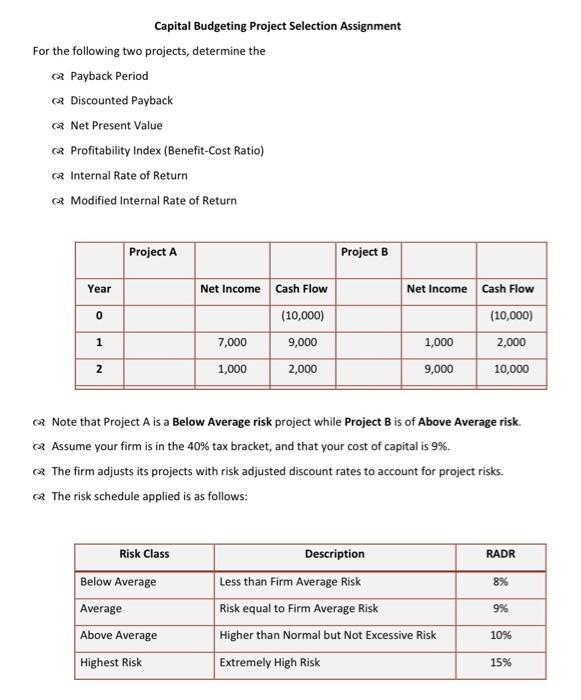

Question: Capital Budgeting Project Selection Assignment For the following two projects, determine the Payback Period Discounted Payback Net Present Value Profitability Index (Benefit-Cost Ratio) @ Internal

Capital Budgeting Project Selection Assignment For the following two projects, determine the Payback Period Discounted Payback Net Present Value Profitability Index (Benefit-Cost Ratio) @ Internal Rate of Return Modified Internal Rate of Return Project A Project B Year Net Income Cash Flow (10,000) 0 Net Income Cash Flow (10,000) 7,000 9,000 1,000 2,000 1 2,000 1,000 9,000 2 10,000 Note that Project A is a Below Average risk project while Project B is of Above Average risk & Assume your firm is in the 40% tax bracket, and that your cost of capital is 9%. The firm adjusts its projects with risk adjusted discount rates to account for project risks. The risk schedule applied is as follows: RADR 8% Risk Class Below Average Average Above Average Highest Risk Description Less than Firm Average Risk Risk equal to Firm Average Risk Higher than Normal but Not Excessive Risk Extremely High Risk 9% 10% 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts