Question: CAPITAL BUDGETING Projects A and B are mutually exclusive projects. They have the following cash flows: Use increments of 2% in finding the profile (ie.,

CAPITAL BUDGETING

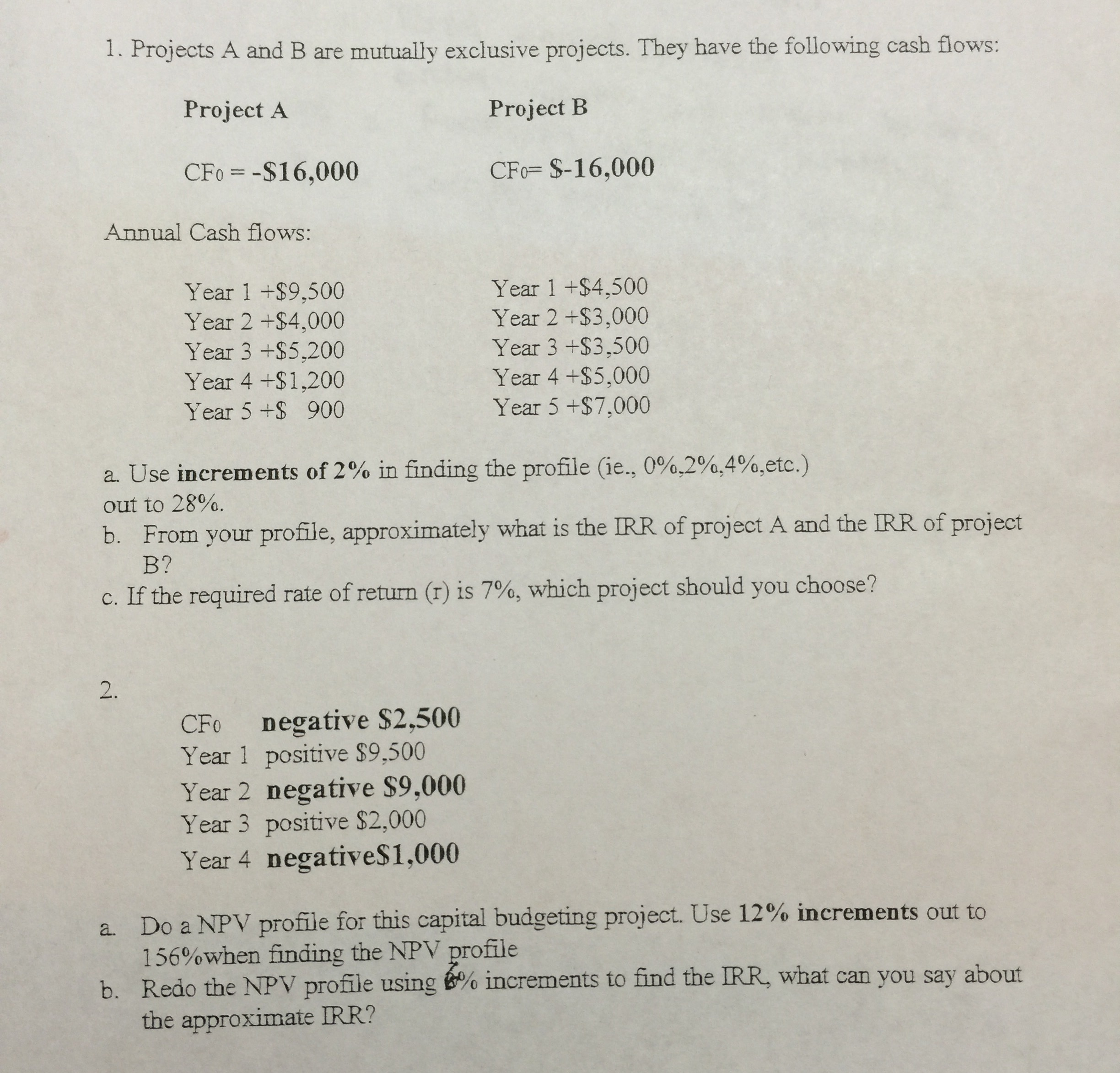

Projects A and B are mutually exclusive projects. They have the following cash flows: Use increments of 2% in finding the profile (ie., 0%,2%,4%,etc.) out to 28%. From your profile, approximately what is the ERR of project A and the IRR of project B? If the required rate of return (r) is 7%, which project should you choose? Do a NPV profile for this capital budgeting project. Use 12% increments out to 156%when finding the NPV profile Redo the NPV profile using 6% increments to find the IRR, what can you say about the approximate IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts