Question: Capital Budgeting Rules Shadow Assignment/ 1. Use the various capital budgeting rules to determine if the following set of cash flows would be accepted with

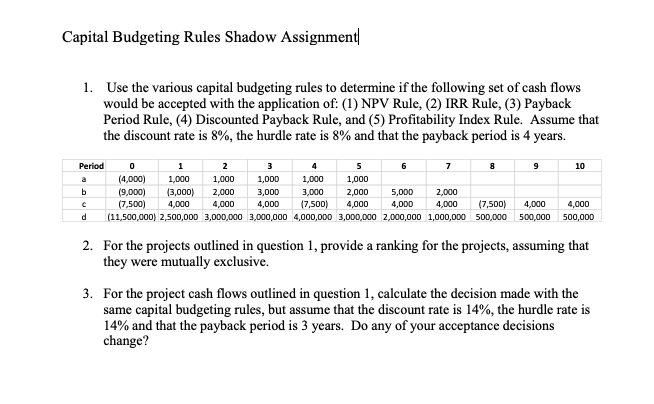

Capital Budgeting Rules Shadow Assignment/ 1. Use the various capital budgeting rules to determine if the following set of cash flows would be accepted with the application of: (1) NPV Rule, (2) IRR Rule, (3) Payback Period Rule, (4) Discounted Payback Rule, and (5) Profitability Index Rule. Assume that the discount rate is 8%, the hurdle rate is 8% and that the payback period is 4 years. 9 10 Period 0 1 2 3 4 5 6 7 8 a (4,000) 1,000 1,000 1,000 1,000 1,000 b (9,000) (3,000) 2,000 3,000 3,000 2,000 5,000 2,000 c (7,500) 4,000 4,000 4,000 17,500) 4,000 4,000 4,000 (7,500) d (11,500,000) 2,500,000 3,000,000 3,000,000 4,000,000 3,000,000 2,000,000 1,000,000 500,000 4,000 500,000 4,000 500,000 2. For the projects outlined in question 1, provide a ranking for the projects, assuming that they were mutually exclusive. 3. For the project cash flows outlined in question 1, calculate the decision made with the same capital budgeting rules, but assume that the discount rate is 14%, the hurdle rate is 14% and that the payback period is 3 years. Do any of your acceptance decisions change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts