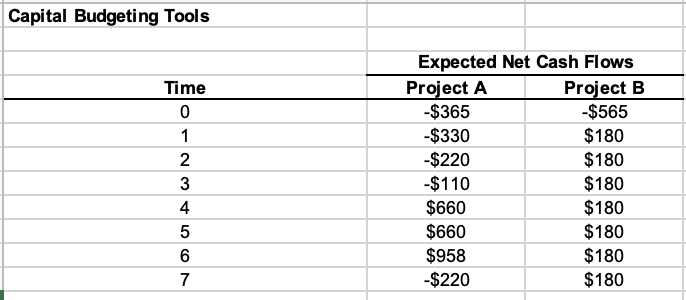

Question: Capital Budgeting Tools Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B -$365 $565 -$330 $180 -$220

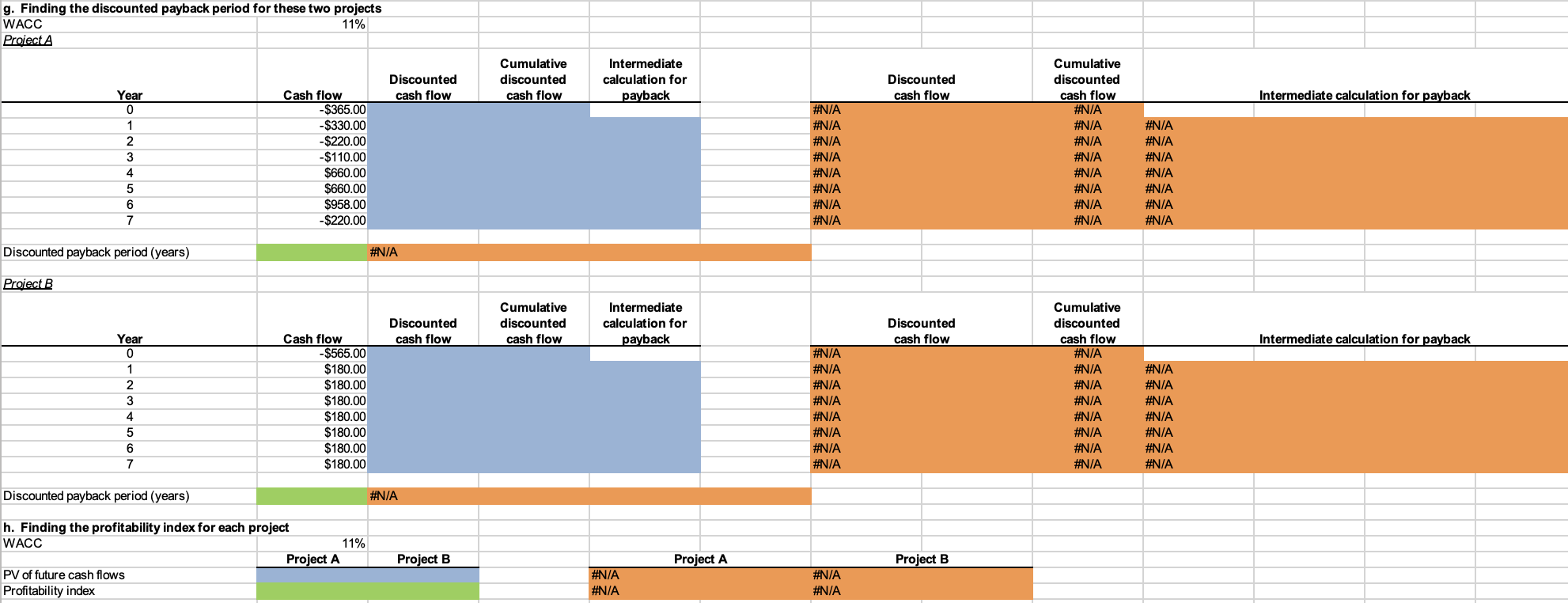

Capital Budgeting Tools Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B -$365 $565 -$330 $180 -$220 $180 $110 $180 $660 $180 $660 $180 $958 $180 -$220 $180 LON g. Finding the discounted payback period for these two projects WACC 11% Proiect A Discounted cash flow Cumulative discounted cash flow Intermediate calculation for payback Discounted cash flow Year 0 Intermediate calculation for payback 1 2 3 Cash flow -$365.00 -$330.00 -$220.00 -$110.00 $660.00 $660.00 $958.00 -$220.00 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Cumulative discounted cash flow #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A 4 5 #N/A #N/A #N/A #N/A #N/A #N/A #N/A 6 7 Discounted payback period (years) #N/A Proiect B Discounted cash flow Cumulative discounted cash flow Intermediate calculation for payback Discounted cash flow Intermediate calculation for payback Year 0 1 2 3 Cash flow -$565.00 $180.00 $180.00 $180.00 $180.00 $180.00 $180.00 $180.00 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Cumulative discounted cash flow #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A 4 5 #N/A #N/A #N/A #N/A #N/A #N/A #N/A 6 7 Discounted payback period (years) #N/A h. Finding the profitability index for each project WACC 11% Project A PV of future cash flows Profitability index Project B Project A Project B #N/A #N/A #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts