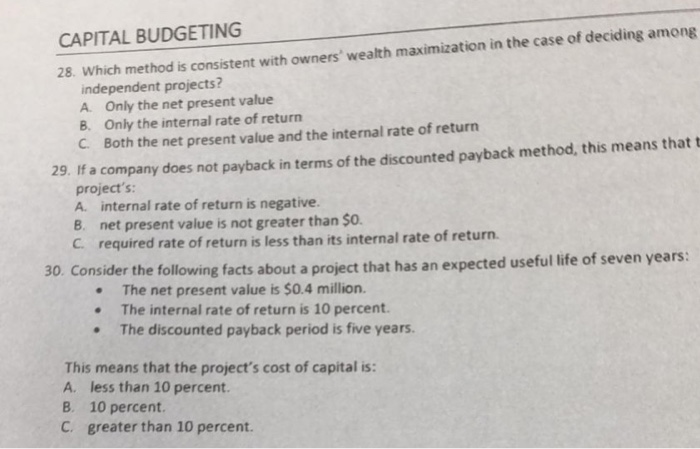

Question: CAPITAL BUDGETING Which method is consistent with owners' wealth maximization in the case of deciding among 28. independent projects? A. Only the net present value

CAPITAL BUDGETING Which method is consistent with owners' wealth maximization in the case of deciding among 28. independent projects? A. Only the net present value B. Only the internal rate of return C. Both the net present value and the internal rate of return 29. If a company does not payback in terms of the discounted payback method, this means that t project's: A. internal rate of return is negative. B. net present value is not greater than $0 C required rate of return is less than its internal rate of return. 30. Consider the following facts about a The net present value is $0.4 million. . The internal rate of return is 10 percent . The discounted payback period is five years This means that the project's cost of capital is: A. less than 10 percent. 10 percent. C greater than 10 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts