Question: capital yield & yield to maturity pleass help solve this homework question (a&b&c) im confused as to how to finish k here to read the

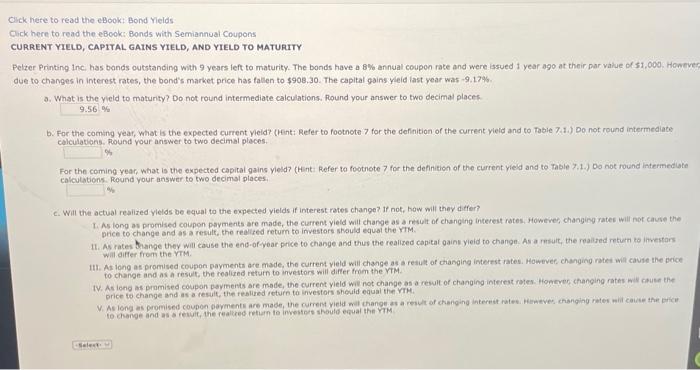

k here to read the eBook: Bond Yields k here to read the eBook: Bonds with Semiannual Coupons RRENT YIELD, CAPITAL GAINS YIELD, AND YIELD TO MATURITY Iter Printing inc. has bonds outstanding with 9 years ieft to maturity. The bonds have a 8% annual coupon rate and were issued 1 year ago at their par value of 51 , 000 . Howevn e to changes in interest rates, the bond's market price has fallen to $908,30. The capital gains yleid last year was 9.17%. a. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places \% b. For the coming year, what is the expected current yieid? (heint: Refer to footnote 7 for the definition of the current yield and to Pabie 7.8 .) Do not round intermediate calculatiank, Pround your answer to two decimal places. For the coming yeac, what is the expected capital gains yield (H:nt: Refer to foothote 7 for the definition of the current yield and to hable 7.1.), Do not found intermediate. Faleutations, Round your answer to two decimsi places. c. Will the actual realized ylelds be equal to the oxpected yields if interest rotes change? If not, how will they ditfer? 1. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates, Howeve, changing rates will not cause the price to change and as a result, the realifed return to investors should equat the YTM. 11. As rates bhange they will cause the end-of-year price to change and thus the realized capital gains yieid to changn. As a rasuic, the realized return to investars wili aiffer from the VTM. 111. As long as promised coupon payments are made, the current vield will change as a result of changing interst rates. Howivef, changing ratei wit cavie the price to change and as a result, the realized return to investors will differ from the YTM. IV. As iong as pramised coupon poymens are made, the current yield wit not change as a result of changing interest retes. Honcver changing rates mis cause the price to change and as a result, the reslued reture to investors shedid equal the VTH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts