Question: Capizzi Corporation has an activity-based costing system with three activity cost pools- Machining, Order Filling, and Other. In the first stage allocations, costs in the

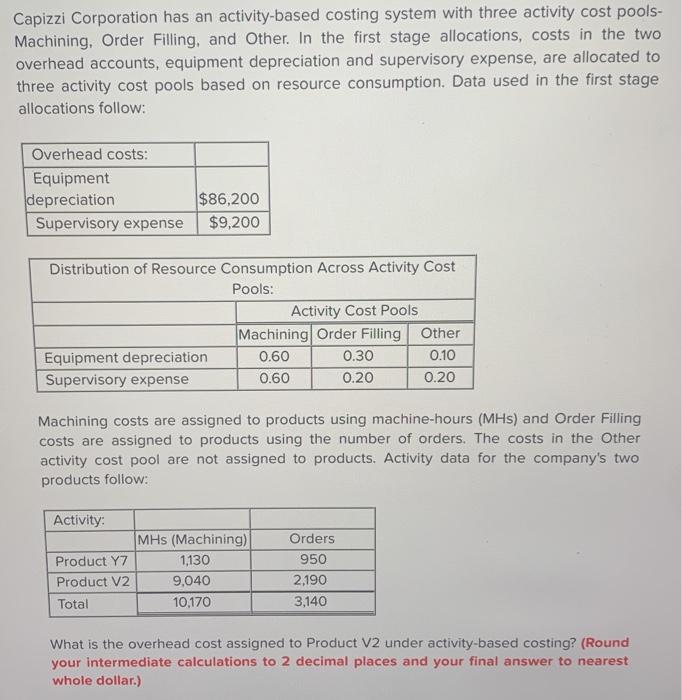

Capizzi Corporation has an activity-based costing system with three activity cost pools- Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment depreciation Supervisory expense $86,200 $9,200 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Machining Order Filling Other Equipment depreciation 0.60 0.30 0.10 Supervisory expense 0.60 0.20 0.20 Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: MHS ( Machining) Product Y7 1,130 Product V2 9,040 Total 10,170 Orders 950 2.190 3.140 What is the overhead cost assigned to Product V2 under activity-based costing? (Round your intermediate calculations to 2 decimal places and your final answer to nearest whole dollar.) Multiple Choice $50,895 $19,316 $83,100 $70,211

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts