Question: CAPM and Performance Measures. According to your favorite security analyst (who is very good at estimating betas, expected returns, and standard deviations): BABC,M= 0.8, o[Rabc]

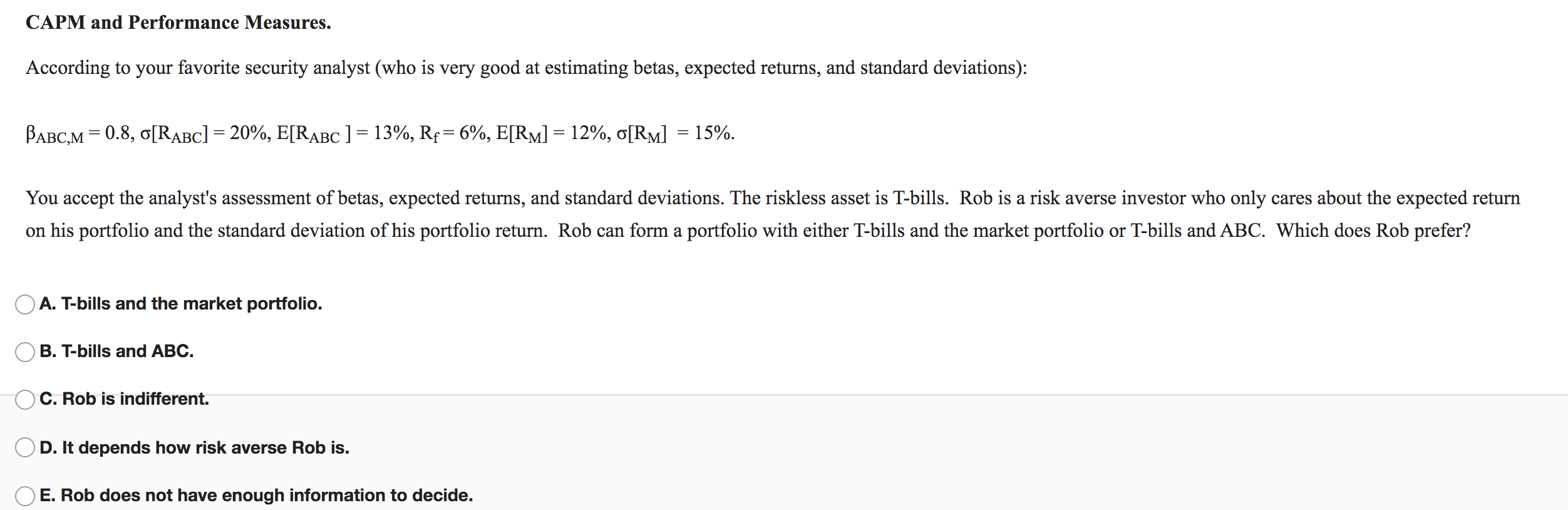

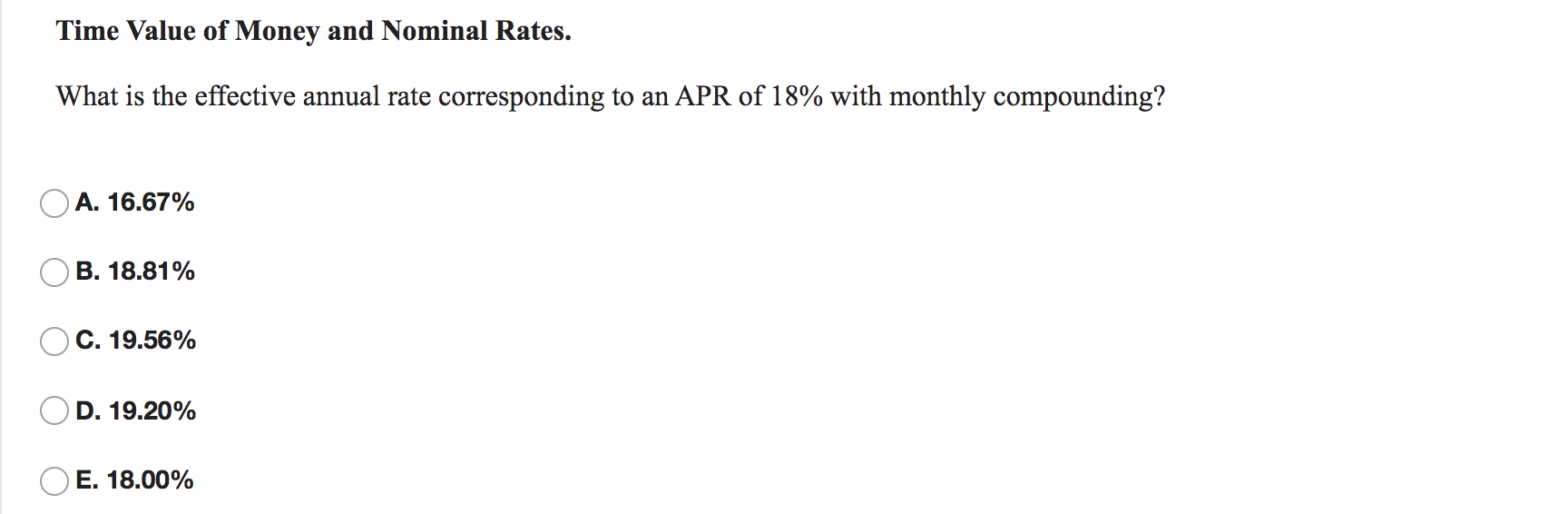

CAPM and Performance Measures. According to your favorite security analyst (who is very good at estimating betas, expected returns, and standard deviations): BABC,M= 0.8, o[Rabc] = 20%, E[Rabc ] = 13%, Rp=6%, E[RM] = 12%, o[RM] = 15%. You accept the analyst's assessment of betas, expected returns, and standard deviations. The riskless asset is T-bills. Rob is a risk averse investor who only cares about the expected return on his portfolio and the standard deviation of his portfolio return. Rob can form a portfolio with either T-bills and the market portfolio or T-bills and ABC. Which does Rob prefer? OA. T-bills and the market portfolio. B. T-bills and ABC. C. Rob is indifferent. D. It depends how risk averse Rob is. E. Rob does not have enough information to decide. Time Value of Money and Nominal Rates. What is the effective annual rate corresponding to an APR of 18% with monthly compounding? A. 16.67% B. 18.81% C. 19.56% D. 19.20% E. 18.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts