Question: Capstone 1-3: VISION STATEMENT Assignment: In this assignment we will develop a vision for your company. We assume that your team is about to have

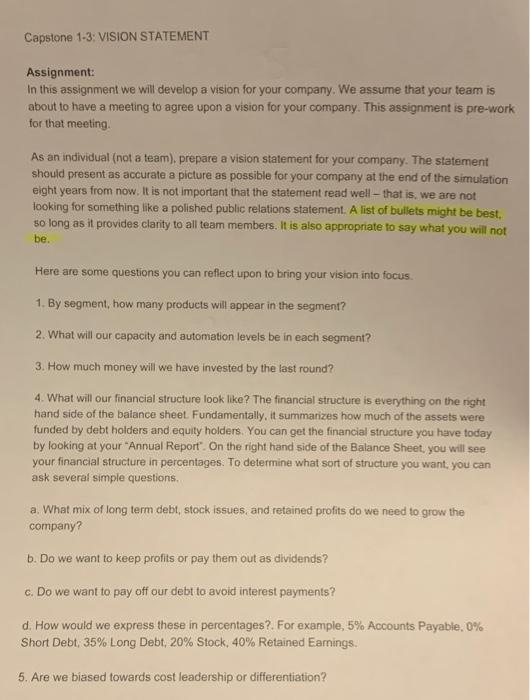

Capstone 1-3: VISION STATEMENT Assignment: In this assignment we will develop a vision for your company. We assume that your team is about to have a meeting to agree upon a vision for your company. This assignment is pre-work for that meeting As an individual (not a team), prepare a vision statement for your company. The statement should present as accurate a picture as possible for your company at the end of the simulation eight years from now. It is not important that the statement read well - that is, we are not looking for something like a polished public relations statement. A list of bullets might be best, so long as it provides clarity to all team members. It is also appropriate to say what you will not be. Here are some questions you can reflect upon to bring your vision into focus. 1. By segment, how many products will appear in the segment? 2. What will our capacity and automation levels be in each segment? 3. How much money will we have invested by the last round? 4. What will our financial structure look like? The financial structure is everything on the right hand side of the balance sheet Fundamentally, it summarizes how much of the assets were funded by debt holders and equity holders. You can get the financial structure you have today by looking at your "Annual Report". On the right hand side of the Balance Sheet, you will see your financial structure in percentages. To determine what sort of structure you want, you can ask several simple questions a. What mix of long term debt, stock issues, and retained profits do we need to grow the company? b. Do we want to keep profits or pay them out as dividends? c. Do we want to pay off our debt to avoid interest payments? d. How would we express these in percentages?. For example, 5% Accounts Payable. 0% Short Debt, 35% Long Debt, 20% Stock, 40% Retained Earnings. 5. Are we biased towards cost leadership or differentiation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts