Question: Capstone Case Study: Install Solar Panels vs Buy Electricity You are tasked with evaluating two financial alternatives for a 1 0 - year production project.

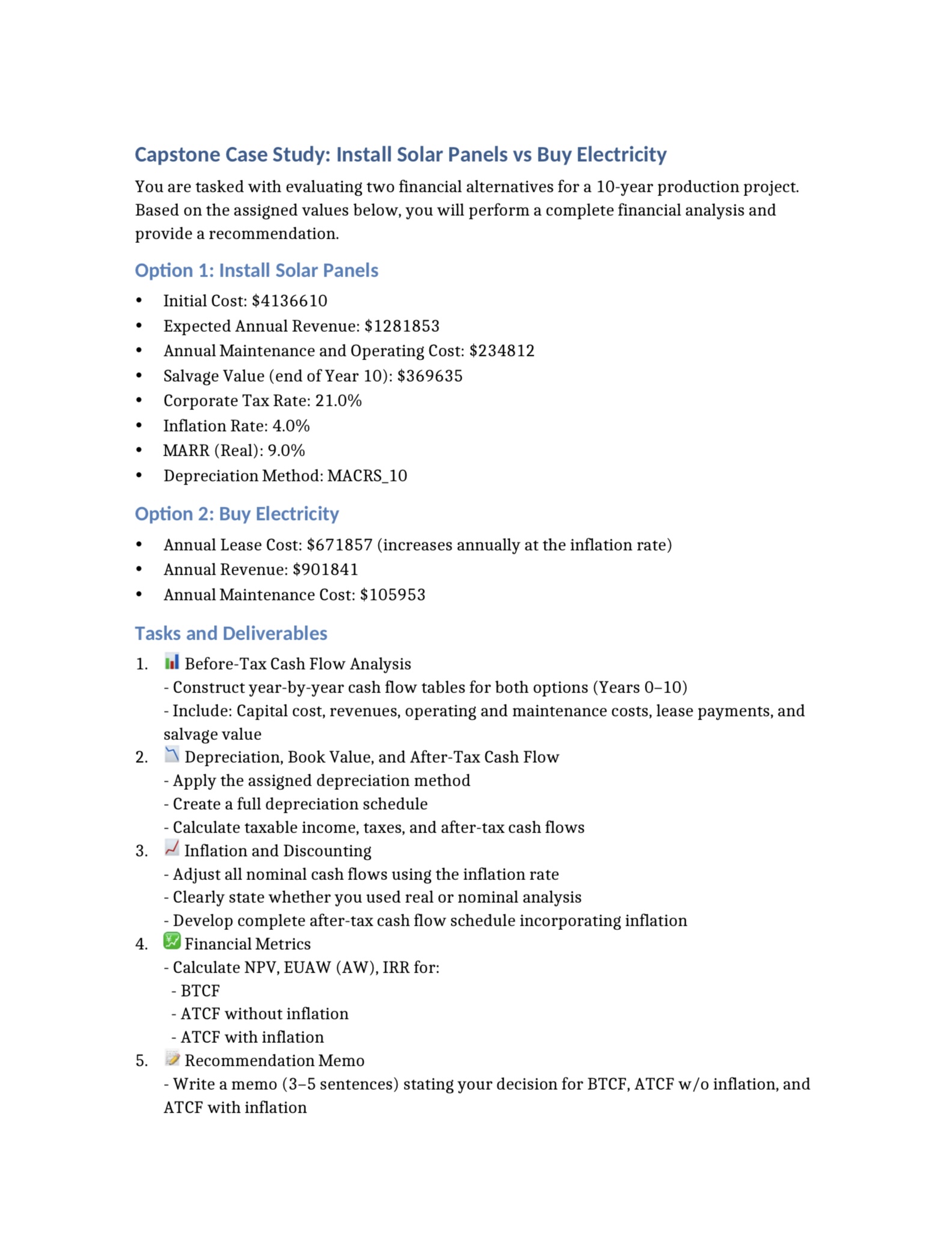

Capstone Case Study: Install Solar Panels vs Buy Electricity You are tasked with evaluating two financial alternatives for a year production project. Based on the assigned values below, you will perform a complete financial analysis and provide a recommendation. Option : Install Solar Panels Initial Cost: $ Expected Annual Revenue: $ Annual Maintenance and Operating Cost: $ Salvage Value end of Year : $ Corporate Tax Rate: Inflation Rate: MARR Real: Depreciation Method: MACRS Option : Buy Electricity Annual Lease Cost: $ increases annually at the inflation rate Annual Revenue: $ Annual Maintenance Cost: $ Tasks and Deliverables Inl BeforeTax Cash Flow Analysis Construct yearbyyear cash flow tables for both options Years Include: Capital cost, revenues, operating and maintenance costs, lease payments, and salvage value Depreciation, Book Value, and AfterTax Cash Flow Apply the assigned depreciation method Create a full depreciation schedule Calculate taxable income, taxes, and aftertax cash flows Inflation and Discounting Adjust all nominal cash flows using the inflation rate Clearly state whether you used real or nominal analysis Develop complete aftertax cash flow schedule incorporating inflation Financial Metrics Calculate NPV EUAW AW IRR for: BTCF ATCF without inflation ATCF with inflation Recommendation Memo Write a memo sentences stating your decision for BTCF ATCF wo inflation, and ATCF with inflation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock