Question: Car Buying Activity b. Create a balance sheet for the first 6 payments. When buying a car, most people cannot afford to buy it for

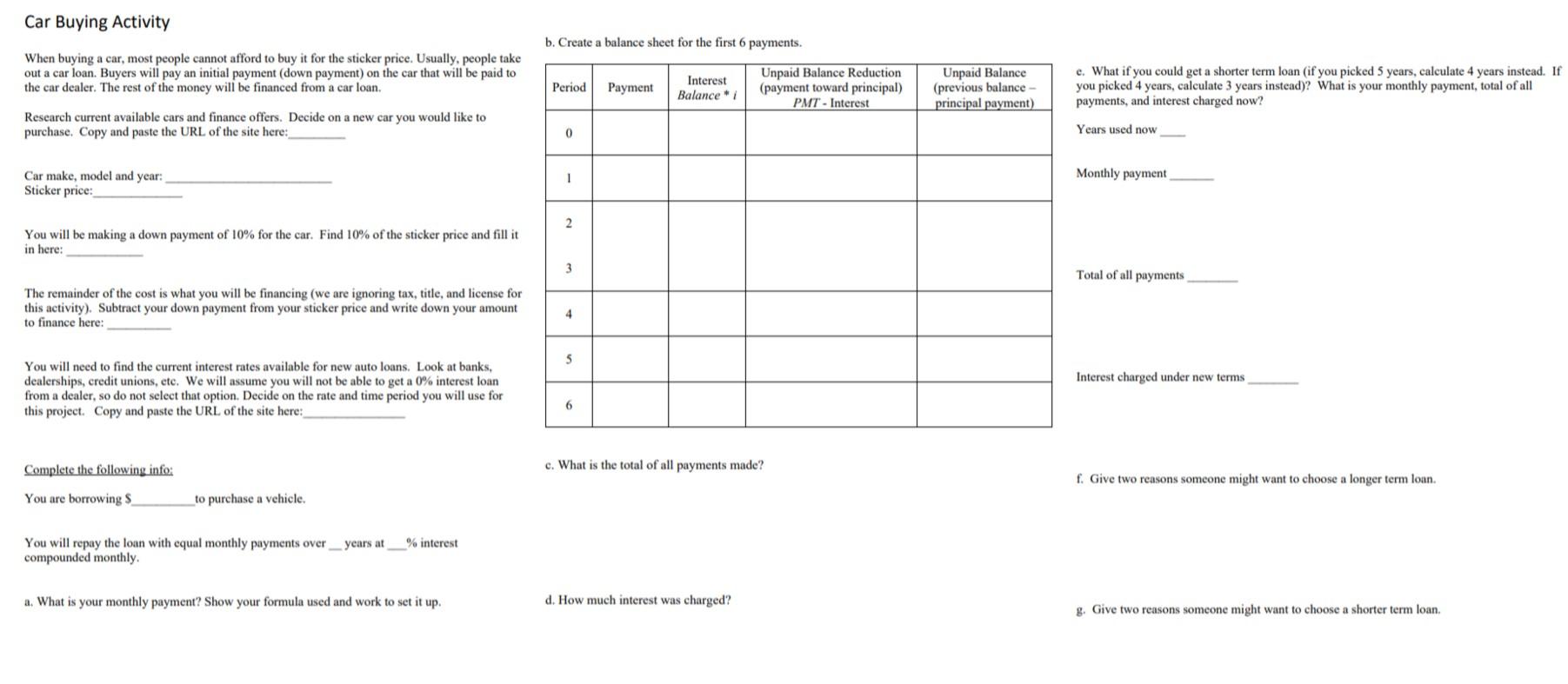

Car Buying Activity b. Create a balance sheet for the first 6 payments. When buying a car, most people cannot afford to buy it for the sticker price. Usually, people take out a car loan. Buyers will pay an initial payment (down payment) on the car that will be paid to the car dealer. The rest of the money will be financed from a car loan. Period Payment Interest Balance 1 Unpaid Balance Reduction (payment toward principal) PMT - Interest Unpaid Balance (previous balance principal payment) c. What if you could get a shorter term loan (if you picked 5 years, calculate 4 years instead. If you picked 4 years, calculate 3 years instead)? What is your monthly payment, total of all payments, and interest charged now? Research current available cars and finance offers. Decide on a new car you would like to purchase. Copy and paste the URL of the site here: 0 Years used now Car make, model and year: Sticker price: 1 Monthly payment 2 You will be making a down payment of 10% for the car. Find 10% of the sticker price and fill it in here: 3 Total of all payments The remainder of the cost is what you will be financing (we are ignoring tax, title, and license for this activity). Subtract your down payment from your sticker price and write down your amount to finance here: 4 S Interest charged under new terms You will need to find the current interest rates available for new auto loans. Look at banks. dealerships, credit unions, etc. We will assume you will not be able to get a 0% interest loan from a dealer, so do not select that option. Decide on the rate and time period you will use for this project. Copy and paste the URL of the site here: 6 Complete the following info: c. What is the total of all payments made? f. Give two reasons someone might want to choose a longer term loan. You are borrowing $ to purchase a vehicle % interest You will repay the loan with equal monthly payments over years at compounded monthly a. What is your monthly payment? Show your formula used and work to set it up. d. How much interest was charged? g. Give two reasons someone might want to choose a shorter term loan. Car Buying Activity b. Create a balance sheet for the first 6 payments. When buying a car, most people cannot afford to buy it for the sticker price. Usually, people take out a car loan. Buyers will pay an initial payment (down payment) on the car that will be paid to the car dealer. The rest of the money will be financed from a car loan. Period Payment Interest Balance 1 Unpaid Balance Reduction (payment toward principal) PMT - Interest Unpaid Balance (previous balance principal payment) c. What if you could get a shorter term loan (if you picked 5 years, calculate 4 years instead. If you picked 4 years, calculate 3 years instead)? What is your monthly payment, total of all payments, and interest charged now? Research current available cars and finance offers. Decide on a new car you would like to purchase. Copy and paste the URL of the site here: 0 Years used now Car make, model and year: Sticker price: 1 Monthly payment 2 You will be making a down payment of 10% for the car. Find 10% of the sticker price and fill it in here: 3 Total of all payments The remainder of the cost is what you will be financing (we are ignoring tax, title, and license for this activity). Subtract your down payment from your sticker price and write down your amount to finance here: 4 S Interest charged under new terms You will need to find the current interest rates available for new auto loans. Look at banks. dealerships, credit unions, etc. We will assume you will not be able to get a 0% interest loan from a dealer, so do not select that option. Decide on the rate and time period you will use for this project. Copy and paste the URL of the site here: 6 Complete the following info: c. What is the total of all payments made? f. Give two reasons someone might want to choose a longer term loan. You are borrowing $ to purchase a vehicle % interest You will repay the loan with equal monthly payments over years at compounded monthly a. What is your monthly payment? Show your formula used and work to set it up. d. How much interest was charged? g. Give two reasons someone might want to choose a shorter term loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts